Graham Hayden

@grahamhayden11

ID: 910027408853618688

19-09-2017 06:26:56

644 Tweet

114 Takipçi

143 Takip Edilen

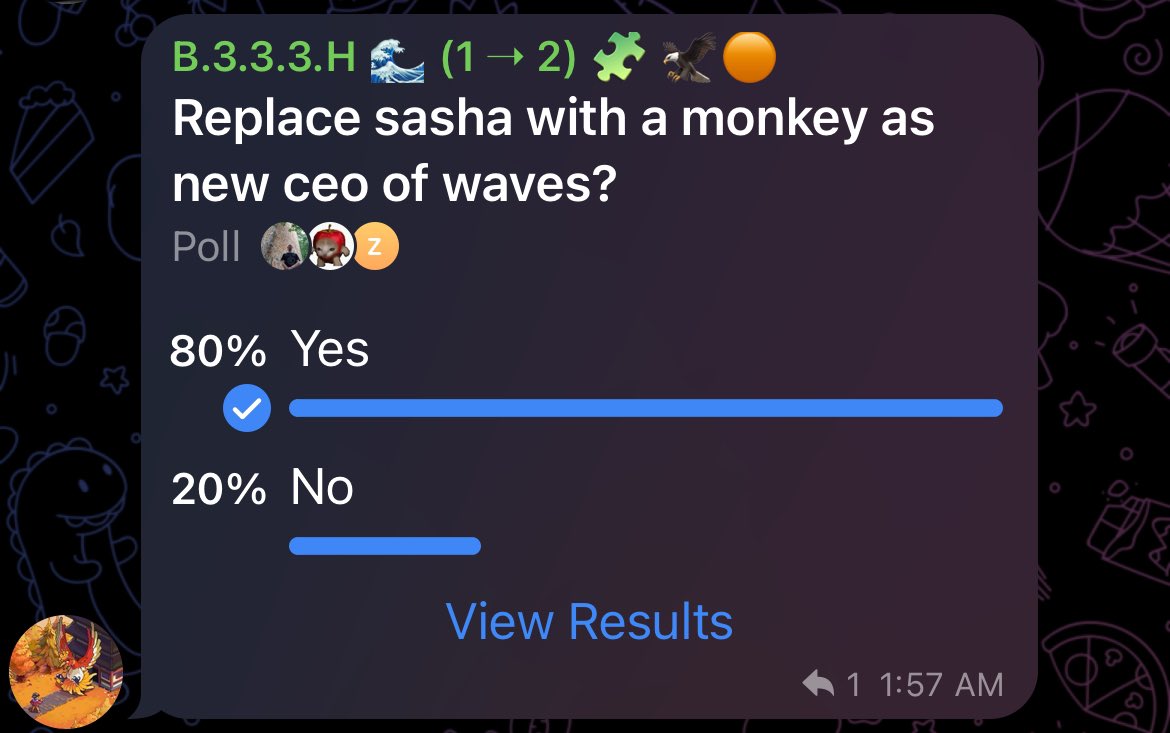

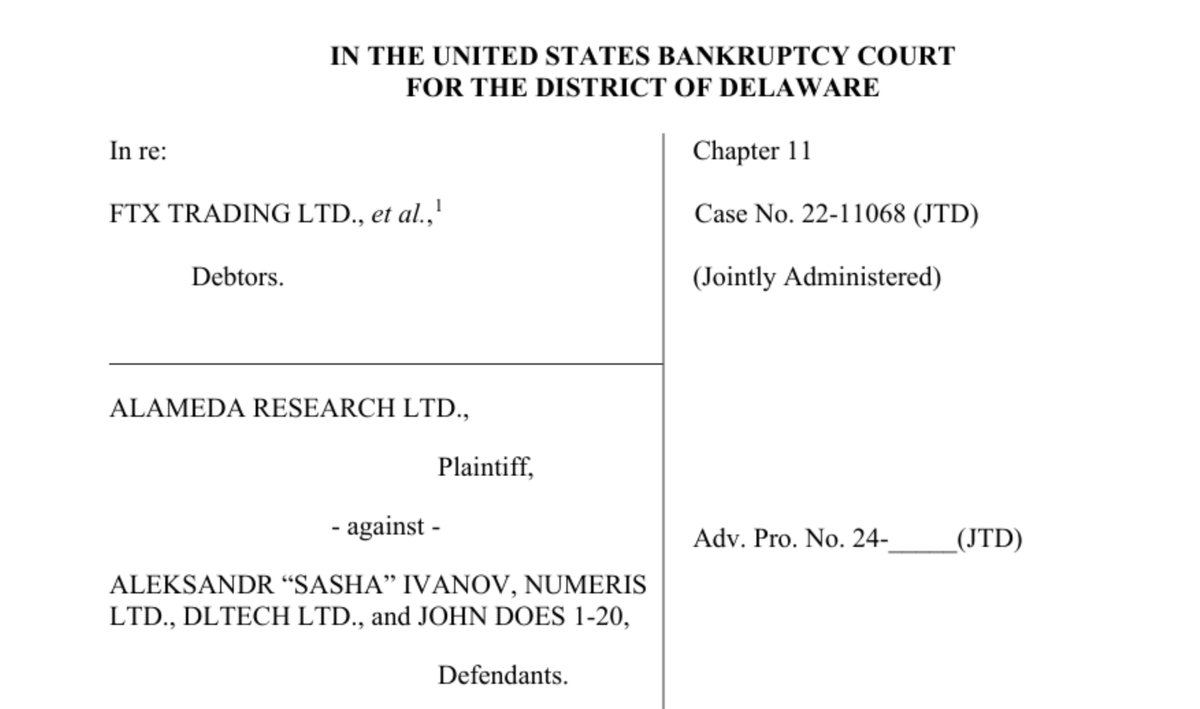

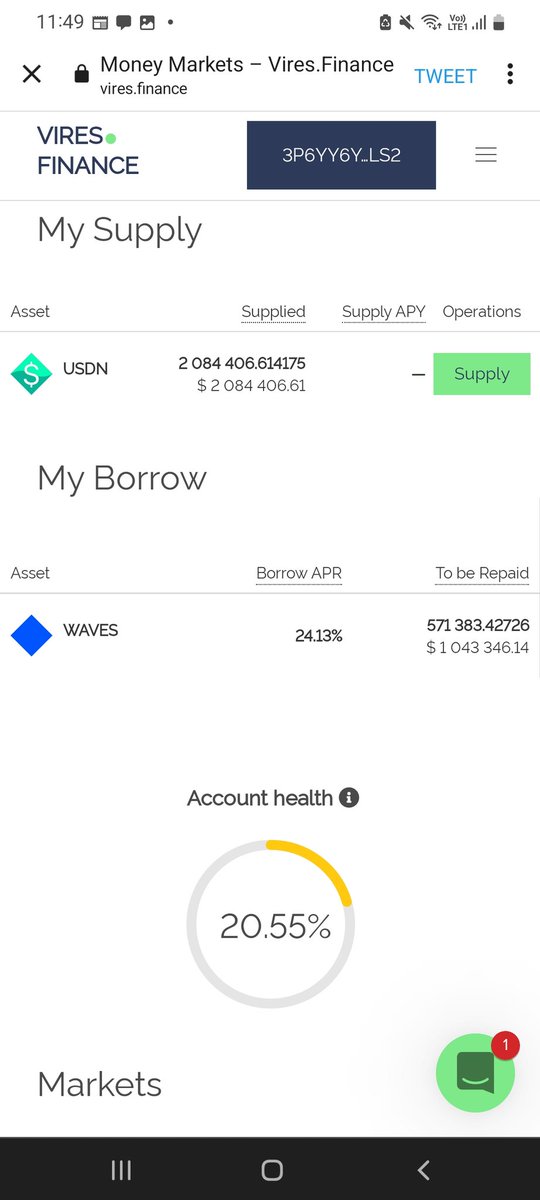

How was someone able to borrow 570k Waves over 1m $ with USDN as collateral from Vires.Finance 🌊 when it was voted against and it is not possible for anyone else to do and everyone else has to fight over a 10k daily limit between everyone CoinDesk Cointelegraph WX Network

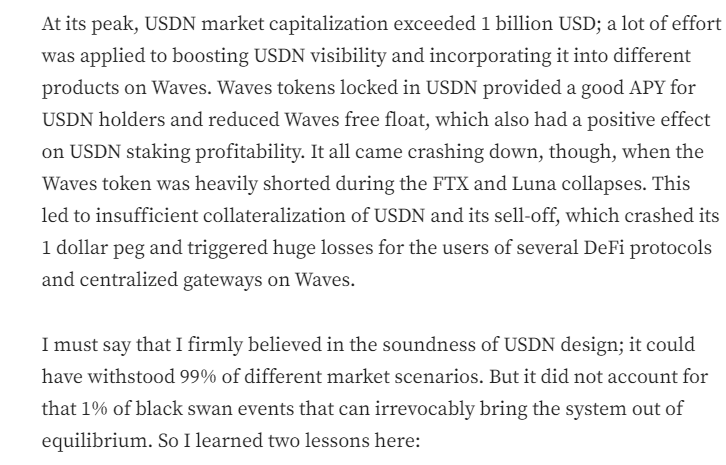

Yeah it's all onchain Sasha.waves , you borrowed every users $USDT and $USDC on Vires.Finance 🌊 to prop your $USDN ponzi. And then Lost $500M of users money

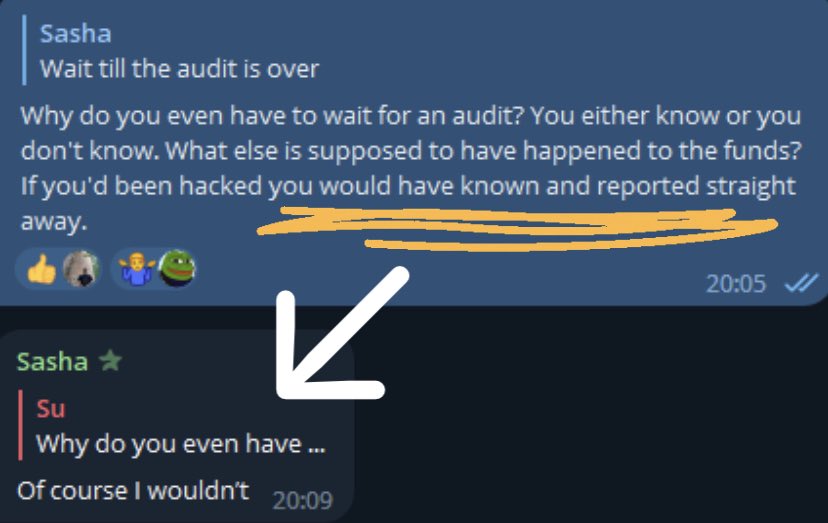

@TheWavesGuy DL News Sasha.waves .USD Denominated Sasha.waves @TheWavesGuy If you would have known about lost fund (hack) Of course, you Sasha you wouldn’t reported us the drama. 😱 Me: Yes, I can read.🧐

Main Pool smart contract was finalized and can’t be changed anymore Puzzle Lend Verify() = false

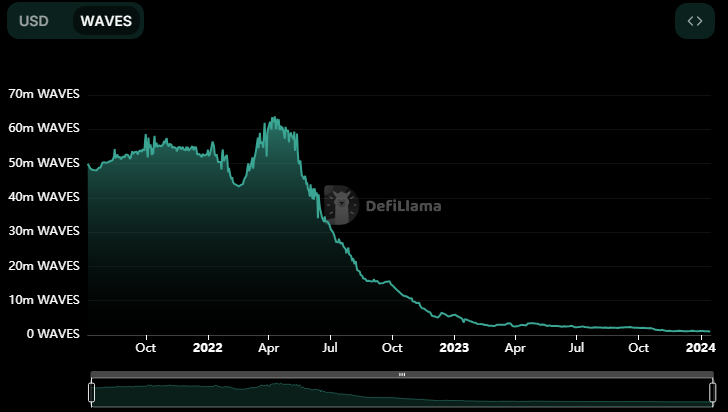

Daily reminder that Sasha.waves stole $500M of users money on $WAVES $XTN just keeps going lower, its now 2 cents on the dollar