Soonder - Energy = life and prosperity

@scinvestoru308

🇧🇪 Contrarian investor - Work in the European Energy sector - interested in commodity markets mainly O&G, Coal and Uranium

ID: 1512780322517176320

09-04-2022 13:12:12

1,1K Tweet

580 Takipçi

1,1K Takip Edilen

Barchart Uranium short term futures are one of the weakest signals of supply/demand. Why? 1) Uranium costs are such a small %age of cost of nuclear power generation unlike other energy sources, 2) negotiations are artisanal, happening infrequently at industry conferences, 3) there exists

1/A great podcast featuring Maria Korsnick, President and Chief Executive Officer at Nuclear Energy Institute Very positive on the #nuclear outlook. #uranium bloomberg.com/news/audio/202…

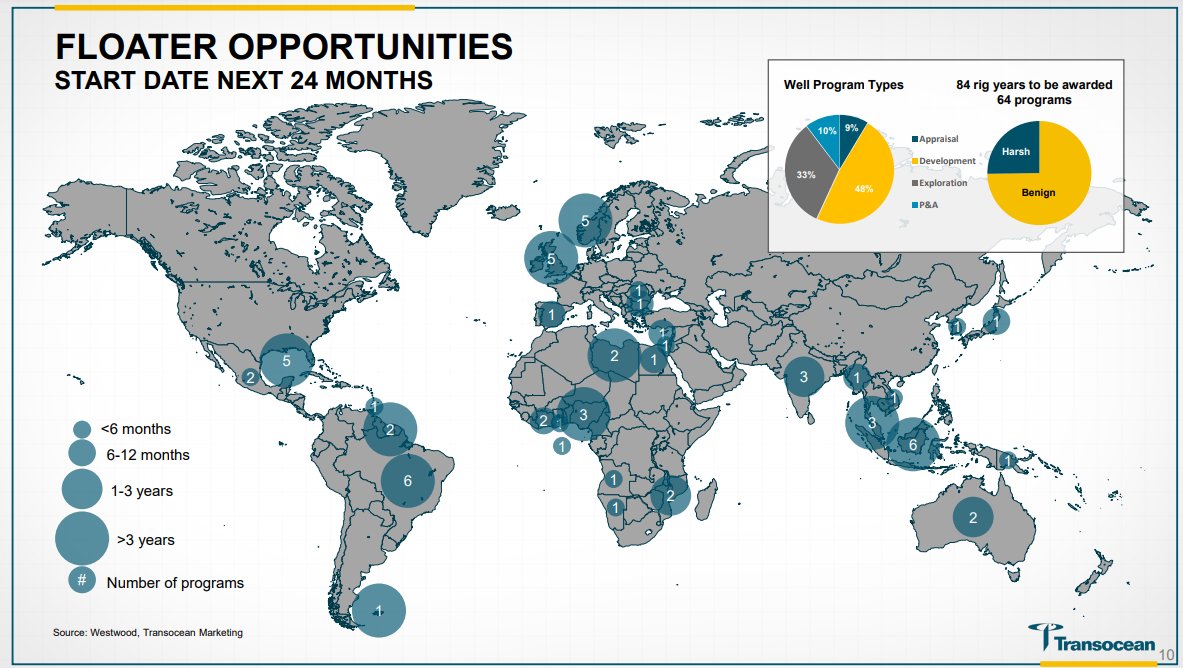

Stonks & Chill I feel way better about $borr than I do $rig right now especially with all that debt and current status of floater dayrates

Michael Shellenberger Shutting down nuclear power is crazy