David Malpass

@davidrmalpass

Former President of the World Bank Group, Under Secretary of the U.S. Treasury, and leading Wall Street economist. Advocate for development and growth.

ID: 1113157792125386752

https://www.linkedin.com/in/davidrmalpass 02-04-2019 19:14:33

2,2K Tweet

106,106K Takipçi

76 Takip Edilen

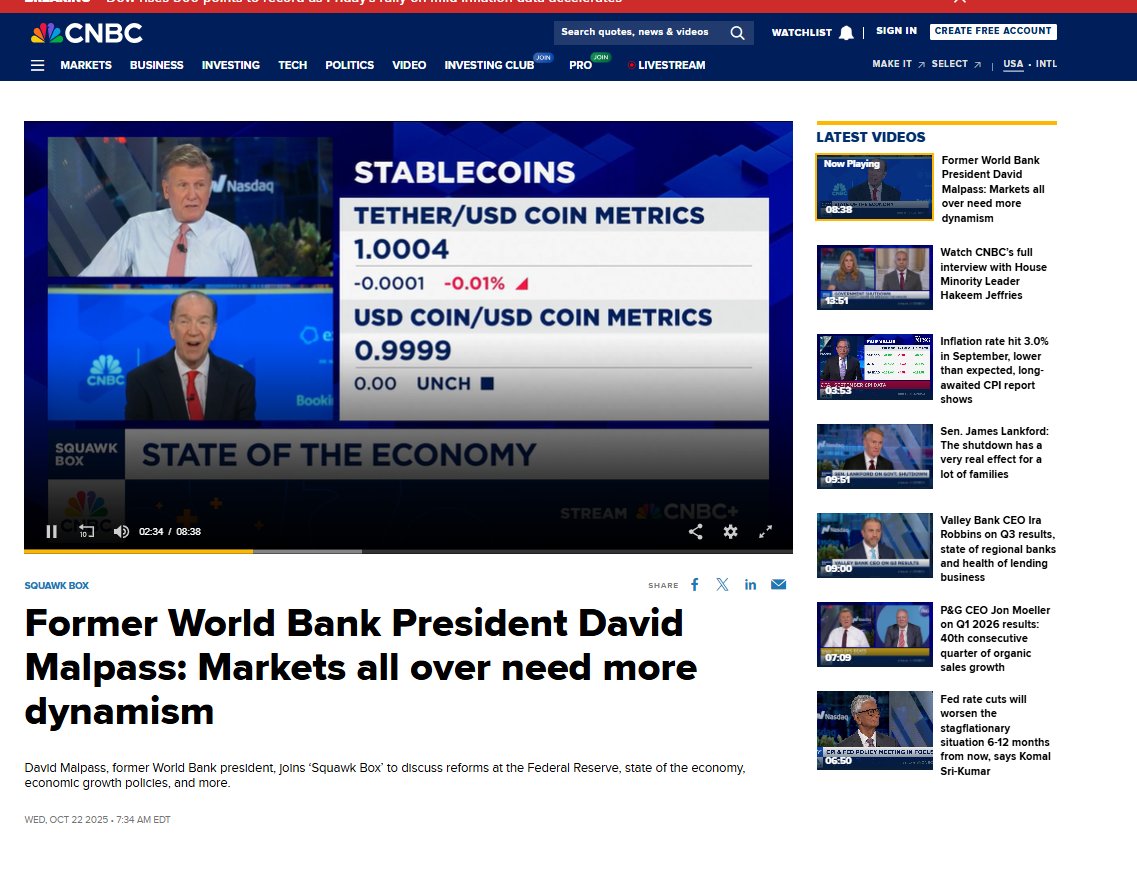

Thanks to Squawk Box for great discussion of growth policies including stablecoins and capital gains windfall. Fed should cut by 0.5% at next meeting – otherwise it is falling further behind, adding billions to the national debt. Watch here. cnbc.com/video/2025/10/…

1/3 Fed policy and regulatory reforms are vital. The Fed channels bank loans into government bonds, crowding out small businesses and wages as Treasury Secretary Scott Bessent explained in his September 5 WSJ commentary.