statistician1005

@statistici89506

ID: 1764708328930734081

04-03-2024 17:43:56

388 Tweet

8 Takipçi

125 Takip Edilen

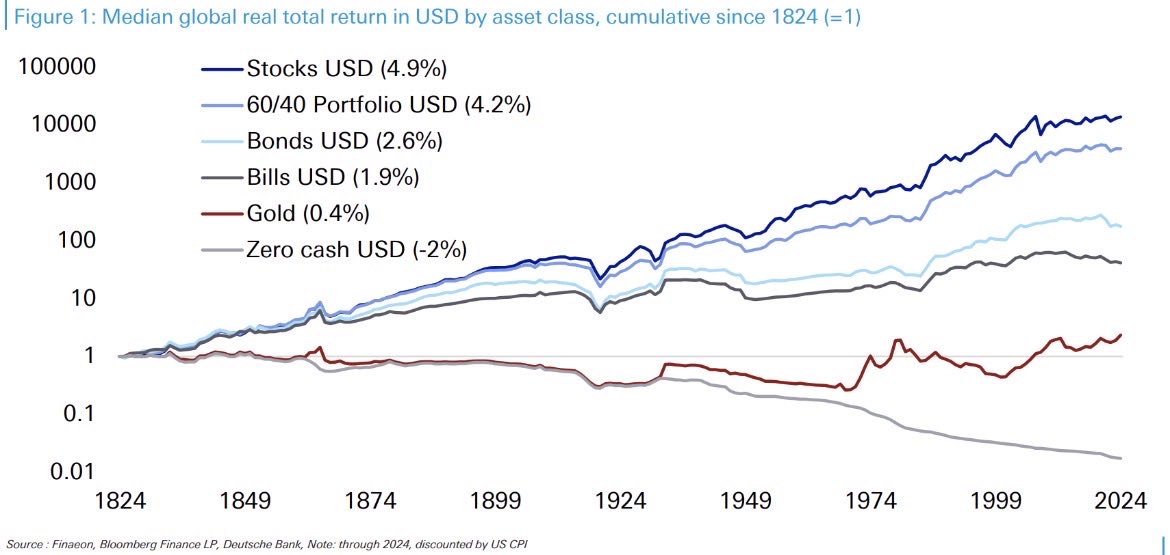

„The Ultimate Guide to Long-Term Investing“ des großartigen Jim Reid von Deutsche Bank Research ist da! Reid zeigt auf Basis von Daten aus 200 Jahren, warum es sich langfristig auszahlt, auf Aktien zu setzen. Wer Privatier werden will, geht in Börsenpapiere, auch wenn Gold im 21.