Juan Bernardo Tobar

@jbtobar_

I am @ConvexValue. I build tech. options // math // rust // philosophy

ID: 3068888327

https://ConvexValue.com 04-03-2015 00:02:52

9,9K Tweet

694 Followers

2,2K Following

SPX Option Scanner 0dte 📡 ranked by net sold volume - lotsa 5950-45-40 puts with net sold premiums in the previous 15 min. & the volume to match. those could be opening short put trades or the closing of what were originally long put trades. 🪜 Convex Value $spx $spy $es_f

IBIT Open Interest Change overnight OI change for 6/6 expiry 🔵puts 🟡calls puts & calls added below spot. above spot, puts & calls taken off. decreased puts > decreased calls 1.3:1 🎃 Convex Value $ibit $btc 🍑

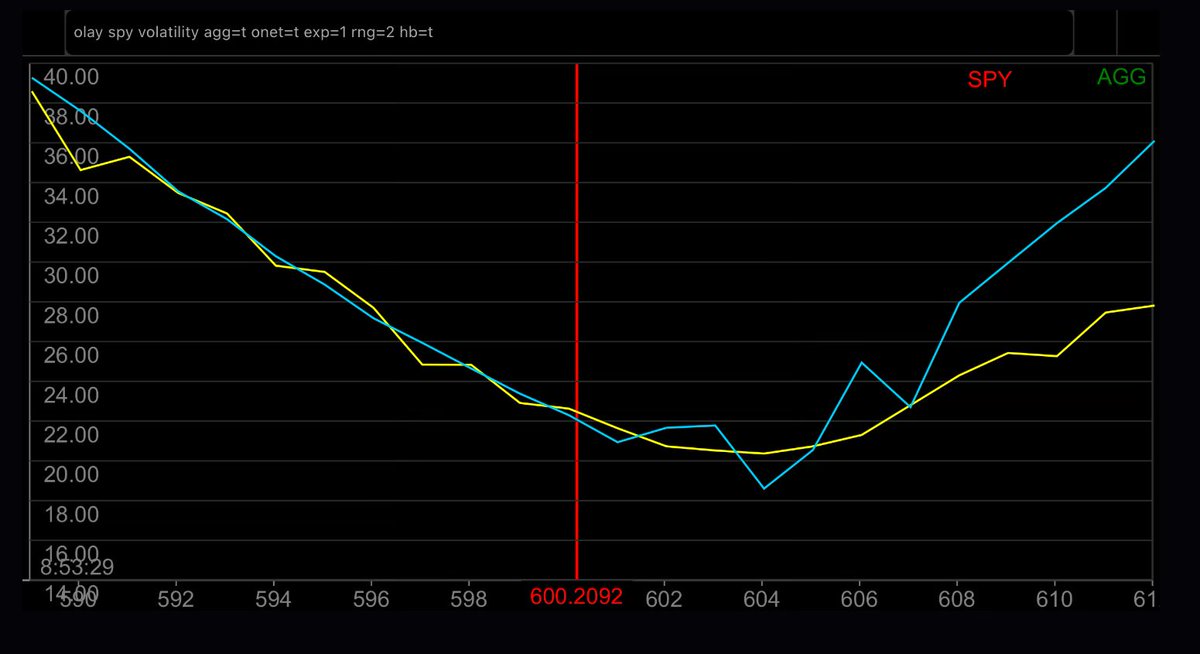

SPY Implied Volatility fixed strike iv smile 0dte -mostly call & put vols are intertwined with deep itm puts taking over above 605. -below current spot, both rise consistently down the chain and above spot they dip to 605 and then rise. 🎛️ Convex Value $spx $spy $es_f 🔌

SPX Delta Notional 0dte -calls dominate up & down the chain today. otm calls heavy up to 6050. itm puts begin to edge out thecalls at 6080. 6100 strike is balanced right now and sticks out. calls > puts 7.6:1 ⚱️Convex Value $spy $spx $es_f 🪦

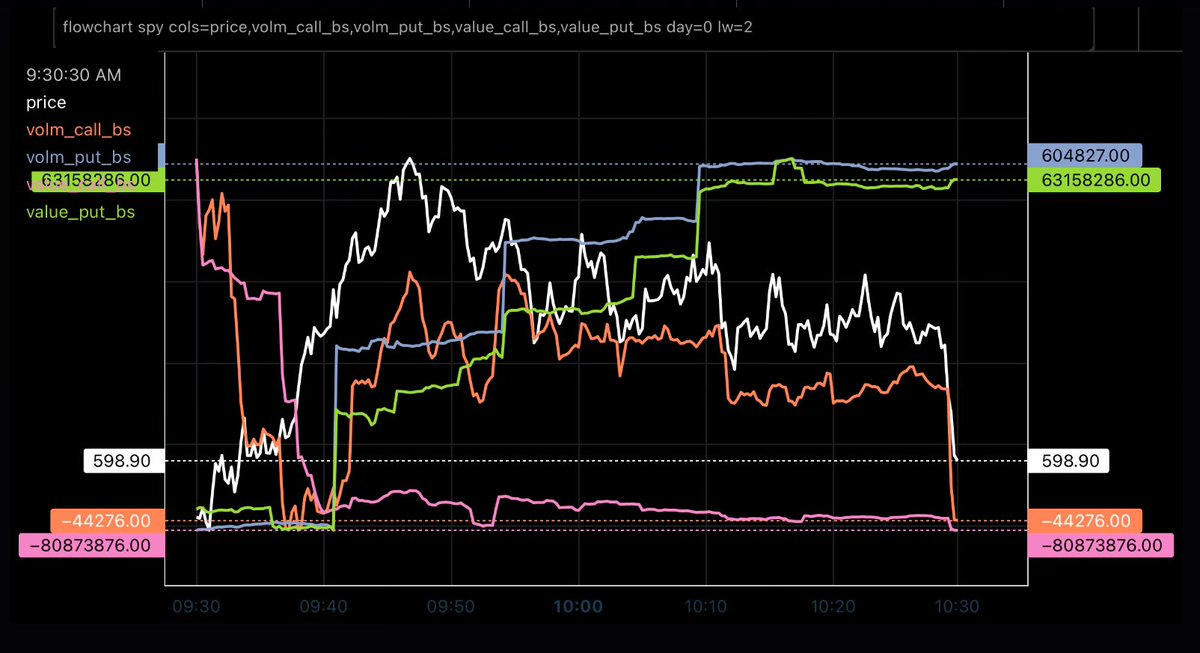

SPY Net Flow net volume & net premium ⚪️price -put premiums & volume are net bought as calls premiums are deadlining net sold as volume chops with pa 📫 Convex Value $spx $spy $es_f 🏷️