Dwight Way Capital

@dwightwaycap

Not Financial Advice.

ID: 1839585598807629824

27-09-2024 08:39:32

271 Tweet

55 Takipçi

164 Takip Edilen

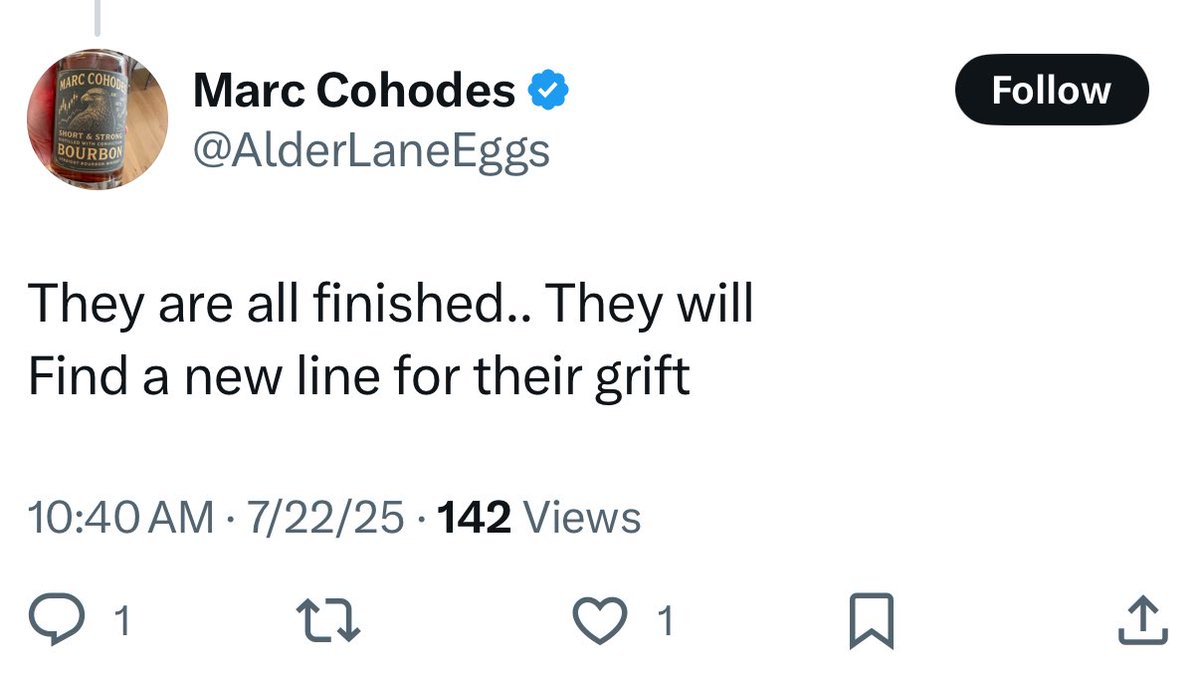

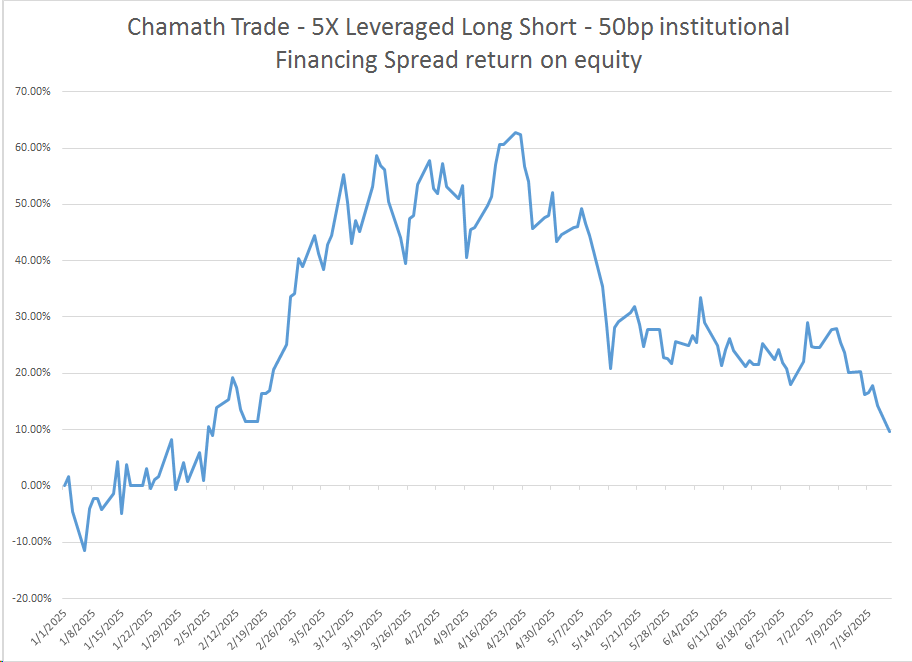

Chamath Palihapitiya at 5x leveraged and 50bp financing spread you made 9% and a .25Sharpe. Crappy crappy trade. The peak was sweet at 70% return (should have bragged then dude) cuz you gave back 80% of your return.

If you’re mad at Cluseau Investments, you’re dumber than fucking rocks. He didn’t post anything even slightly inflammatory