Emily Graffeo

@emily_graffeo

Cross-asset reporter @business | exploring macro, ETFs and asset allocation| [email protected]| alum @uva and dance for @virginiasports. opinions my own

ID: 780872945778368512

https://www.bloomberg.com/authors/AVdCpu2Qdf4/emily-graffeo 27-09-2016 20:53:13

560 Tweet

4,4K Takipçi

1,1K Takip Edilen

Trump’s victory has sparked some market winners (and losers) 📊 🎥 John Authers explains the Trump trades

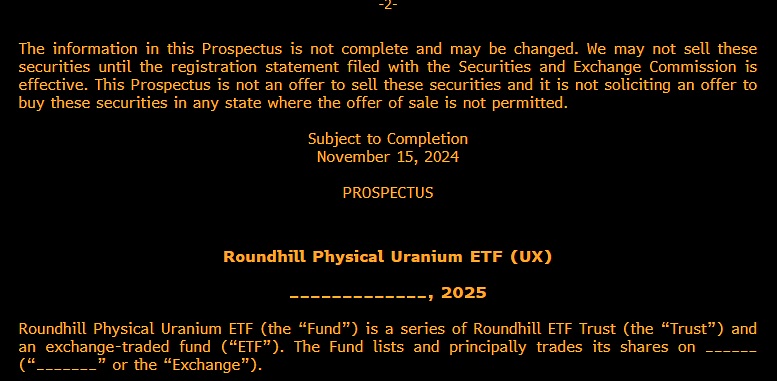

INTERESTING: Roundhill Investments just submitted a filing for a Physical Uranium ETF. The SEC has rejected attempts at this in past. Maybe the new incoming SEC admin will think about it differently?

SCHWAB INCOMING CEO RICK WURSTER: 'I HAVE NOT BOUGHT CRYPTO AND NOW I FEEL SILLY' Just now to Carol Massar & me on Bloomberg Radio

In tonight’s@cornell_tech @ Bloomberg Speaker Series episode, Bloomberg' Emily Graffeo talks with Lightspeed's Michael Mignano about his experience as both a #startup founder & venture investor #CTechBBG #venturecapital

✨scoop: Goldman is exploring options -- including a sale -- of its ETF Accelerator platform, which helps its clients launch their own ETFs bloomberg.com/news/articles/… via Bloomberg Markets

HUGE: UConn's endowment sold its hedge funds and replaced them with Buffer ETFs. Institutions are supposed "smart money" and can get anything they want in any structure so to see them dump HFs (and Yale Model) for ETFs is big. Scoop via Emily Graffeo bloomberg.com/news/articles/…

Our next @Cornell_Tech @ Bloomberg speaker series collab is here! Just in time for Valentine’s Day, The Knot Worldwide's Raina Moskowitz joins Emily Graffeo to discuss her career, her vision for The Knot Worldwide, and strategies for scaling a global brand. Tech At Bloomberg #CTechBBG

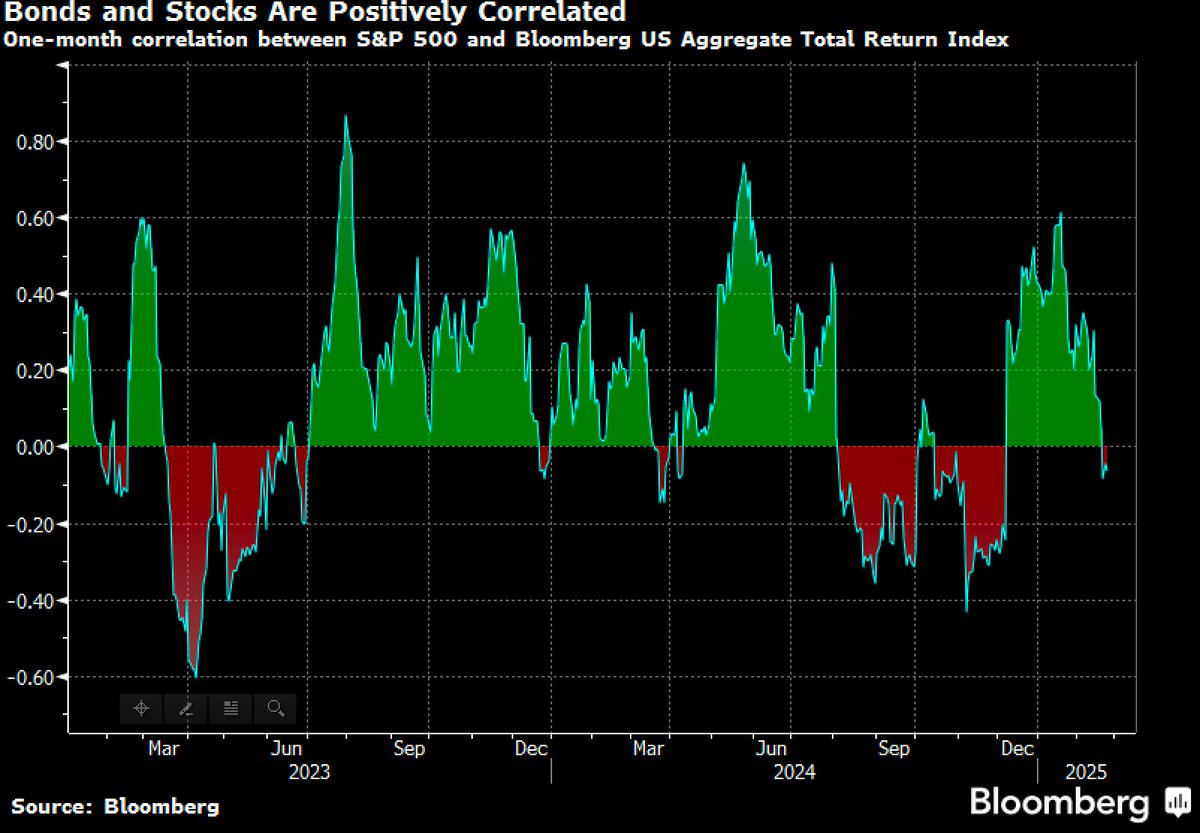

Thank you Emily Graffeo and Paul Sweeney for having me on the show today. We covered a lot of ground, tariffs, commodities, Europe, stagflation, and bonds. Great segment!

Sometimes in journalism a story ends up right where you think. But this Businessweek chronicle of a quaint finance empire led me and @Emily_Graffeo to $70,000 of Ritz-Carlton booze, $4,800 of Hermes scarves and emails about pay-to-play. Please read and share bloomberg.com/news/features/…

ETF issuers generally win customers by keeping fees low. First Trust is different. This Businessweek story about the issuer took Max Abelson and I into a world of resort stays, luxury scarves, and emails about pay to play. Please read and share: bloomberg.com/news/features/… via Businessweek

Discussed the stock market this morning (and the landscape of athleisure competition) with Katie Greifeld and Matthew Miller