Ronin

@faded_ronin

ID: 748231452215615488

29-06-2016 19:07:34

661 Tweet

26 Takipçi

104 Takip Edilen

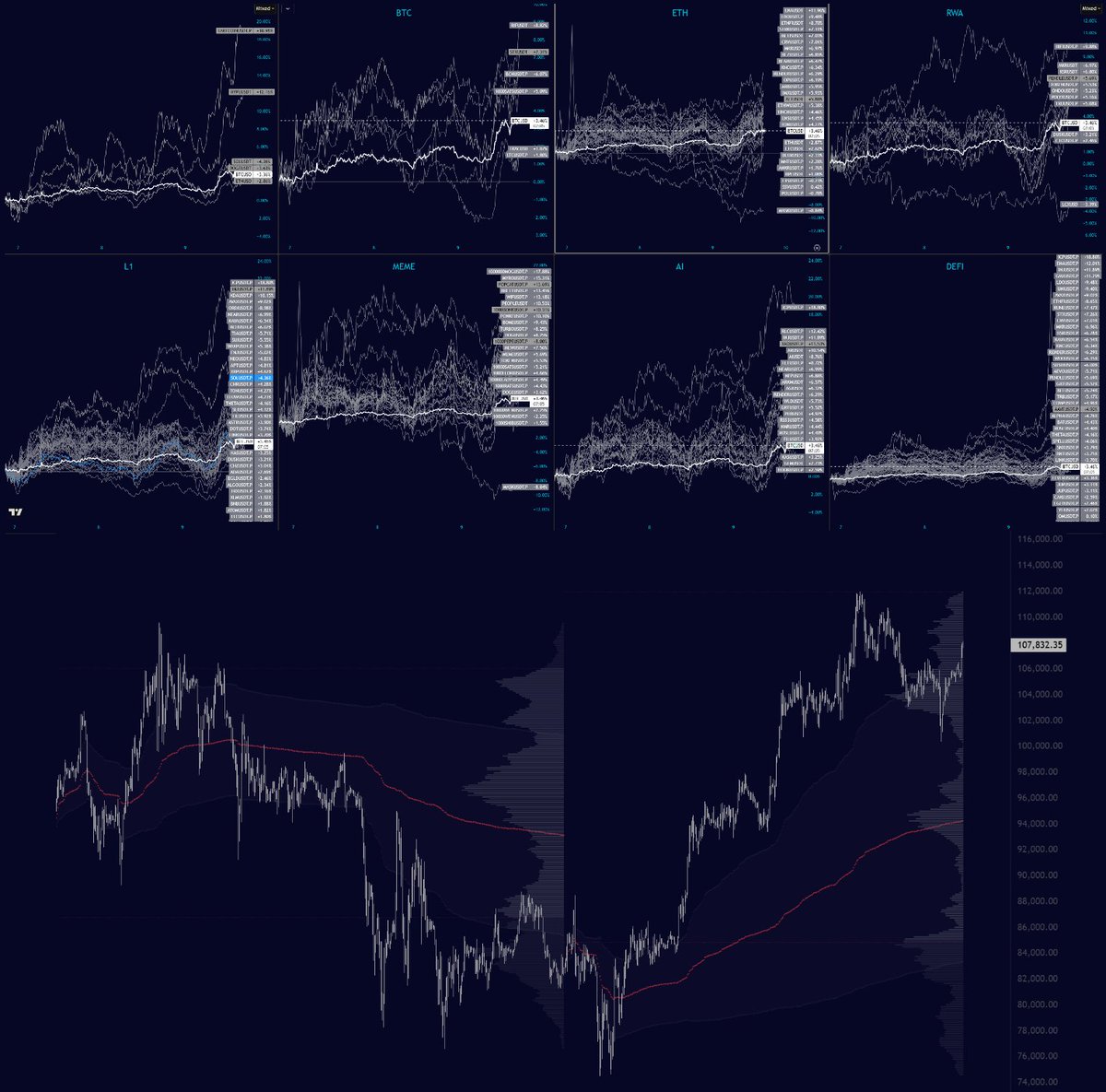

Essential Tools Value Bare minimum for my trading is Volume Profile & Vwap, this is how I determine "value" Volume Profile Use Case: Trade Locations Types: Fixed Range, Fixed time & Visible Range Application: TradingView Vwap Use Case: System selection, Directional bias &