Stratify Data

@stratify_data

Helping businesses incubate big ideas that involve complex data science or data engineering.

+

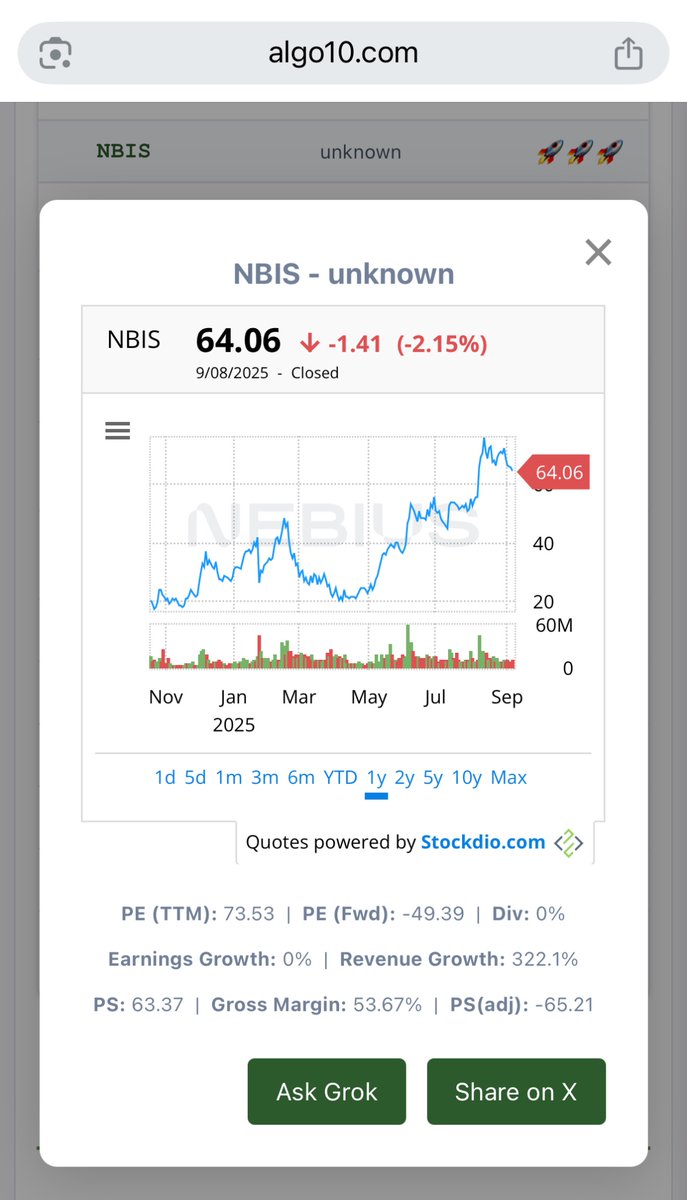

Educational info for individual traders (algo10.com)

ID: 1725234308779069440

https://www.stratifydataconsulting.com/index.html 16-11-2023 19:28:17

2,2K Tweet

194 Takipçi

722 Takip Edilen