Jesse Felder

@jessefelder

"I'm just lookin' for clues at the scene of the crime..."

ID:1473431

http://thefelderreport.com 19-03-2007 05:22:10

71,9K Tweets

164,7K Followers

120 Following

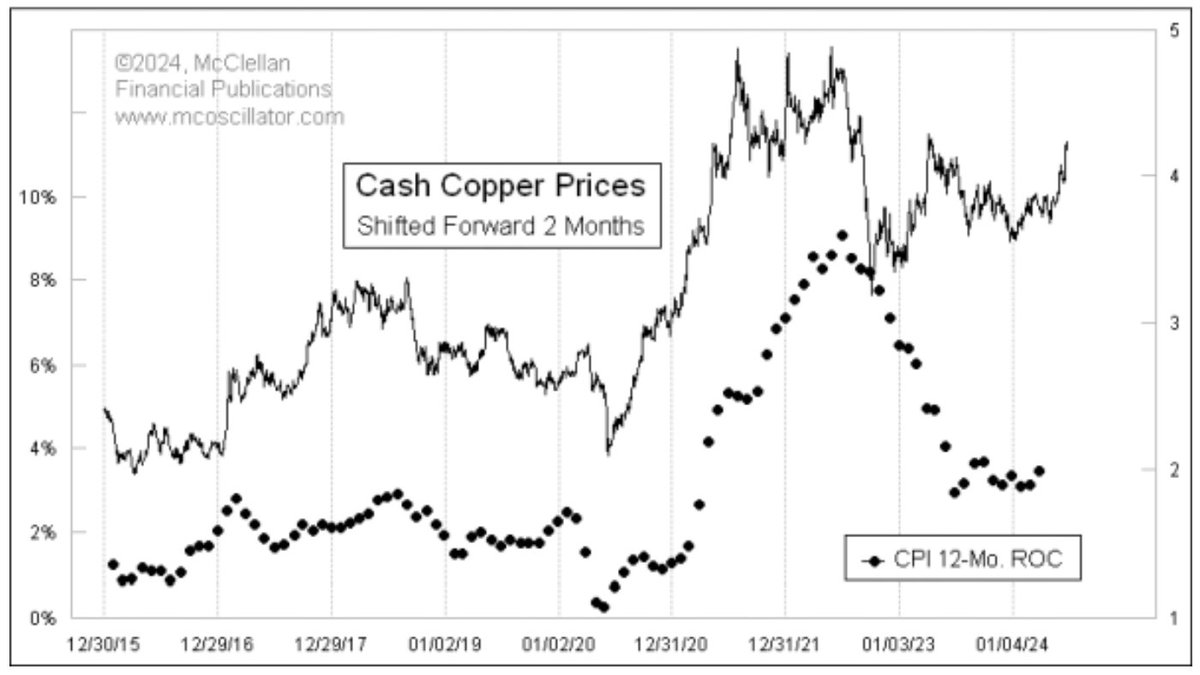

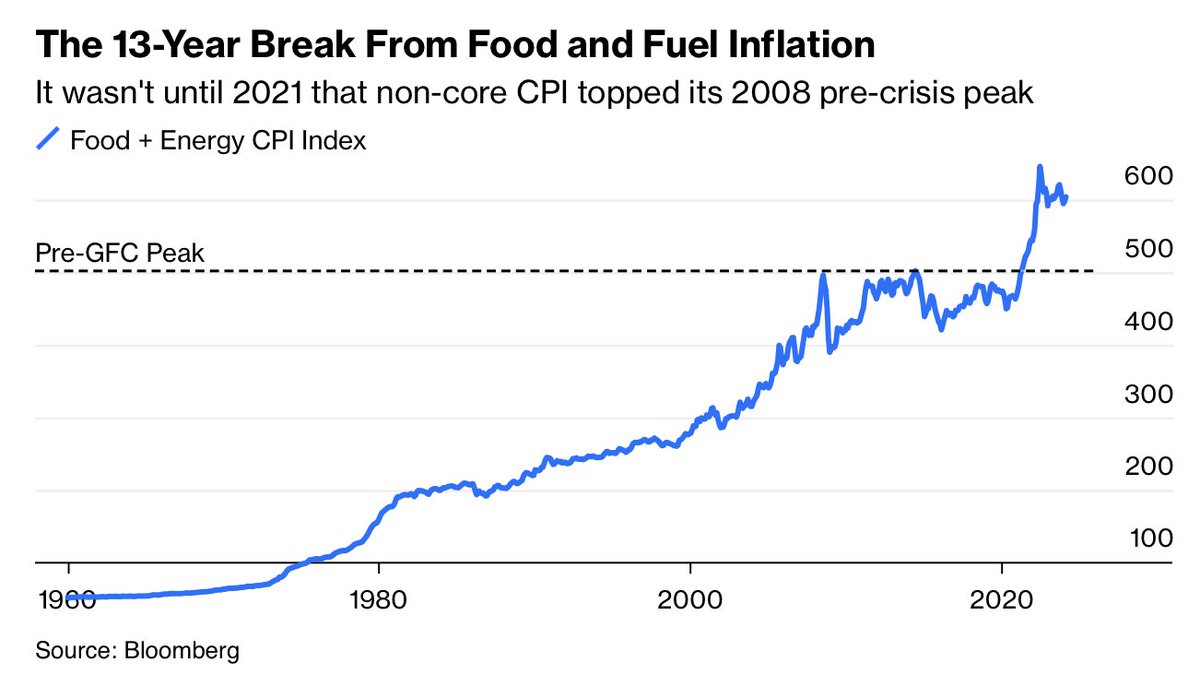

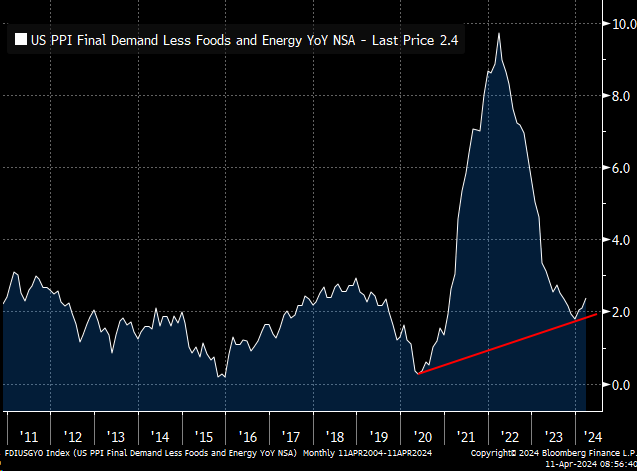

Today’s PPI report seems to be the latest counter-argument to the hard-to-kill consensus that #inflation is under control.

'Covered call ETFs have been very popular.' thedailyshot.com/2024/04/11/the… via (((The Daily Shot)))

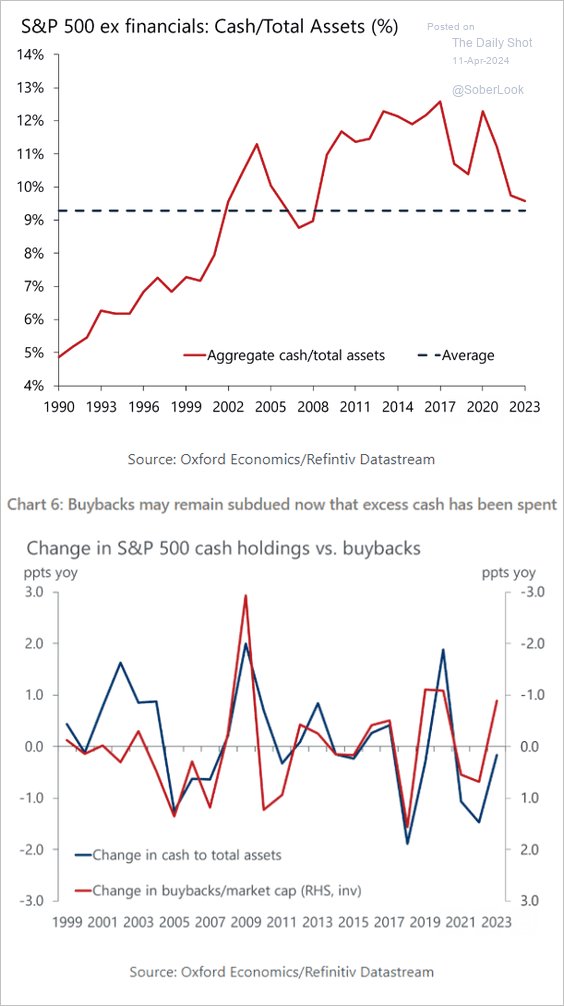

'WIll decreased cash balances become a drag on share buybacks?' thedailyshot.com/2024/04/11/the… via (((The Daily Shot)))

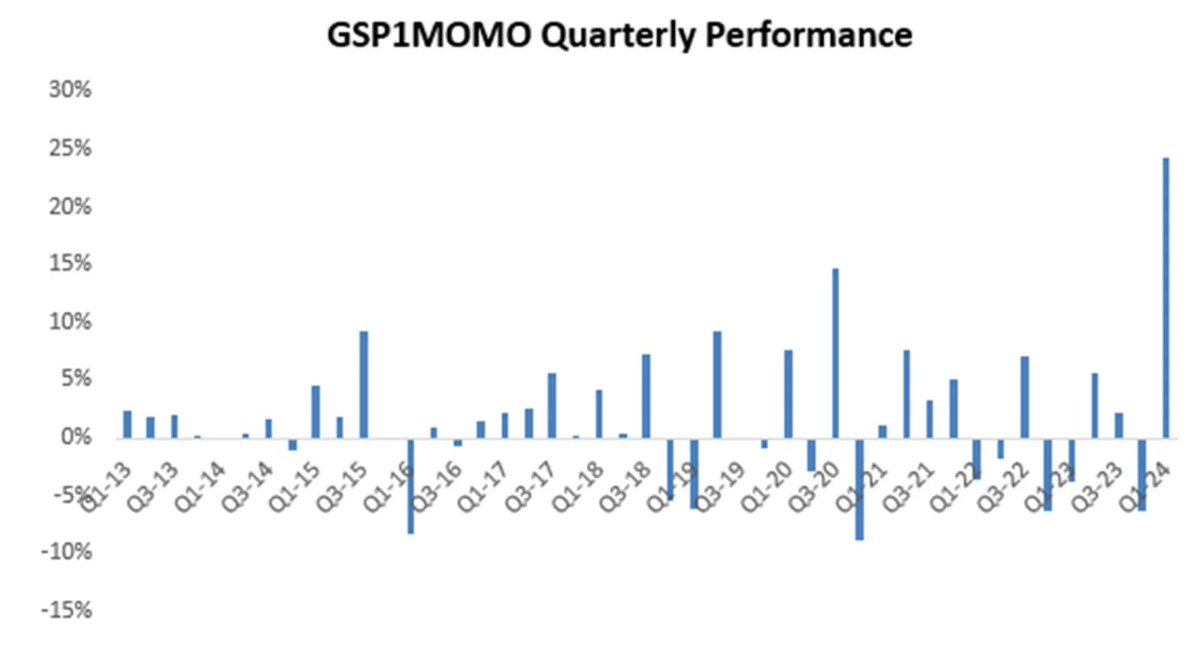

'Momentum had the strongest start of the year ever and best quarter ever.' dailychartbook.com/p/daily-chartb… via Daily Chartbook

'CFTC net equity future positioning has risen to a new all-time high led by S&P 500 futures.' dailychartbook.com/p/daily-chartb… via Daily Chartbook

''The Chinese defense industrial base is increasingly on a wartime footing.' If that isn't a clear enough warning, I don't know what is. Even as the US ignores its inability to build ships and missiles, China is shoring up weaknesses in fuel and finance.' noahpinion.blog/p/americans-ar…

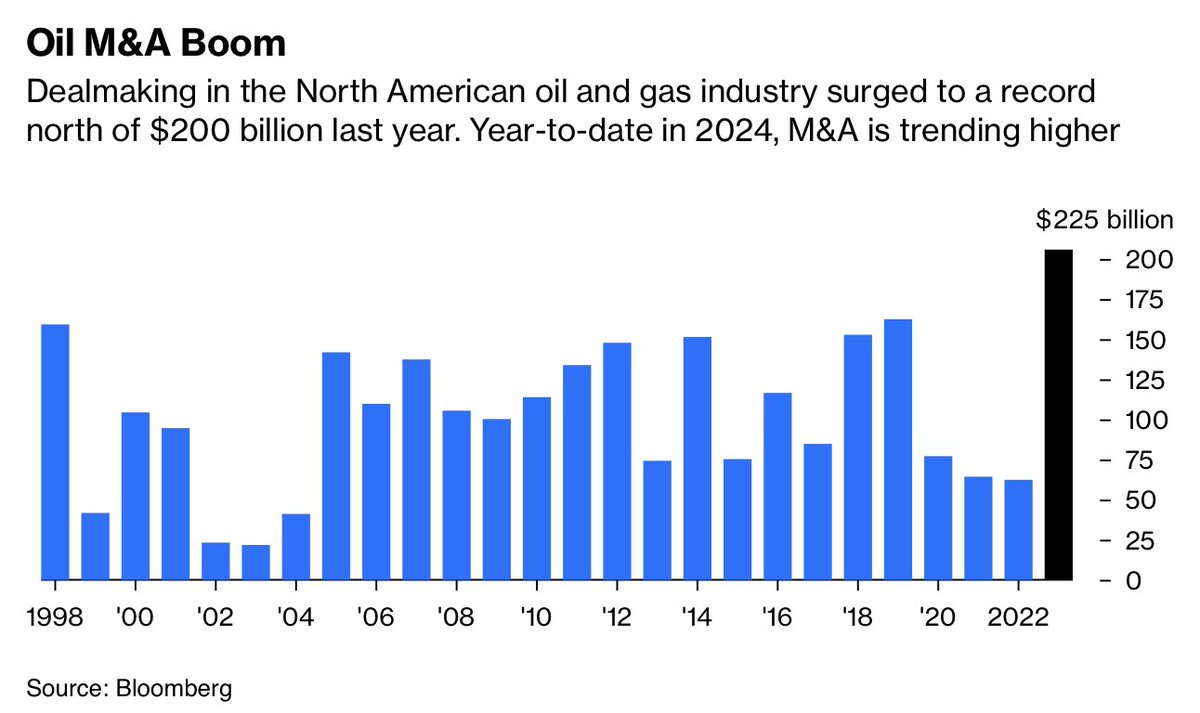

'Even after a record $200 billion dealmaking frenzy last year, US oil and gas producers haven't consolidated nearly enough. There are still too many companies wooing a limited pool of available capital.' bloomberg.com/opinion/articl… by Javier Blas

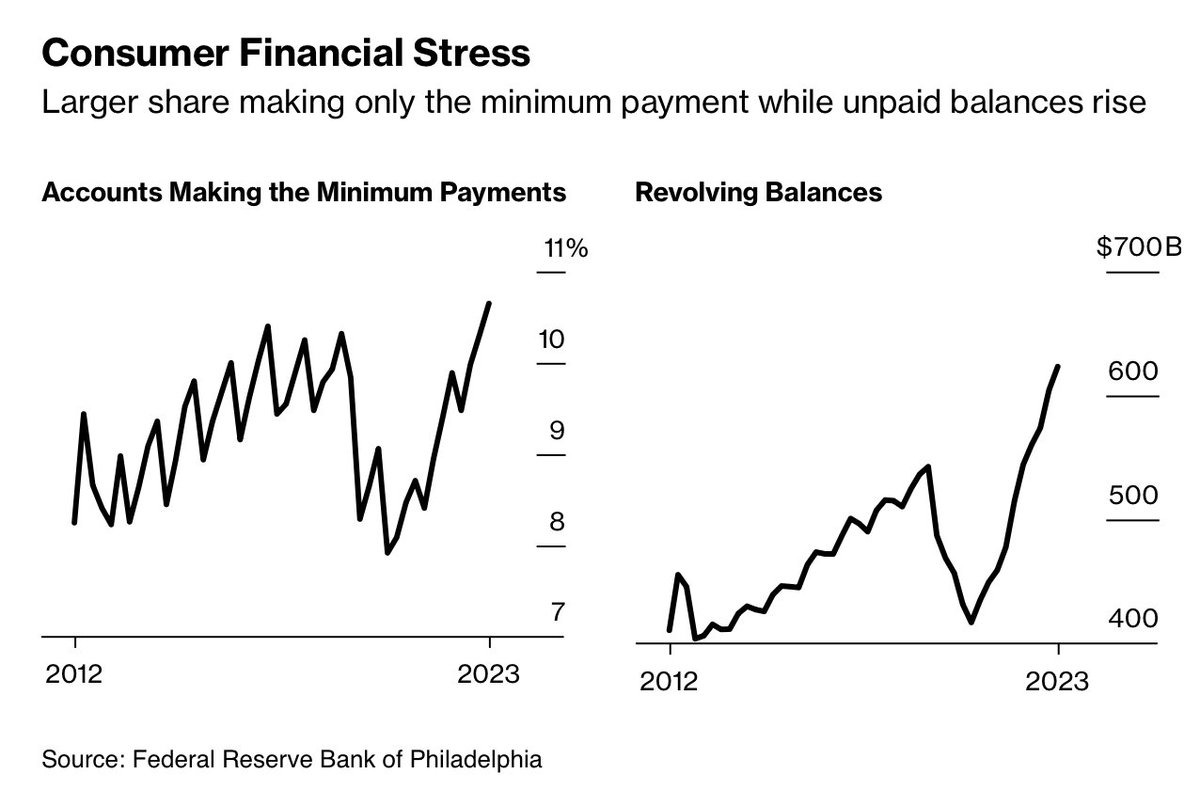

'You have to take seriously the possibility that the next rate move will be upwards rather than downwards. A rate cut in June would be a dangerous and egregious error comparable to the errors the Fed was making in the summer of 2021.' -Lawrence H. Summers bloomberg.com/news/articles/…