Stuart U3O8

@stuartlorimer4

First invested when I was 16. Started small & built my PF with patience & due diligence

ID: 1127809199574900736

13-05-2019 05:34:01

3,3K Tweet

1,1K Takipçi

653 Takip Edilen

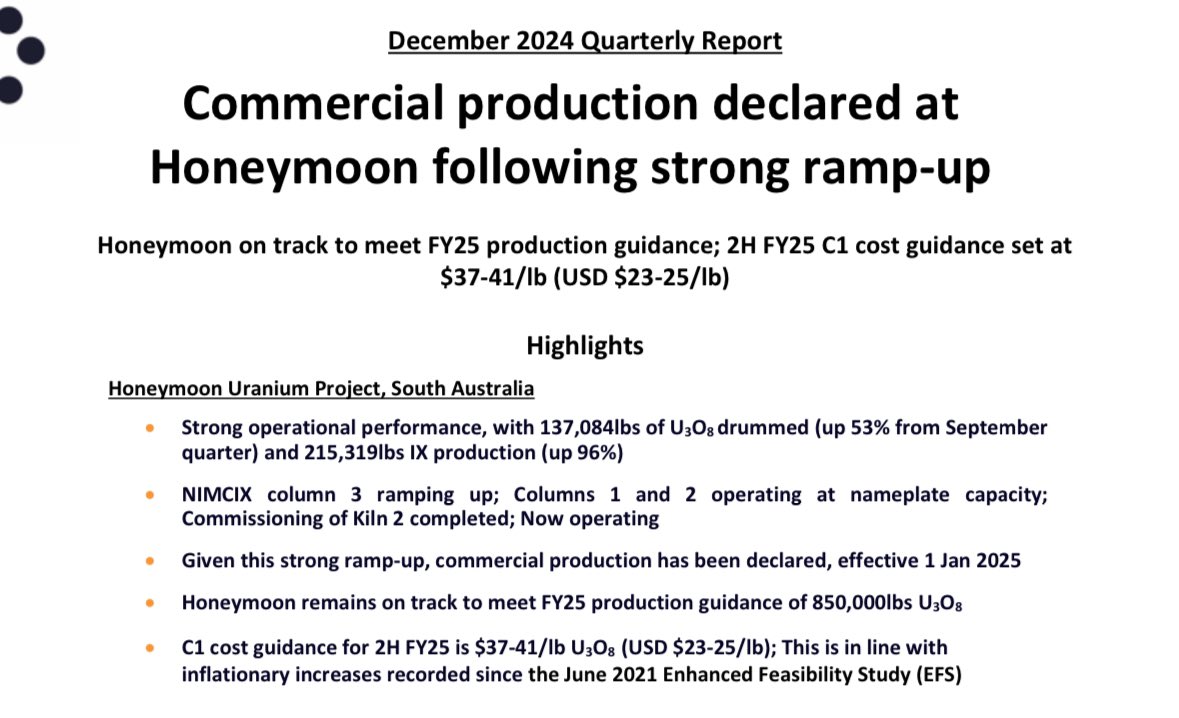

$BOE Boss Energy Ltd reporting a solid re-start of the Honeymoon project with commercial production announced and a C1 cash cost of US 23-25 /lb of #uranium They remain on track to meet FY25 production guidance 👍

Solid quarterly report from Boss Energy Ltd. $BOE currently ahead of production guidance and below production costs. Positive cash flow generation. Shorts remain at 26%! #uranium