Hamp

@jimfink

ID: 17594046

24-11-2008 15:51:13

28,28K Tweet

280 Takipçi

1,1K Takip Edilen

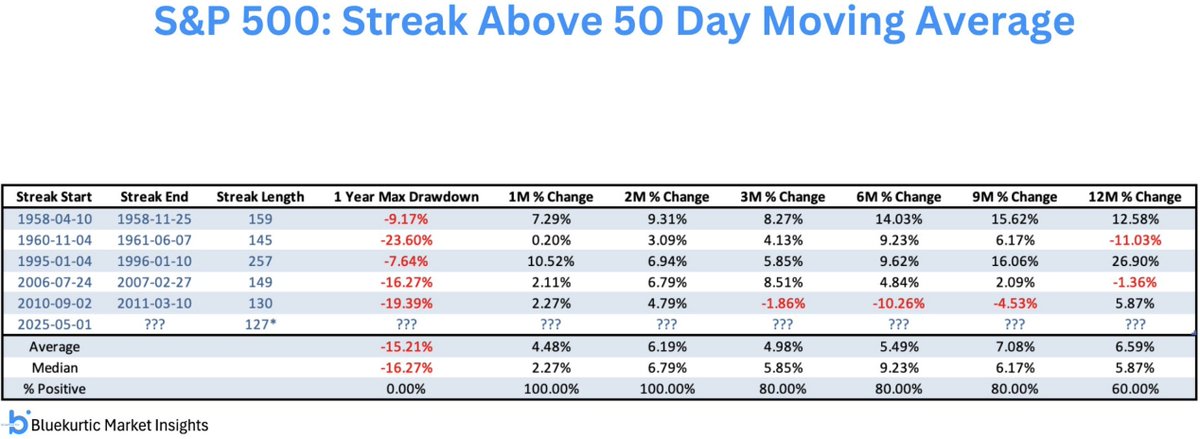

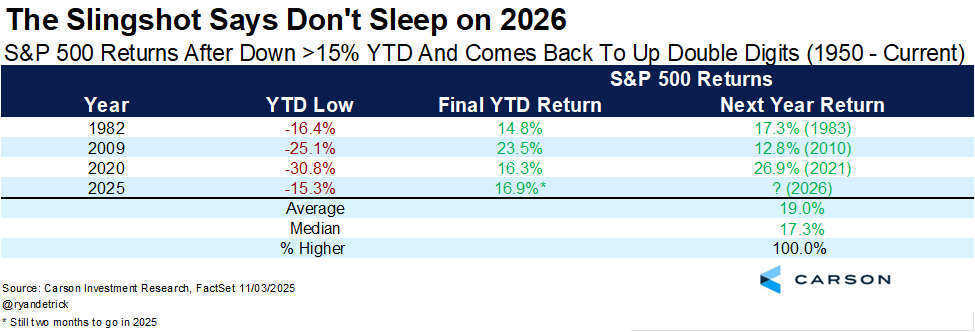

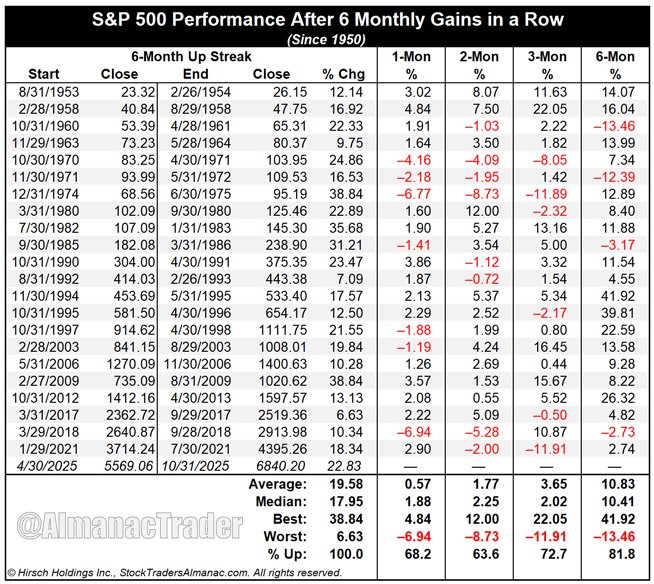

The S&P 500 just completed one of its best runs during the seasonally weak "sell in May" period in history. This was the 4th time since 1950 $SPX rose each month May-Oct. What has it meant for the rest of the year? Median gain of 6.5% vs 3.6% for all years. Ned Davis Research 1/2