Jakob Palmstierna

@jakob_gsr

President @GSR_io

ID: 1562761343450902529

http://www.gsr.io 25-08-2022 11:20:08

50 Tweet

1,1K Takipçi

301 Takip Edilen

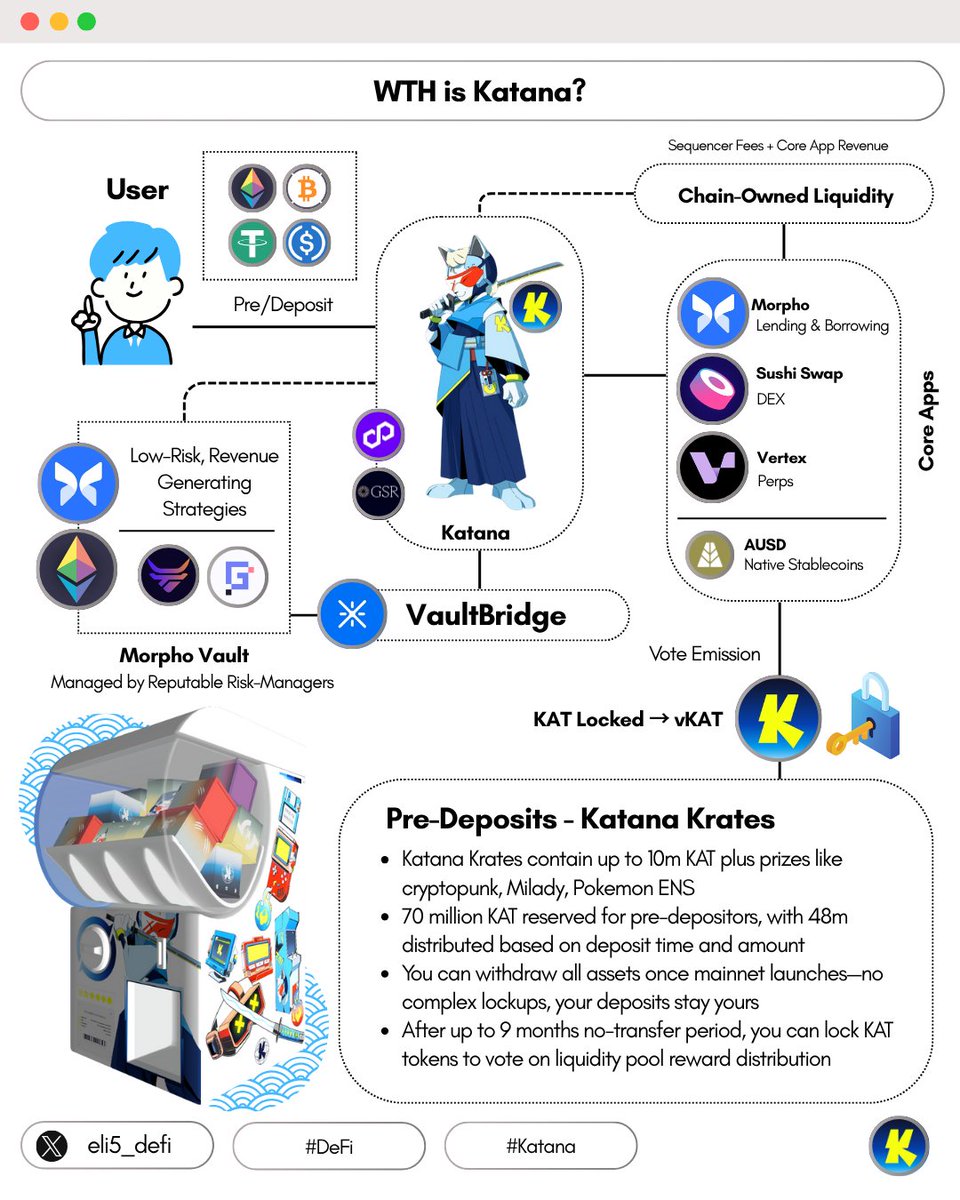

From Jakob Palmstierna at GSR (Jakob Palmstierna): "We're not just deploying capital; we're helping build sustainable, accessible DeFi ecosystems. With Katana, we're applying our deep markets expertise to drive real yield and focused liquidity."

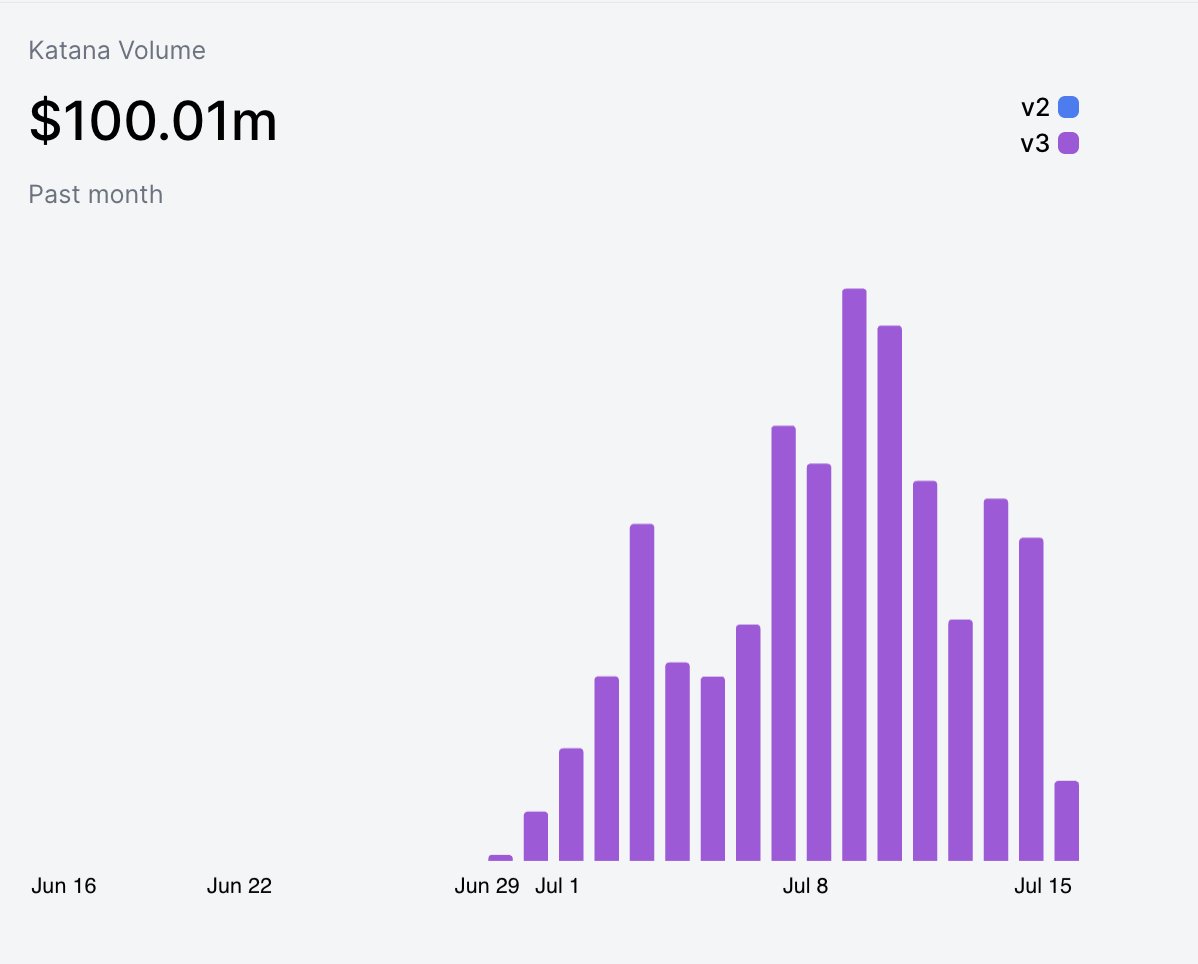

at Stable Summit 🦫 “fragmentation is a tax on users” - Jakob Palmstierna “on katana, the yields are stacked” - Jakob Palmstierna “theres a baseline amount of liquidity at all times” - Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※) “we care about productive TVL, not chain TVL” - Marc, the Degen CEO of Polygon Labs (💜,⚔️, ※)

1/ We are excited to welcome Frank Chaparro to GSR as our first Head of Content and Special Projects. Frank joins us at a pivotal time as we continue to expand across trading, advisory, asset management, and venture. gsr.io/insights/frank…