Seth Golden

@sethcl

I specialize in VIX, Retail, Consumer Goods. Hedge fund consultant, chief market strategist Finom Group

ID: 568403097

https://www.finomgroup.com 01-05-2012 16:00:02

58,58K Tweet

53,53K Takipçi

593 Takip Edilen

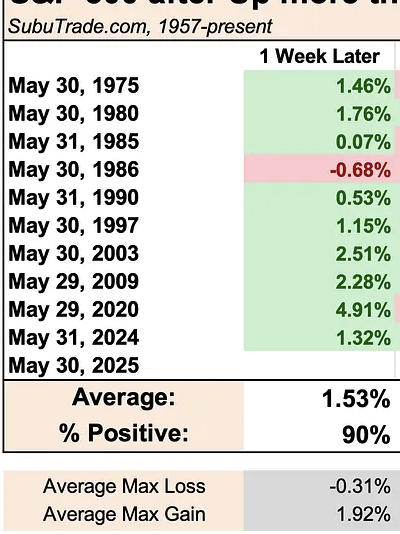

This week🤯 It's not perfect 💯, but it's pretty darn close. The week following a May monthly 4%+ gain, $SPX has been higher the following week 90% of the time; only 1 pullback week of the 10 occurrences. $ES_F $SPY $QQQ $NYA $RUT $NVDA $MSFT $AAPL h/t Subu Trade