International Equity

@intlequity

#RealEstate & #StockMarket #Investing #News • #REIT, #Economic, #Finance, CRE & Residential Market Data & Analysis • U of Penn Alum • Not An Advisor

ID: 915632397885911041

04-10-2017 17:39:10

8,8K Tweet

563 Takipçi

4,4K Takip Edilen

The Market Projects a Much Faster Pace of Rate Cuts than the Fed Richard Field John Lounsbury U.S. Route 41 graceland Tuomas Malinen jim iuorio Jon Fraser Gratke Wealth, LLC David Sommers Is the market right or the Fed? mishtalk.com/economics/the-…

![Lance Lambert (@newslambert) on Twitter photo BIG ONE-DAY DROP

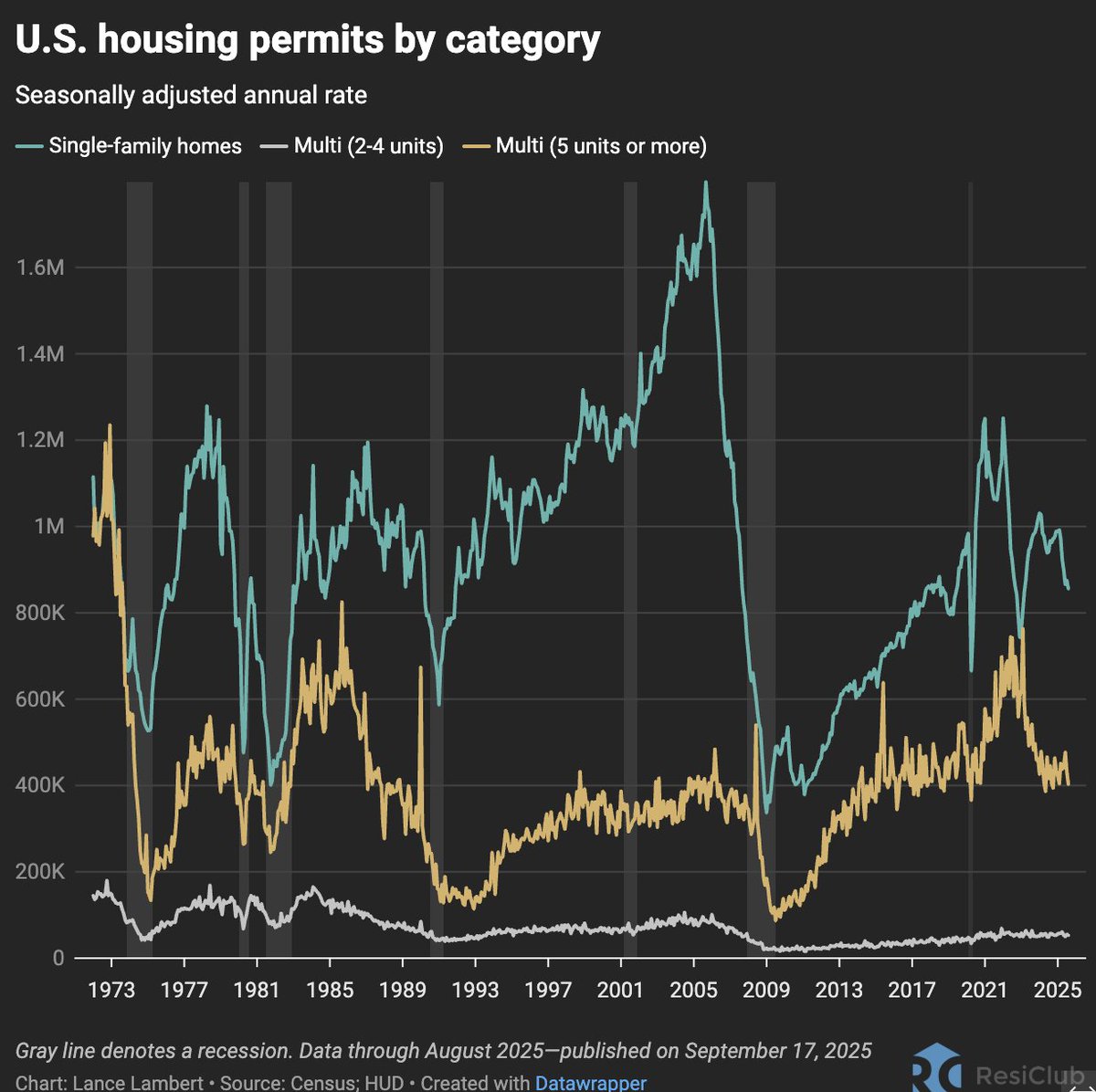

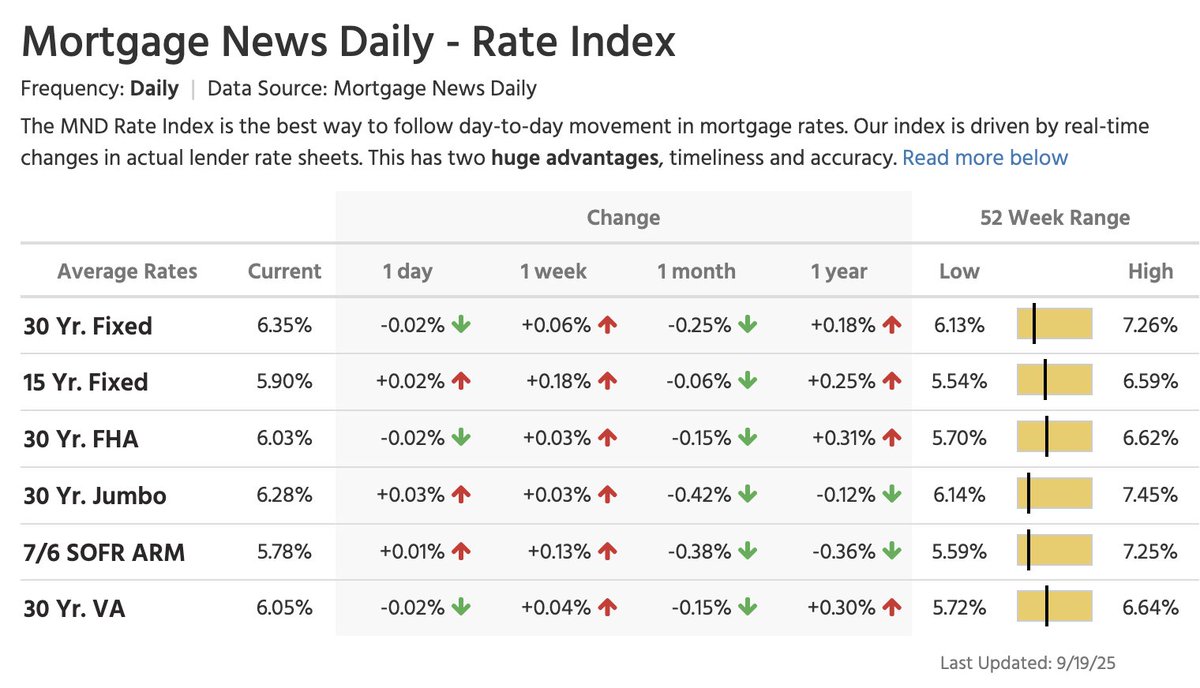

The average 30-year fixed mortgage rate today: 6.13%

Same day last year: 6.12%

2025 range: 6.13% <---> 7.26%

---------

10 Year Treasury yield today: 4.04%

Spread today: 209 bps [That's a 3-year low] BIG ONE-DAY DROP

The average 30-year fixed mortgage rate today: 6.13%

Same day last year: 6.12%

2025 range: 6.13% <---> 7.26%

---------

10 Year Treasury yield today: 4.04%

Spread today: 209 bps [That's a 3-year low]](https://pbs.twimg.com/media/G0-s5PmXIAACidb.jpg)