Mindful Compounding with Luuk

@mindfulcompound

Investor in quality businesses led by excellent managers, while ensuring I don’t overpay 🧠 Next to that, I’m a writer of a blog on (high-)quality investing! 📚

ID: 1768542134322241536

https://mindfulcompounding.substack.com 15-03-2024 07:38:18

315 Tweet

517 Takipçi

495 Takip Edilen

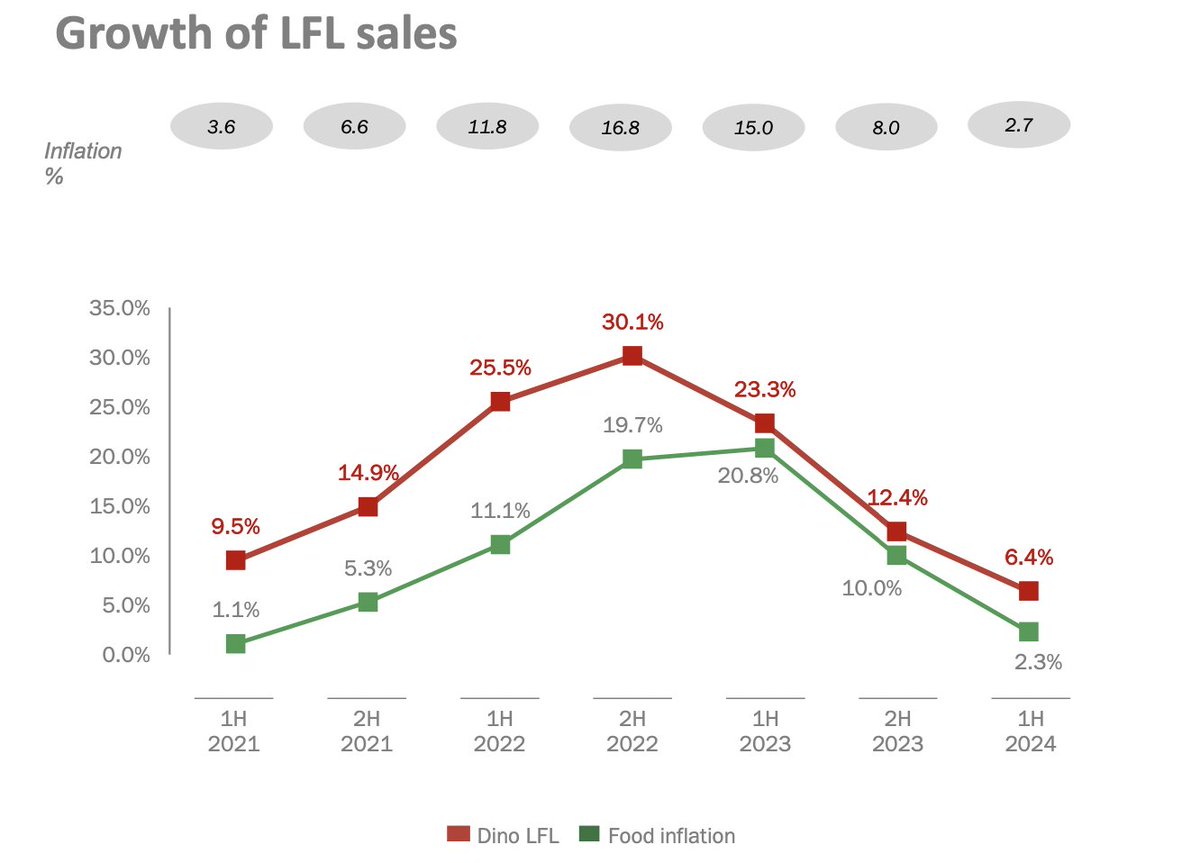

$DNP.WA Dino's up after a strong Q3 report! Key reasons: 1. EBITDA margin is improving, with no more mention of margin pressures (unlike H1 report). 2. LFL sales are rising. 3. More store openings planned for 2025 than 2024. Here's my deep dive on Dino: mindfulcompounding.substack.com/p/a-deep-dive-…

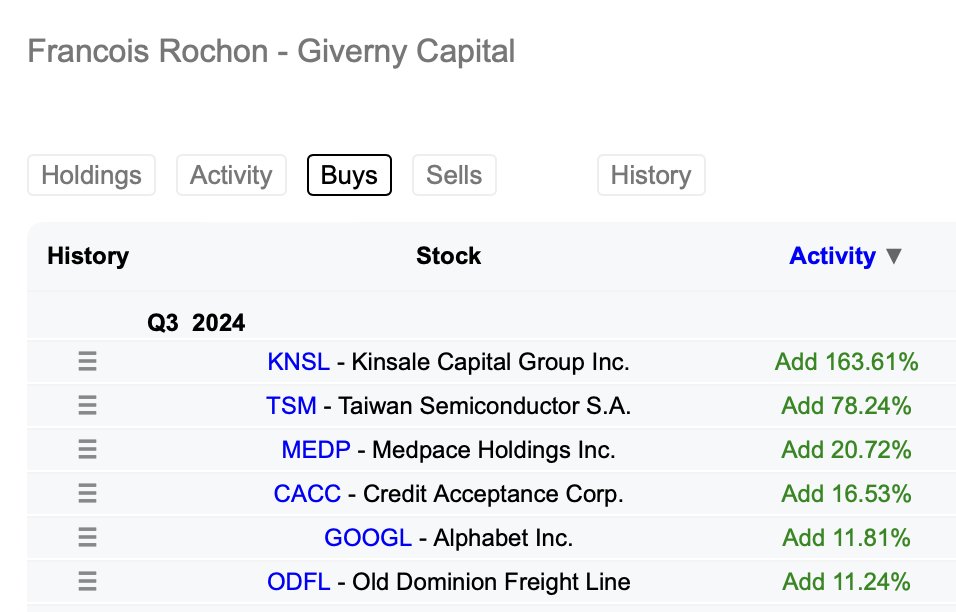

Gotta love it: Rochon’s adding big to $KNSL in Q3 and still expanding $MEDP & $ODFL – interesting picks. Rob Vinall has $CACC too; worth a closer look? I wrote a blog on Rochon's annual letters. Here’s the link if you're interested in his timeless lessons: mindfulcompounding.substack.com/p/what-i-learn…

Added 42 new stock pitches to the website, including (pt 1): David Diranko (Monday Delight)- $BQM.SI, $BOL.AX, $INH.DE, $KSB.DE, $DGL.AX Ole - $NIL-B.ST Quest for Yield - $ZBH Pharmdca - $DAWN Colin King - $CAN.L (acquisition) Luuk - $NEDAP.AS