RAZZY

@lorrd_razzy

Crypto enthusiast | Web3 farmer

ID: 1481525355500478465

13-01-2022 07:16:06

3,3K Tweet

1,1K Takipçi

920 Takip Edilen

Hi I’m Razzy, this is a Proof I’m not a bot even tho i tweet about Mavryk Network | Tokenizing $10B in RWAs and all day Pass it on !!

Mavryk positions itself as more than a protocol. It is a carefully structured ecosystem designed to reimagine finance with efficiency, security, and user sovereignty at its core. By removing intermediaries and automating trust through smart contracts, Mavryk Network | Tokenizing $10B in RWAs builds a

RWA is no 1 narrative on Web3 Mavryk Network | Tokenizing $10B in RWAs is proof that 👀 Soon everyone pivot to RWA We are just getting started

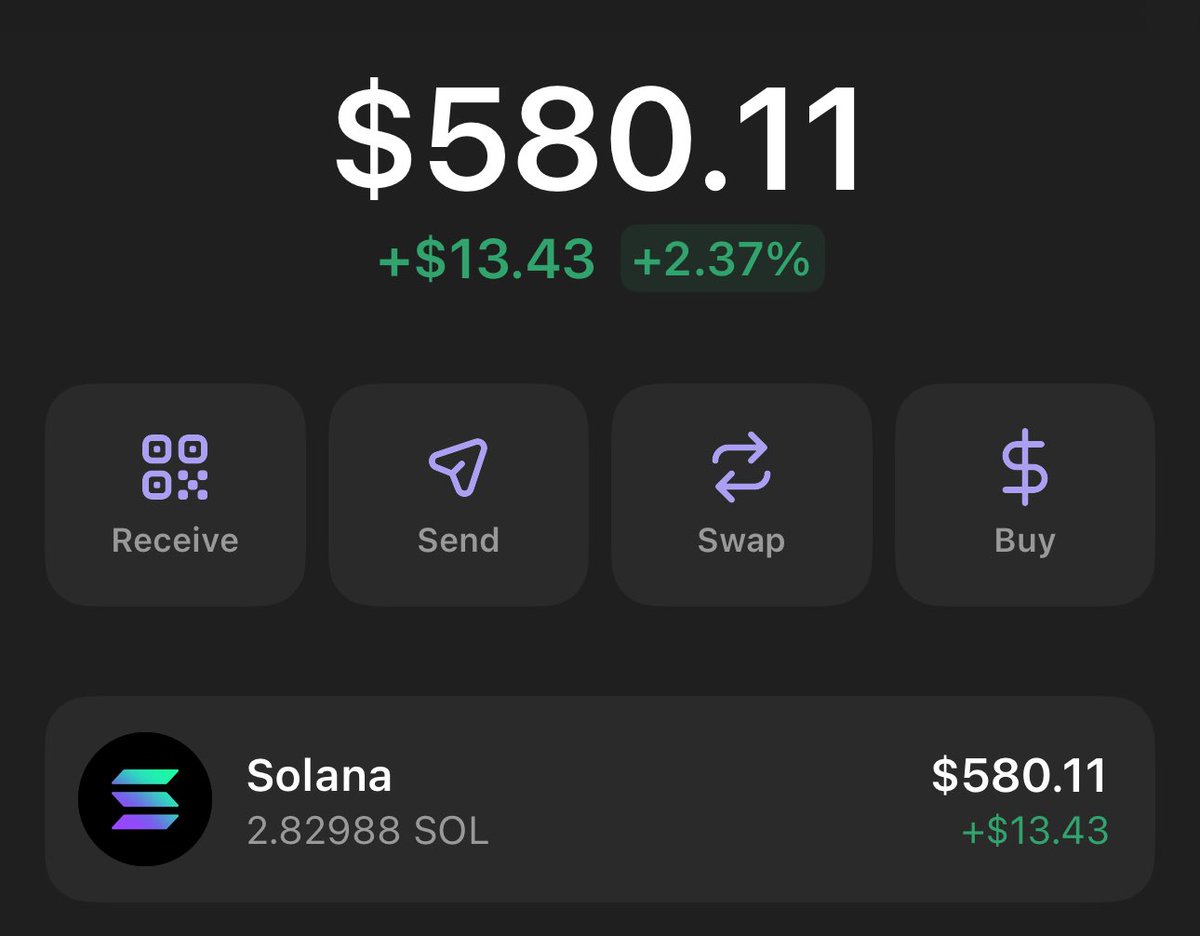

1sol to 5 Degens Like, repost and comment wallet Selecting winners in 12hrs Follow blockchainrollup