Tom Wan

@tomwanhh

head of data @entropyadvisors | prev. @21co__ @21shares

views are my own & NFA

ID: 1448644422380310537

https://dune.com/entropy_advisors 14-10-2021 13:38:45

7,7K Tweet

14,14K Takipçi

1,1K Takip Edilen

.Variational reached a new TVL high at $73.3M! Last week’s market pullback didn’t slow deposits for long. Flows returned quickly across its settlement pools. The Core OLP Vault climbed 66% today from $6M to $10M, leading the rebound.

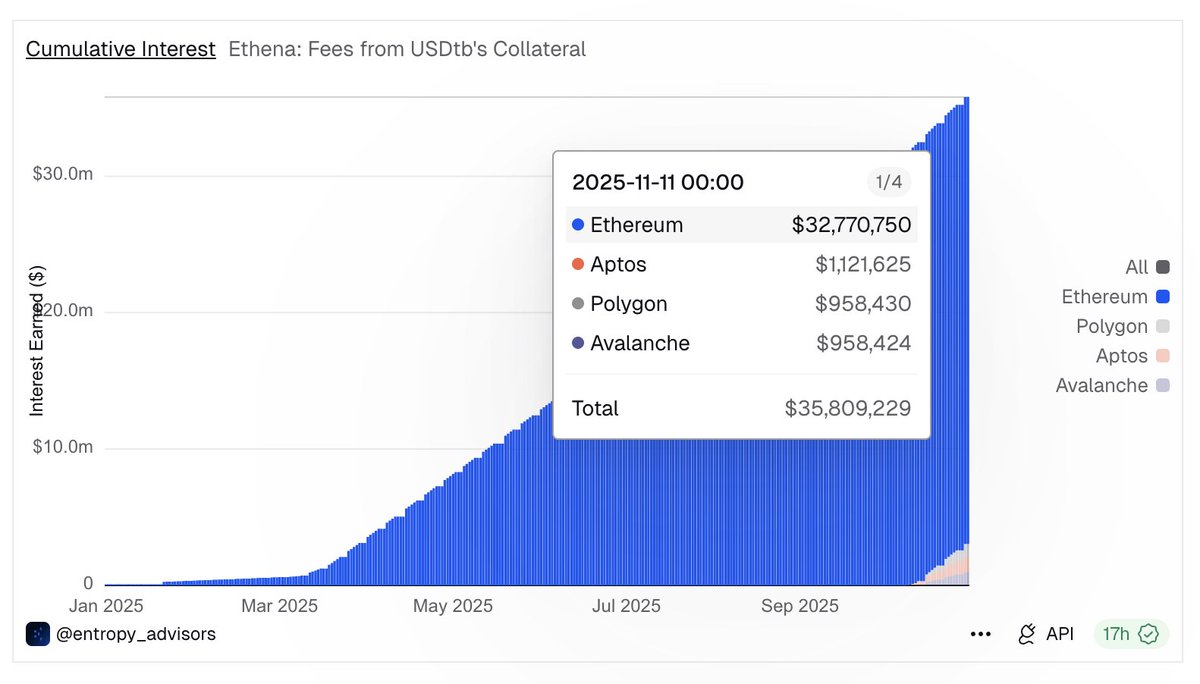

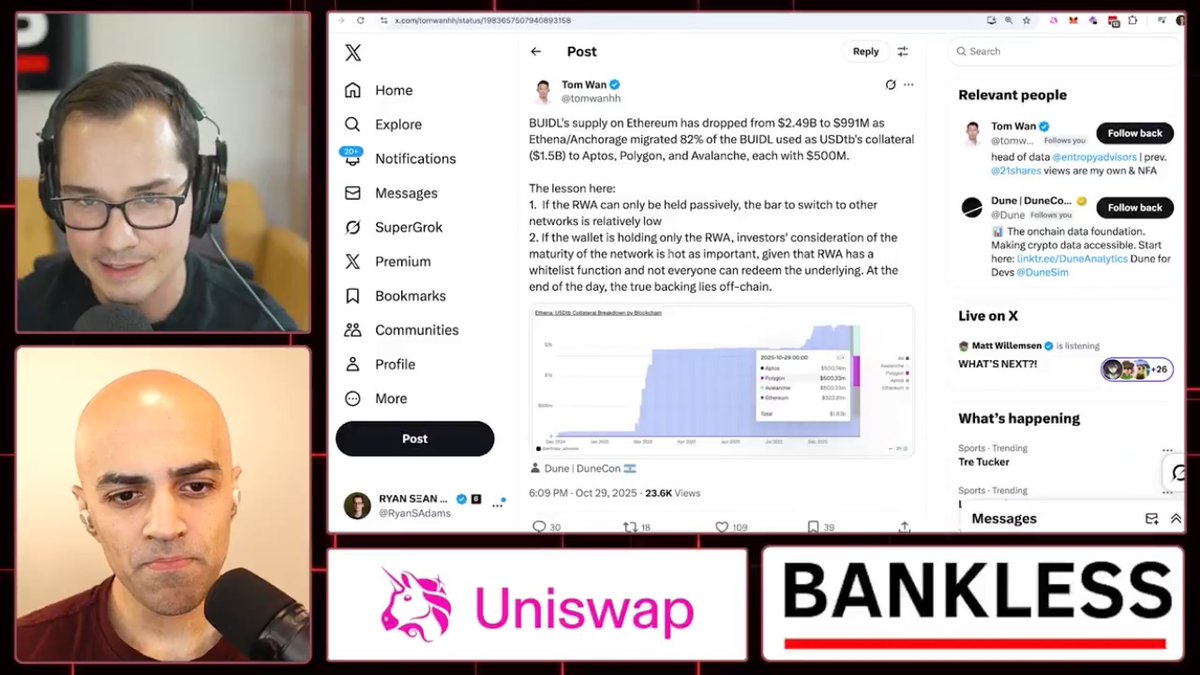

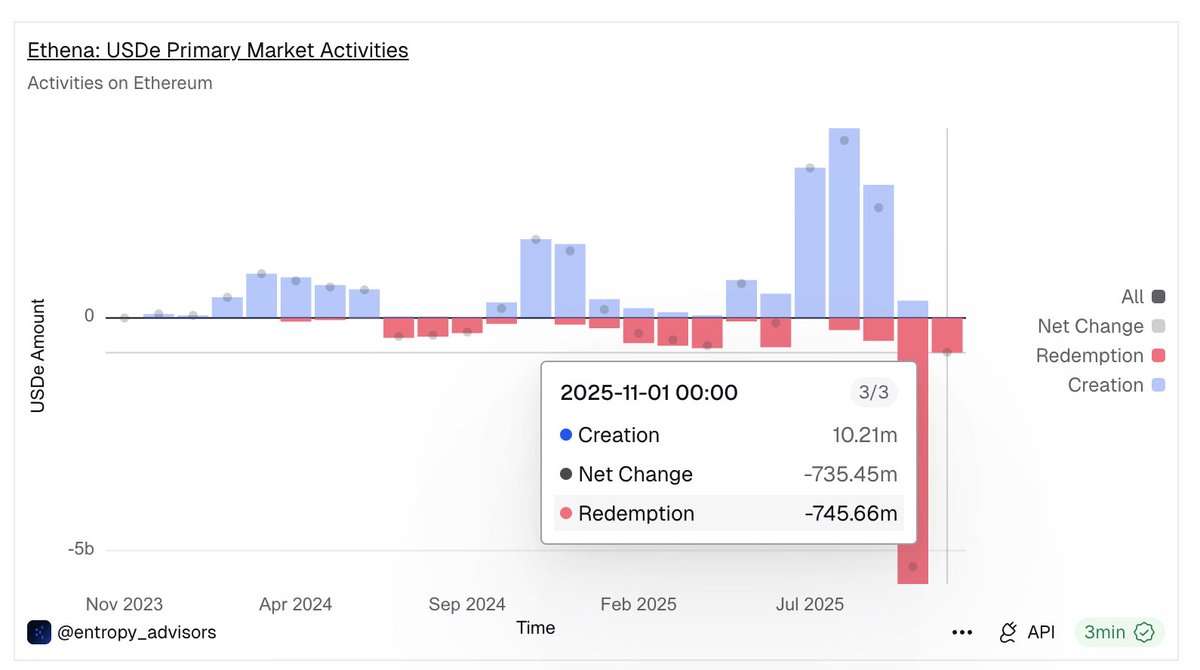

USDtb by Ethena Labs is a prime example of why projects with existing distribution should have their own stablecoins. Given USDtb's key use case is for the Ethena team to hold as a stablecoin position for backing USDe, if they choose USDT/USDC instead, they will be missing out