Mike McGlone

@mikemcglone11

Senior Commodity Strategist - Bloomberg Intelligence

ID: 1663323588

11-08-2013 20:05:59

4,4K Tweet

68,68K Takipçi

487 Takip Edilen

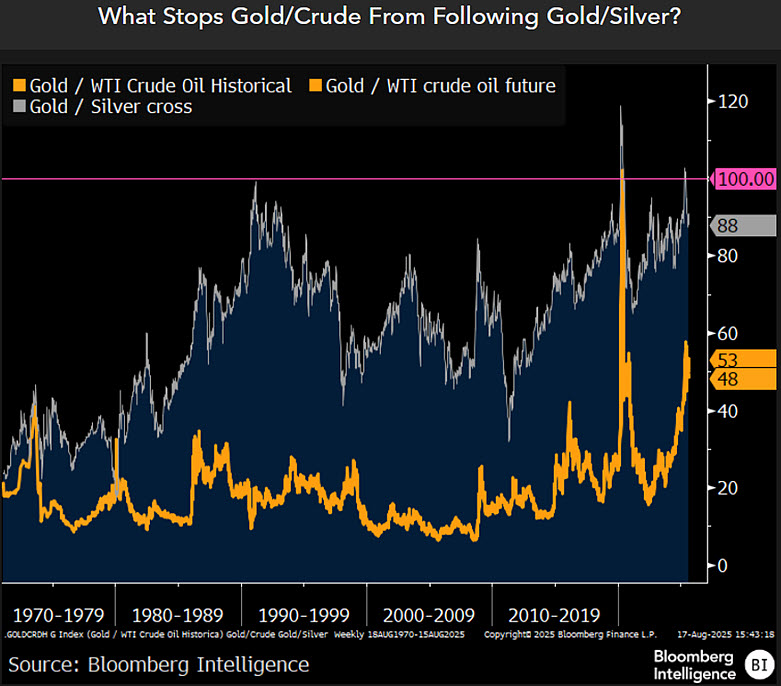

A five-month bull flag in gold. What stops a next step toward $4,000 an ounce? bloomberg.com/news/videos/20… #gold Bloomberg Intelligence

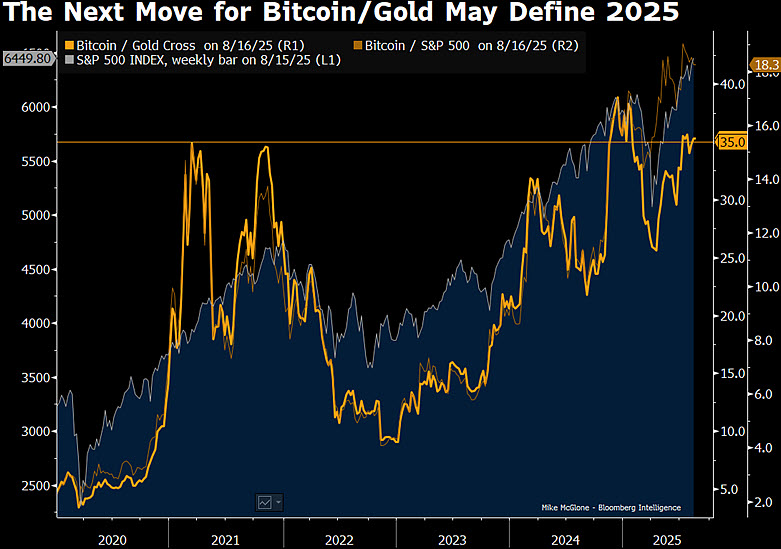

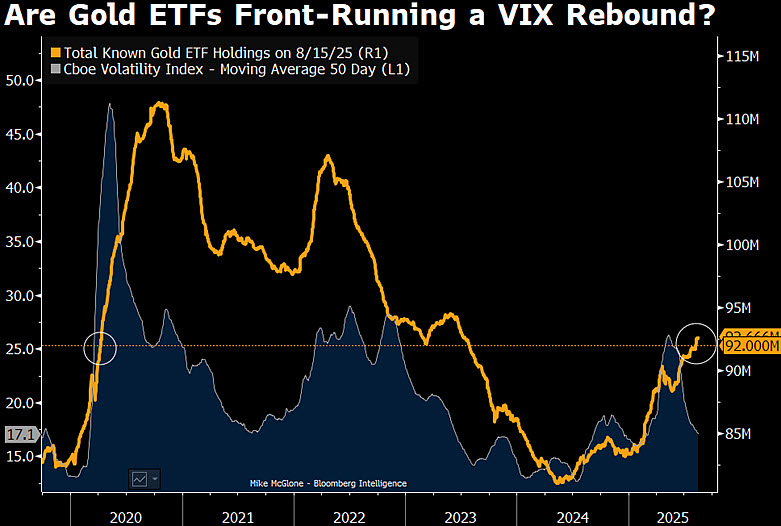

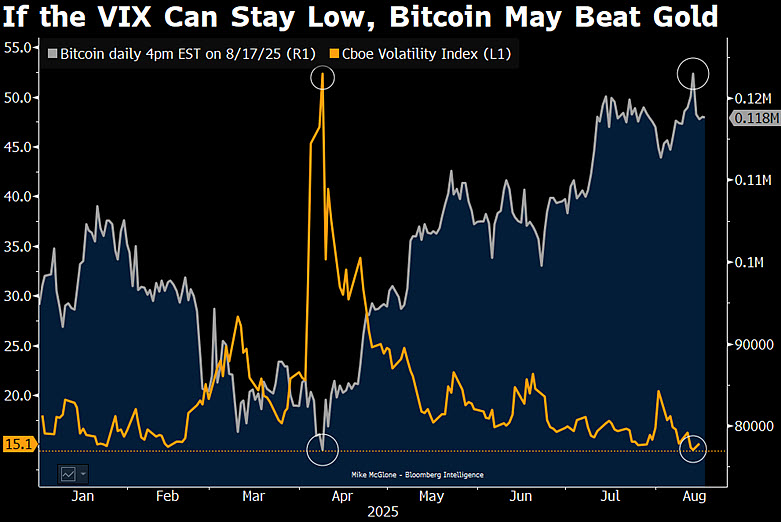

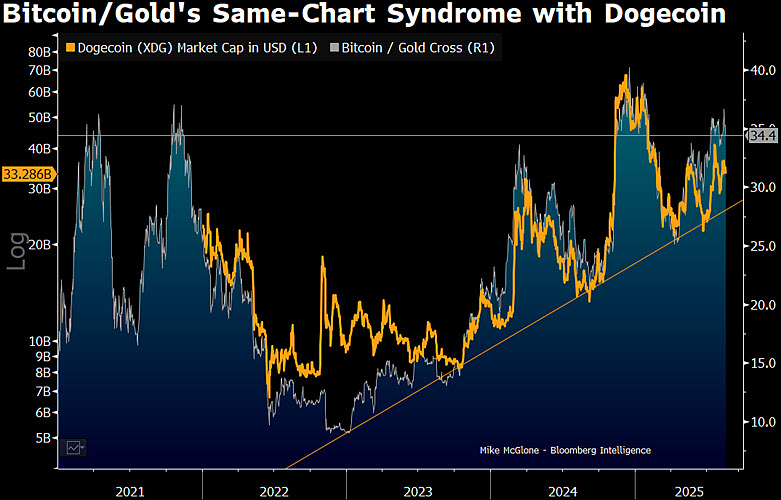

$100,000 Bitcoin, VIX at 20 -- meh, just some reversion that may favor gold. Full report on the Bloomberg terminal here: blinks.bloomberg.com/news/stories/t… {BI COMD} #bitcoin #stockmarket #gold Bloomberg Intelligence