Jeremy McCrea, CFA

@jeremymccreacfa

Energy Research

ID: 547260589

07-04-2012 02:37:38

807 Tweet

9,9K Takipçi

292 Takip Edilen

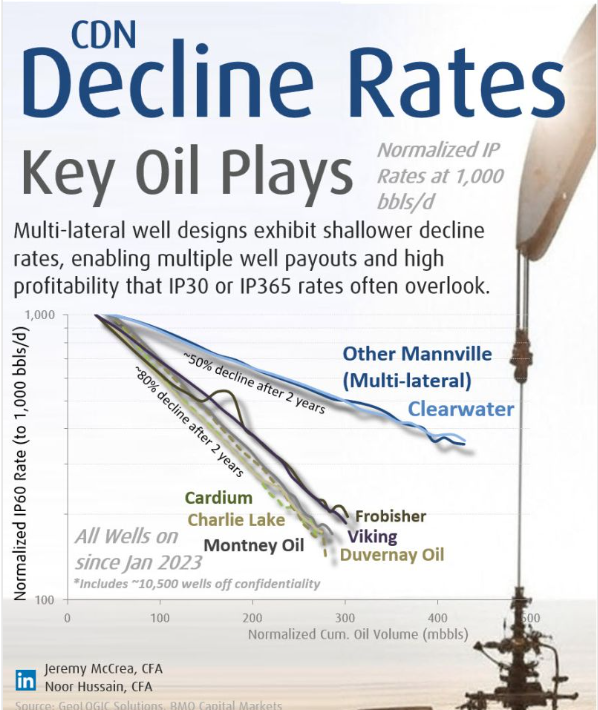

From Jeremy McCrea, CFA "Most fracked wells reach payout within 12-18 months at current WTI prices, but perhaps investors should be considering more when 2x well payout is achieved" "multi-lateral drilling reach 2x payout at a much quicker rate" linkedin.com/in/jeremy-mccr…