Jeff Tucker

@jeff_tucke

Principal Economist at Windermere Real Estate

ID: 1004148684706099201

05-06-2018 23:51:17

1,1K Tweet

1,1K Takipçi

637 Takip Edilen

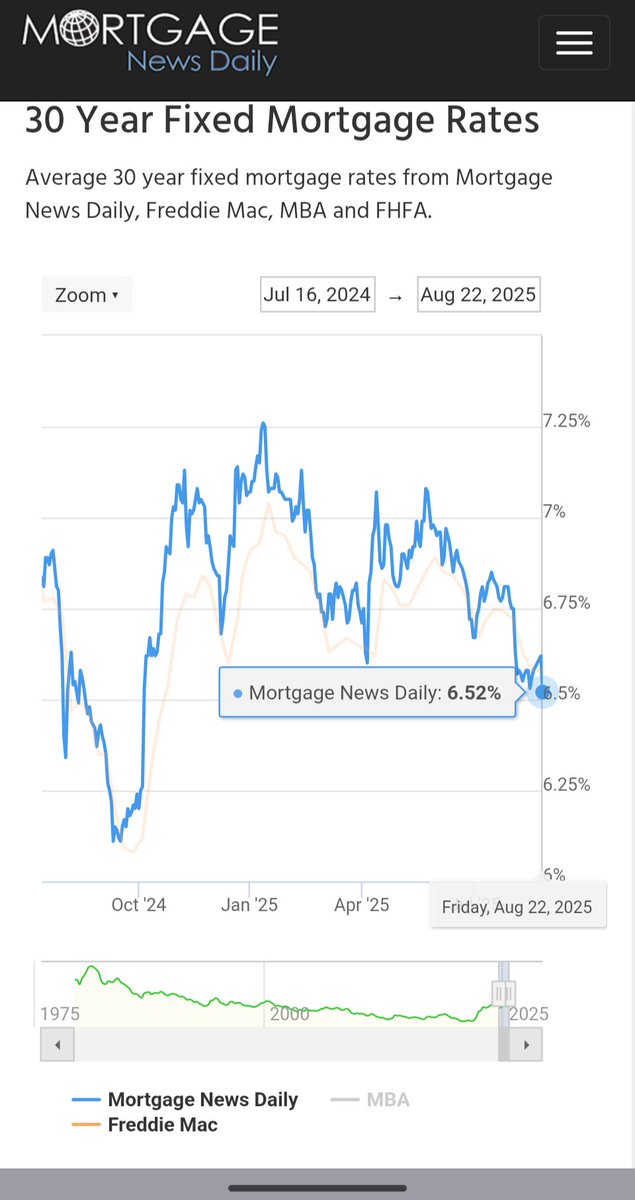

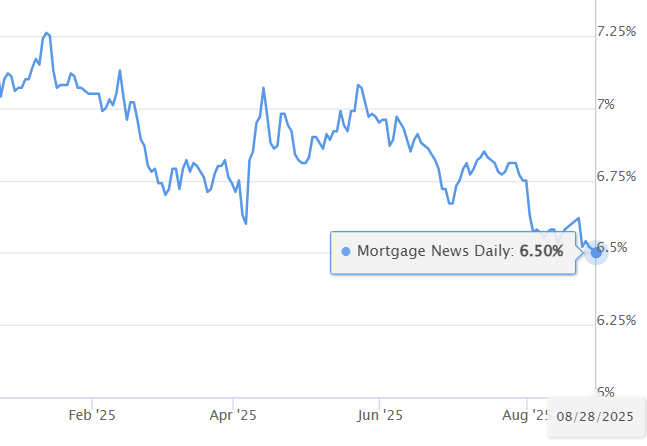

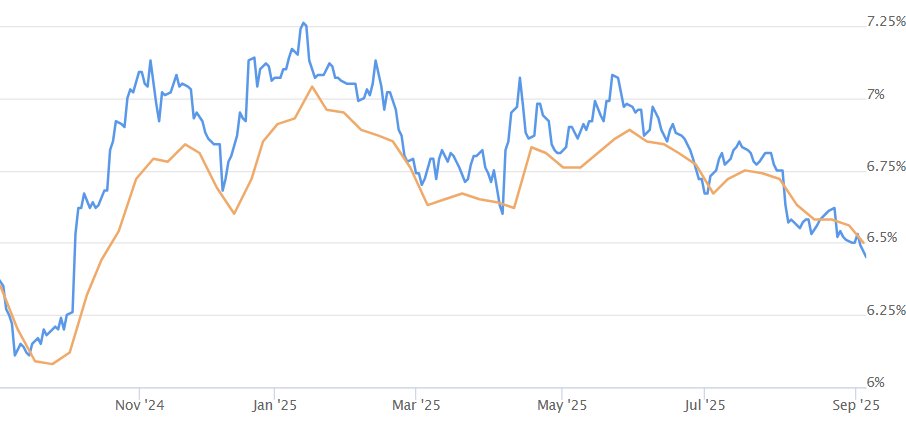

Mortgage deja vu: Mortgage News Daily shows rates below 6.6% this week, right around the time they dipped below 6.6% last year! There's no guarantee they'll continue all the way below 6.25 like last fall, but a softening labor market has made history repeat so far this summer.

Wow! YTD lows today for mortgage rates: 6.52% according to Mortgage News Daily 's midday print. Investors feeling bullish on bonds after dovish speech by Jay Powell at Jackson Hole this morning.