Trader T

@thepfund

P Fund in #Energy #Bitcoin #USD Posting my own hedge/invest memo for introspect.

ID: 521396141

11-03-2012 15:08:05

4,4K Tweet

9,9K Takipçi

224 Takip Edilen

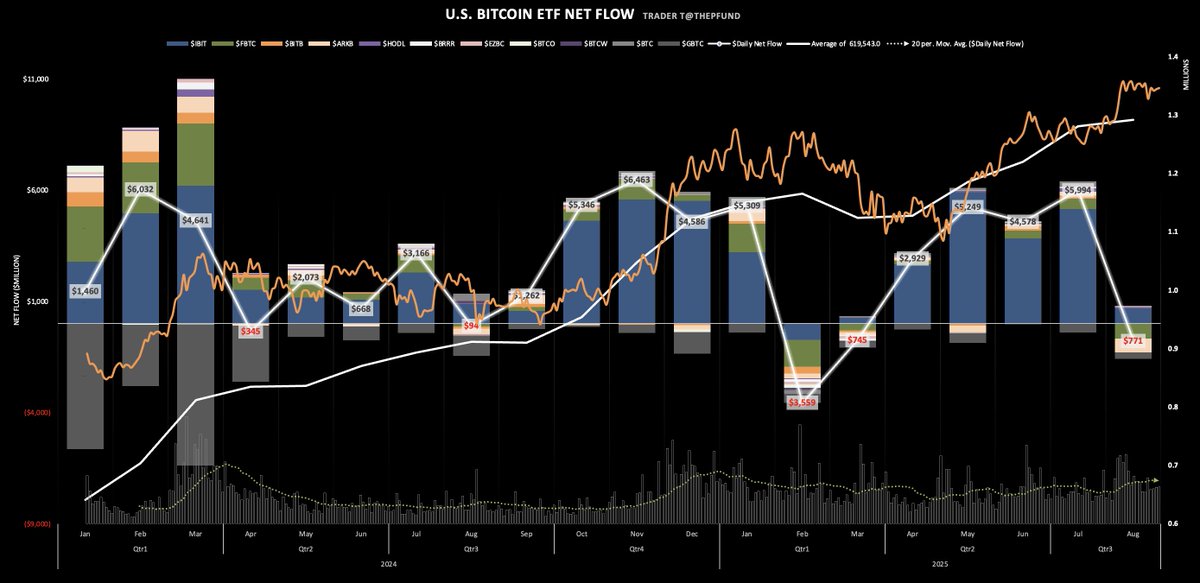

2025/8 Bitcoin ETF Monthly Net Inflow: $-771 million (-7K BTC) - $BTCUSD $115,761 -> $108,595 (-6%) - BlackRock's $IBIT sees an inflow of +5,756 Bitcoin ($688 million) - Fidelity Investments sees an outflow of $-662 m - ARK Invest with $-621 m outflow - $GBTC with $-293 m outflow

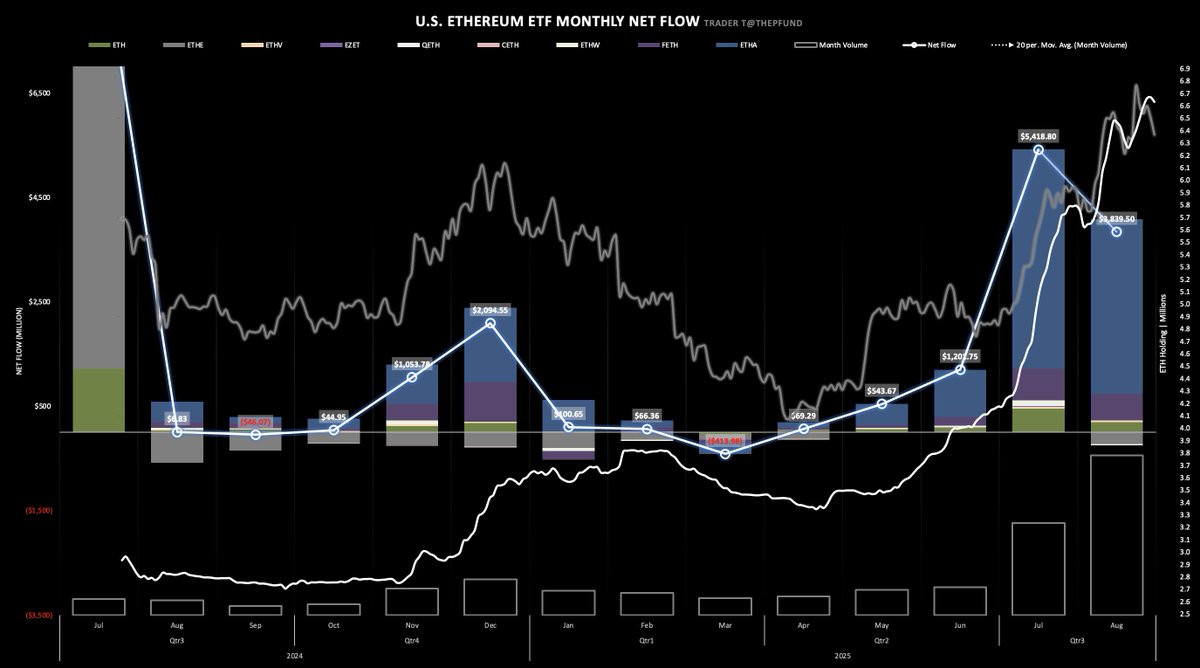

2025/8 Ethereum ETF Monthly Net Inflow: $3.8 billion (+0.8 million ETH) - $ETHUSD: $3,698 → $4,363 (+18%) - 2nd largest inflow since inception - Price reaches all-time high: $4,956 - BlackRock’s $ETHA sees an inflow of $3.4 billion (87% of total inflow this month) - Fidelity Investments