Miguel Santos

@miguelsantosw

Entrepreneur, Bizdev Europe & Strategy for Galileo, investing in fintech, edtech, clean nrg & crypto, snowboarder & DJ. AKA Mike.

ID: 220463192

27-11-2010 21:34:17

4,4K Tweet

4,4K Takipçi

401 Takip Edilen

If your lending strategy is still “spray, pray, and pre-qualify,” it might be time for a reboot. Consumers expect Netflix-level personalization, not dial-up-era loan offers. At Galileo Financial Technologies we’re done waiting for legacy systems to catch up — we’re building what’s next. Great

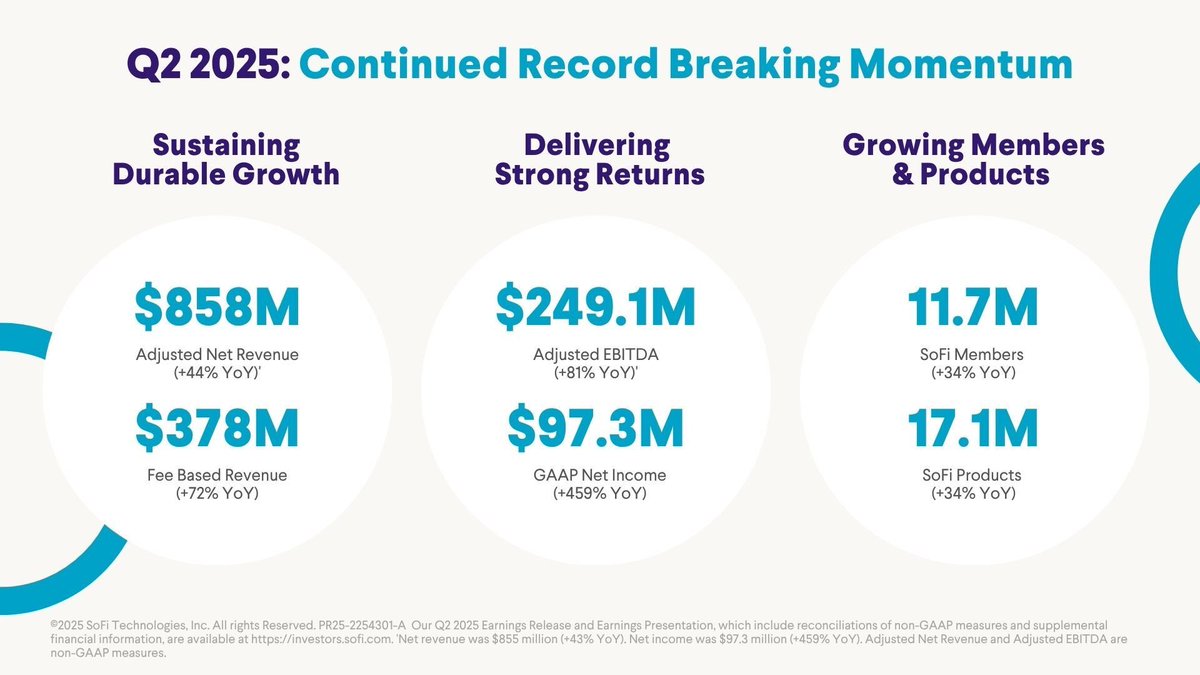

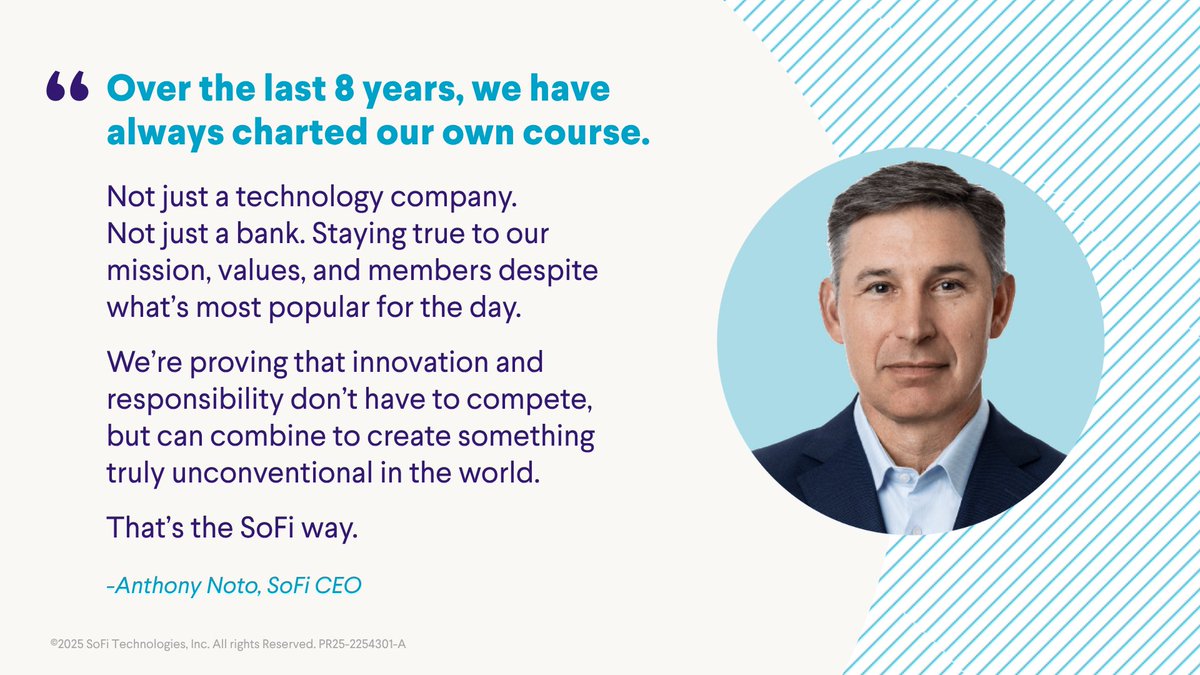

$SOFI CEO Anthony Noto on CNBC talking about Q2 2025 results.

For many SoFi members, sending money to family abroad isn’t optional - it’s essential. That’s why we partnered with Lightspark to power our soon-to-launch blockchain-enabled international money transfer service directly from the SoFi app.