Harish Reddy

@harishreddy_sm

Co-founder Stable Money; tech.. hft.. markets.. iitb..; dad to 3 cats and a baby girl

ID: 101869399

04-01-2010 21:35:39

122 Tweet

233 Takipçi

676 Takip Edilen

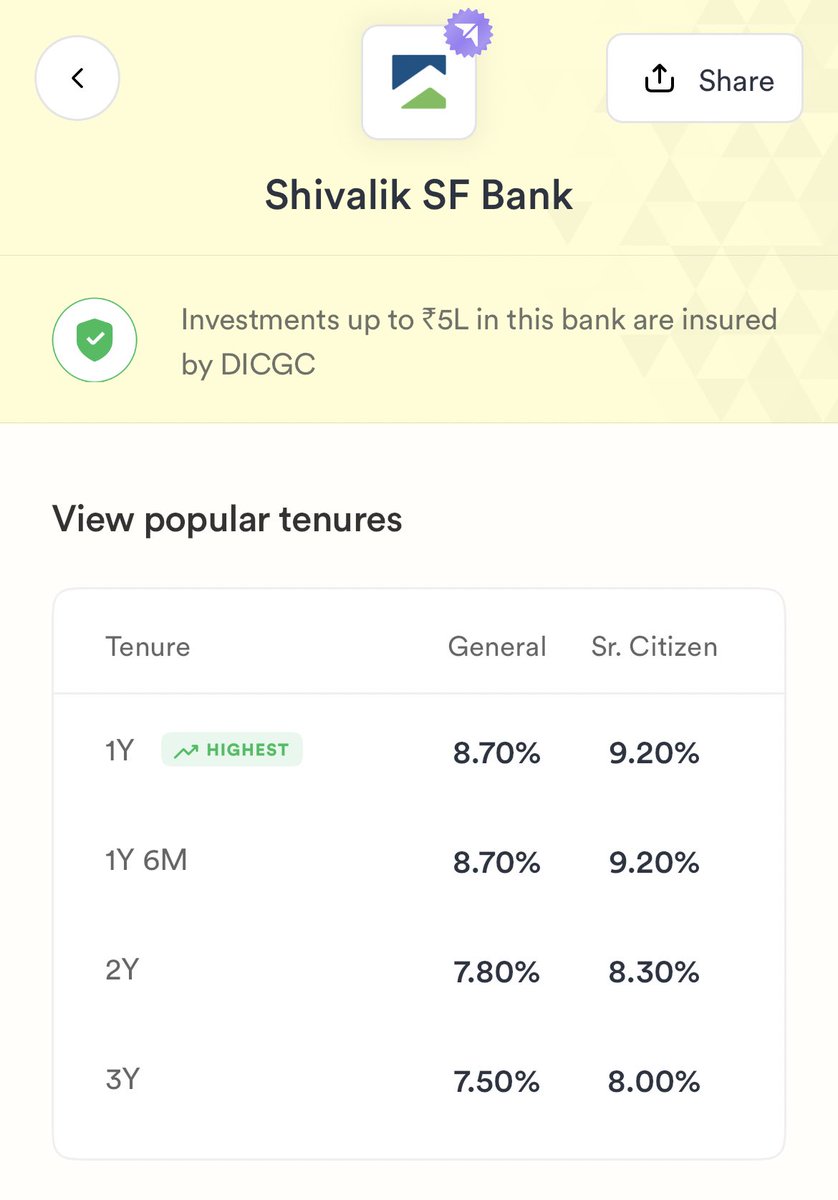

Want to find the best rate of interests on FD in India, check out this app. Stable Money This exclusive invite link expires in 24 hours:⏳ stablemoney.app.link/dC1zf3WVzFb

I think Stable Money uses its app icon in the best possible way. Tells you the return you get without even opening the app. Forget fintech, can't think of any other app which uses app icons so nicely. Try it here: stablemoney.app.link/quDbxoexBEb

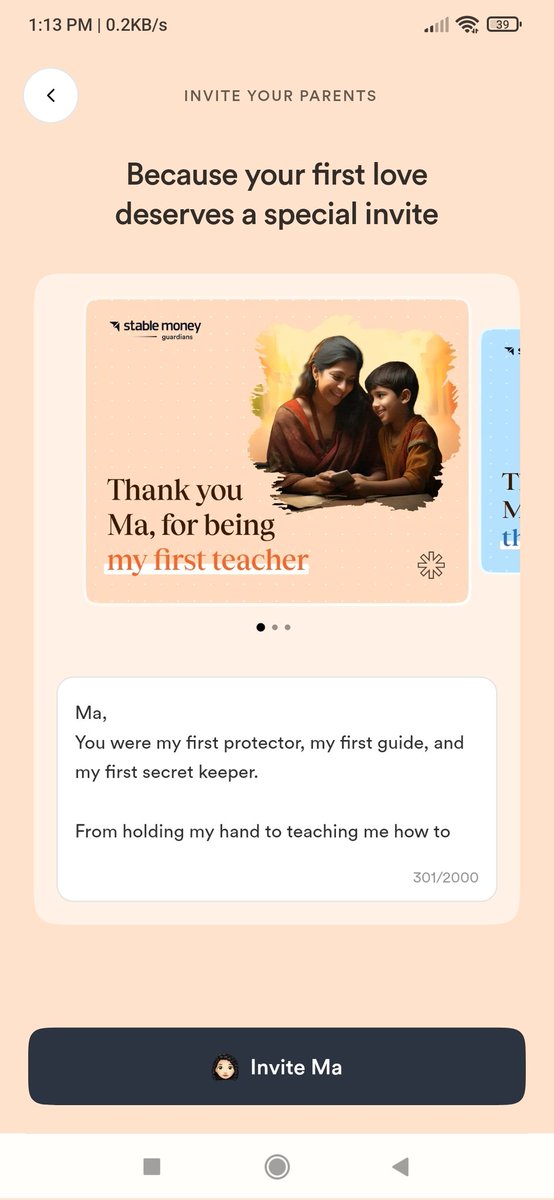

Such a sweet campaign by Stable Money Invite your parents to make an FD. Check out details here: stablemoney.app.link/quDbxoexBEb

Did you mix tax saving investments for FY24. You still have 12 hours to invest in tax saver FDs to complete your 80C quota. Invest and save taxes through Stable Money

9.01% p.a. - the highest fixed deposit rate for general public among all scheduled commercial banks in India., now available on Stable Money ! stablemoney.app.link/MBAuaLmWnCb

Thrilled to continue our partnership with Stable Money as they redefine the fixed-income investment space with innovative digital solutions. The company is making fixed-return investments more accessible and efficient for everyone. Harish Reddy Saurabh Jain Shuvi Shrivastava

Thrilled to co-lead the Series A round and double down on our investment in Stable Money with Harish Reddy and Saurabh Jain. As India's GDP grows and the middle-income segment prospers, the need for tech-first wealth platforms is crucial. Stable Money is enabling retail

What an exciting news …. #StableMoney gets Series ‘A’ funding of $15M … amazing milestone. Congratulations Saurabh Jain Harish Reddy and entire Stable Money team. Very proud to be an early customer/investor of your platform, enjoying your services and excited to see

FDs vs Equities! 'Most investors are happy with equity as an investor class,' says S Naren of ICICIPruMF. Speaking to Prashant Nair & Nigel D'Souza, Nilesh Shah of Kotak Mahindra AMC adds that fixed income instruments will outperform Midcaps & Smallcaps in next 12-18 mths.