Objective

@objectivedefi

Objective Labs is a no-nonsense partner for risk management and growth in DeFi.

ID: 1871856660563562496

https://www.objectivelabs.io/ 25-12-2024 09:53:05

22 Tweet

344 Takipçi

14 Takip Edilen

Today we are excited to introduce Objective Labs with the mission to scale DeFi beyond its bubble. We work with teams to find and execute on asymmetric opportunities. Our first partnership with Euler Labs helped them scale to $1B in no time. This is our philosophy:

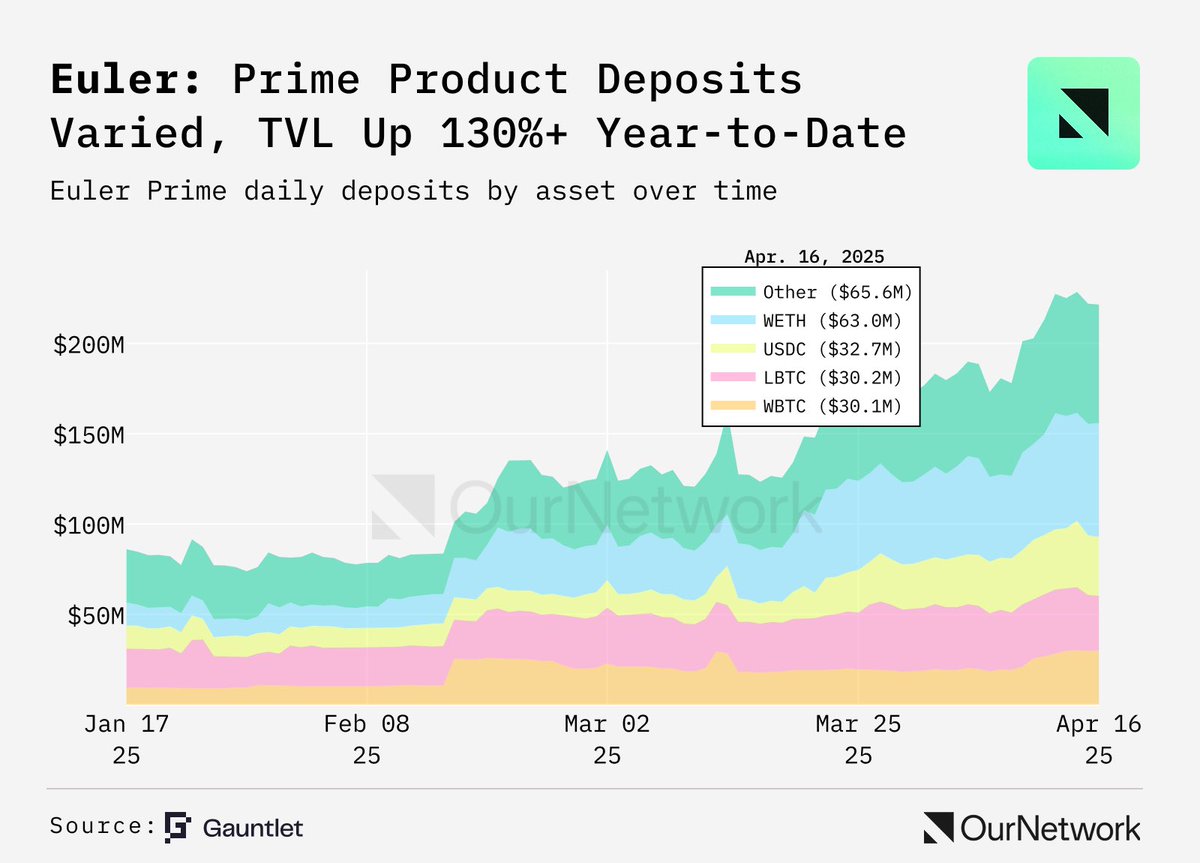

1/ While Euler Labs continues to launch across various new chains and gain momentum, growth on Ethereum persists. Here are some notable changes that went down last week (April 7 - 13). 🧵 x.com/eulerfinance/s…