Julian Hebron

@thebasispoint

Founder TheBasisPoint.com - on the strategy & business of housing, banking, fintech.

ID: 13498412

http://thebasispoint.com/newsletter 15-02-2008 01:16:32

19,19K Tweet

3,3K Takipçi

525 Takip Edilen

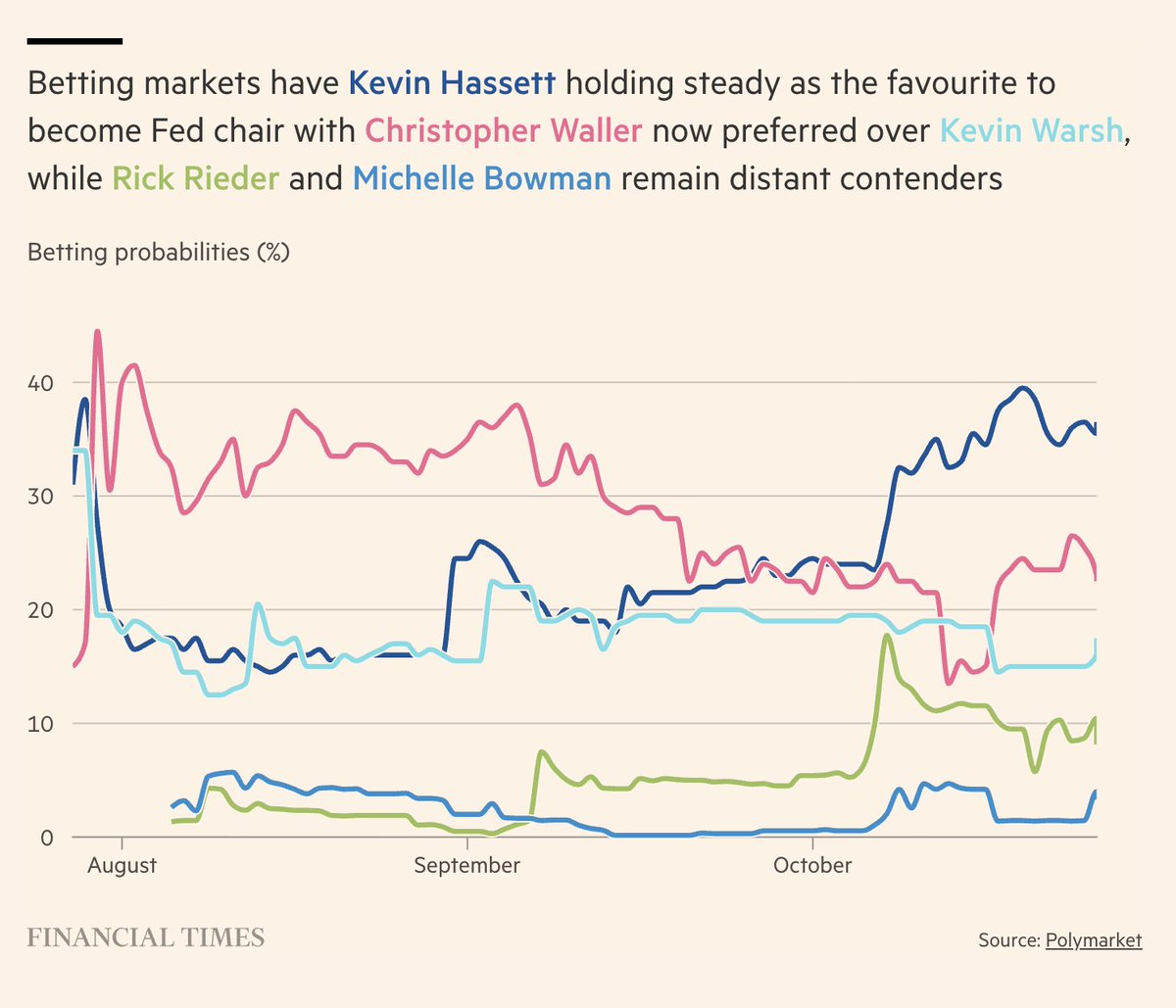

Image below on how betting markets rank Bessent's top 5 picks to replace Powell as Fed chair. And here's the full FT piece by Claire Jones - ft.com/content/88c7be…

2 great excerpts from Adam Mosseri back to office in 2026 memo sent to all Instagram and Threads employees… all companies should do this. === 2. Fewer meetings: We all spend too much time in meetings that are not effective, and it's slowing us down. Every six months, we'll cancel

Worth watching: a measured, accurate housing 2026 outlook with Julie Hyman at Yahoo Finance and my friend Jeff Taylor at Mphasis Mphasis Digital Risk — he debunks the 40-year-old first time homebuyer headlines, and talks rates and state of affordability too.

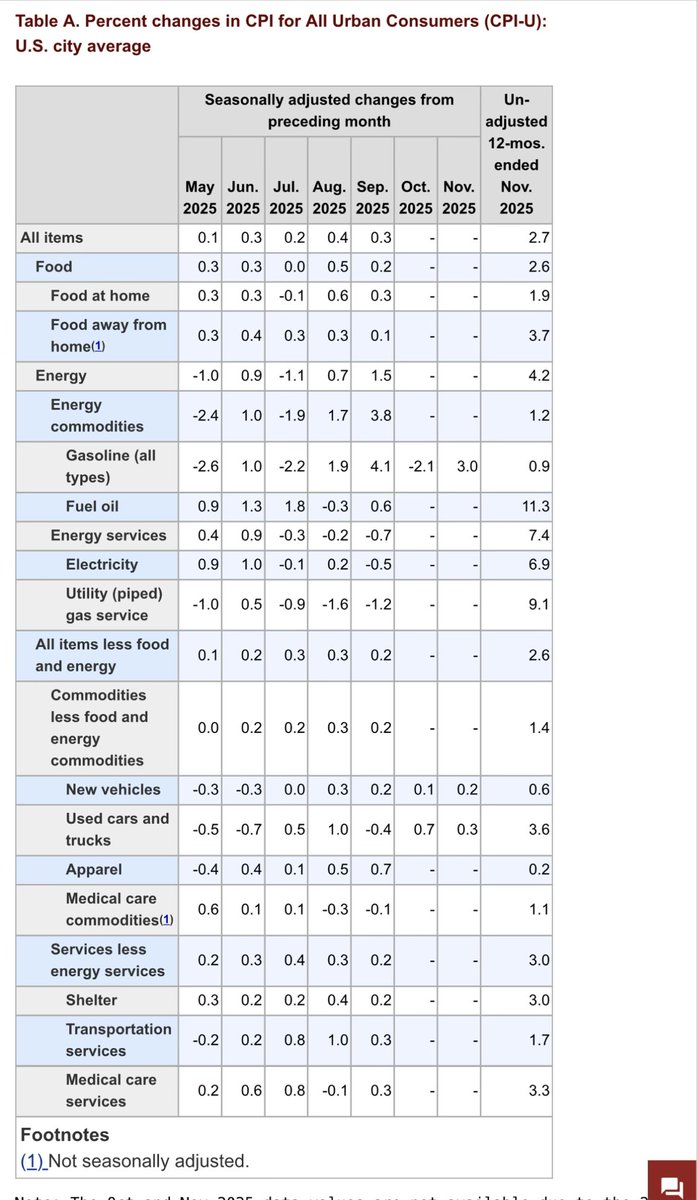

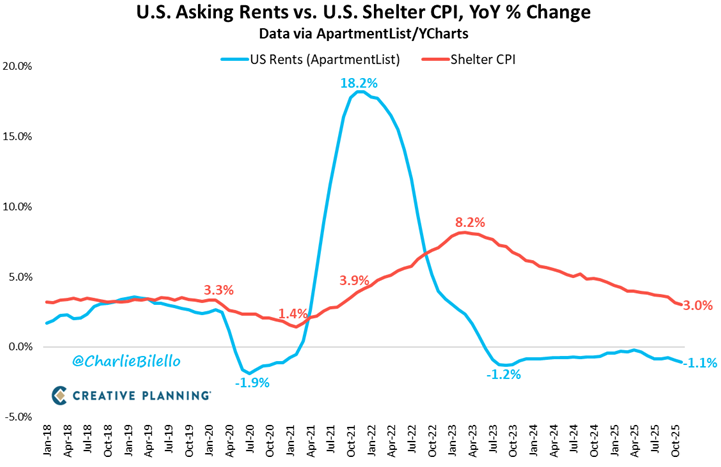

From Omair Sharif "This is totally inexcusable. The BLS just assumed rent/OER were zero for October. I am sure they have a good technical explanation for this, but the only way you get a two-month average for rent of 0.06% and OER at 0.135% is assuming October was zero.