Expend

@expend

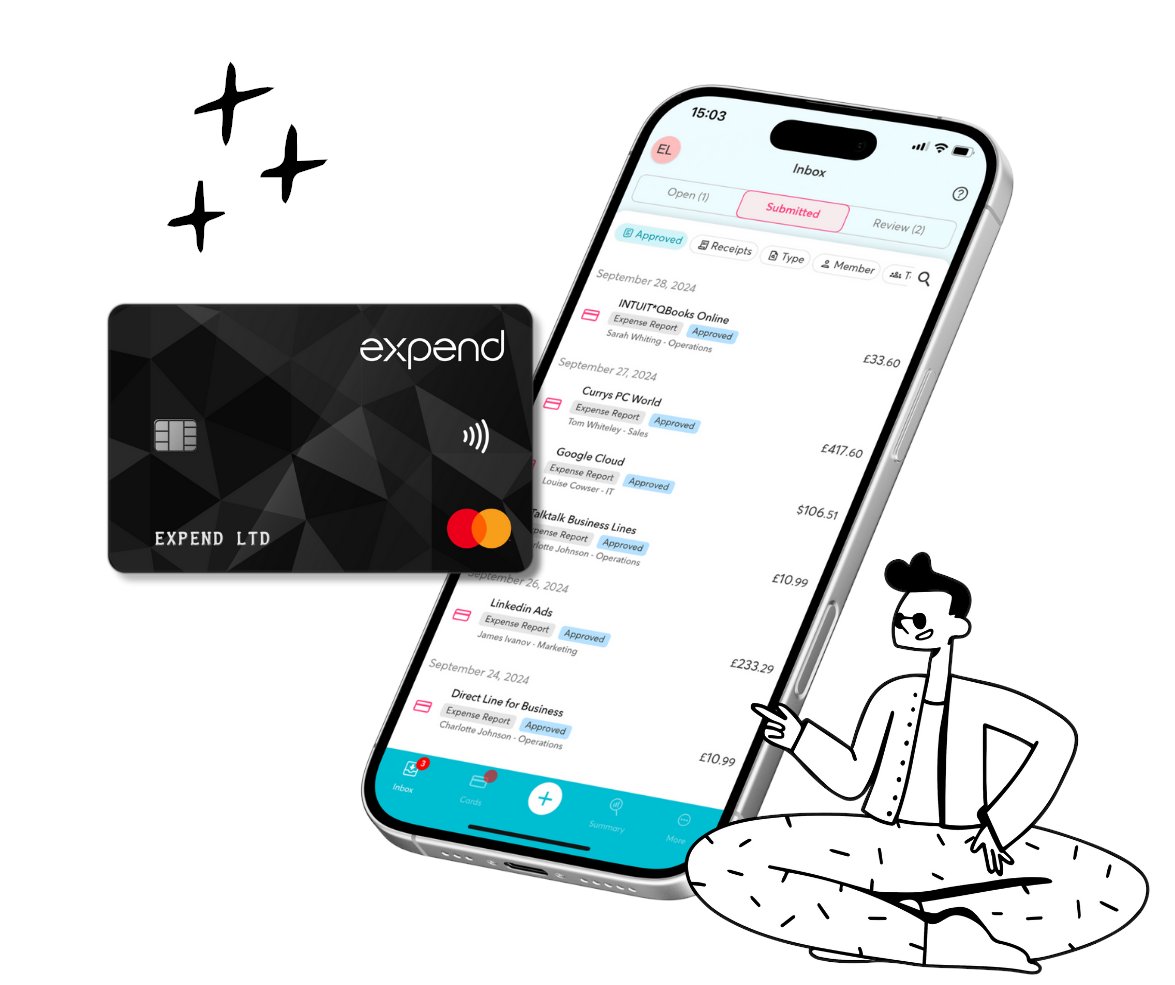

We're here to make business expenses easy! 👋 We're transforming company expense management for powerful businesses like yours. Start your free trial today 🚀

ID: 2209099668

https://expend.com/why-expend 22-11-2013 15:01:41

1,1K Tweet

557 Takipçi

912 Takip Edilen