amocat

@hoohan

ID: 1375816592

24-04-2013 00:48:11

7,7K Tweet

60 Takipçi

75 Takip Edilen

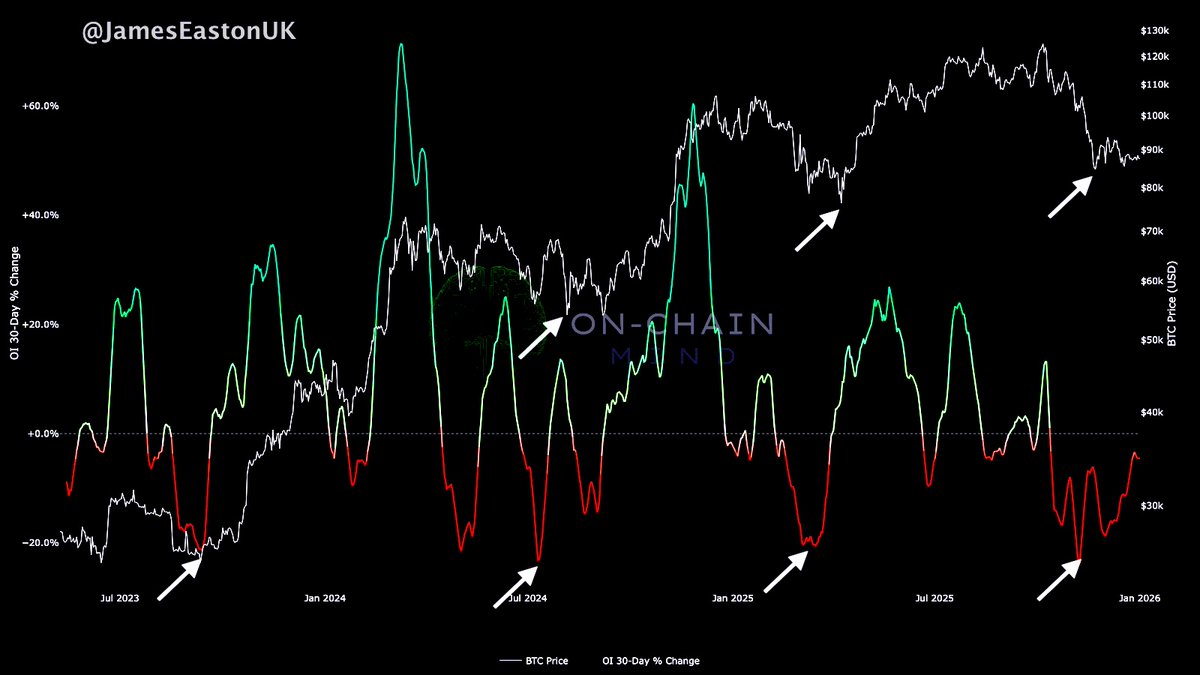

$BTC 🟠 Futures Open Interest is in the gutter. Historically this has marked huge reversals. Bullish. h/t: On-Chain Mind 🧠

Hyperliquid YEAH BUT WHEN WILL THE HIP-3 PRECOMPILE AND COREWRITER ACTIONS BE ENABLED TO PLACE ORDERS VIA HYPEREVM?????? STOP DRAGGING THE CHAIN