YieldZombie

@crypto_viziris

Long on DeFi

ID: 960497274689327105

05-02-2018 12:56:10

2,2K Tweet

144 Takipçi

854 Takip Edilen

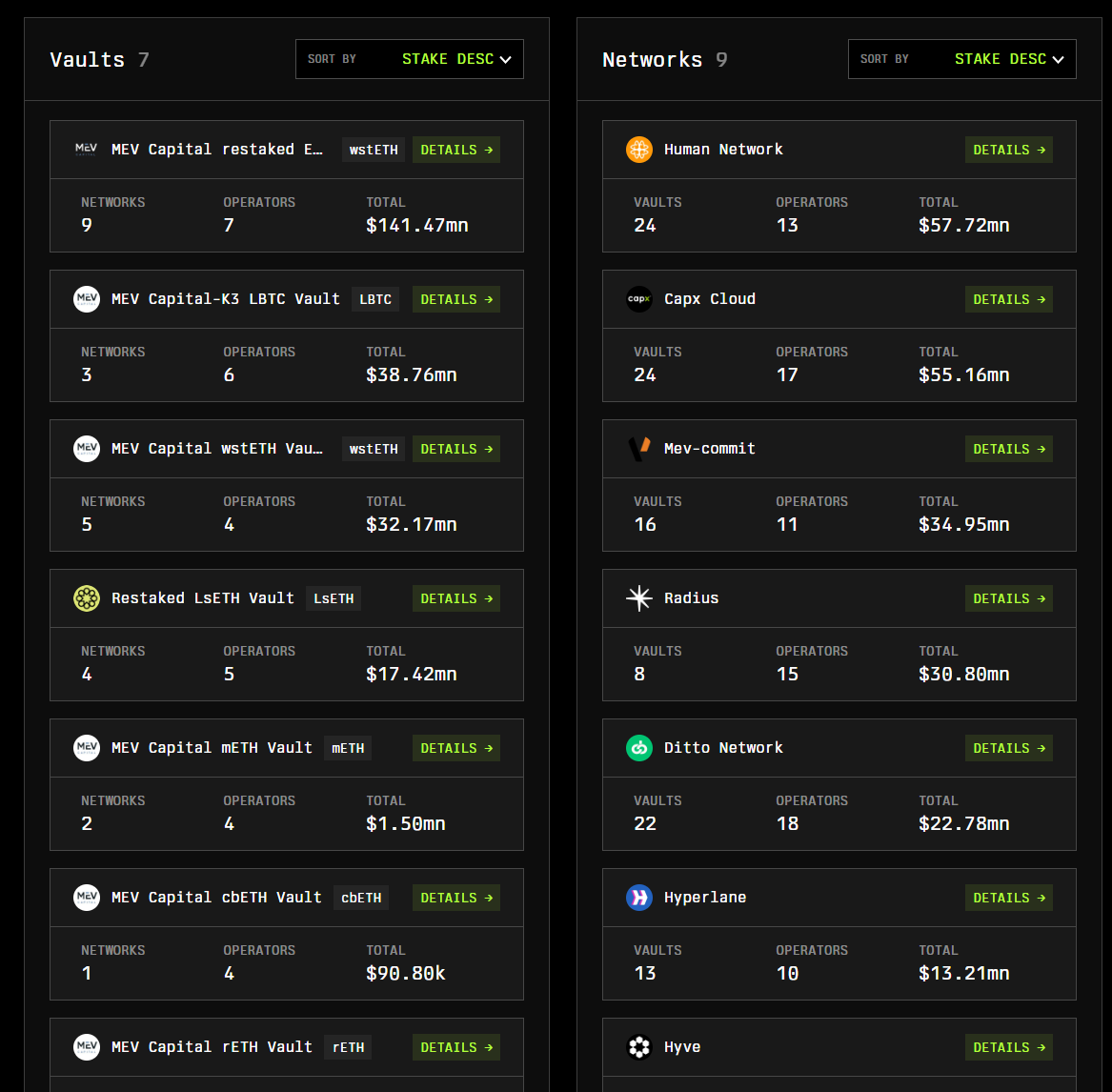

We receive stakes from vaults curated by MEV Capital Using these stakes, we secure networks including - Mishti Network - Capx AI - Primev | preconf.eth - Radius - Ditto Network - Hyperlane ⏩ - Hyve DA - CYCLE NETWORK - Kalypso

🐾 We are pleased to announce another episode of PawCast, our Pawdcast, where we will have a relaxed conversation with our guests about Berachain and the DeFi universe! And we are excited to welcome MEV Capital as our guests. Don't miss it! Thursday, 1:00 PM UTC on our X.

Introducing Terminal Finance — the marketplace for institutional asset trading, powered by reward-bearing dollars including Ethena Labs's sUSDe. Terminal is the Converge liquidity hub designed for institutional assets and digital dollars.

The Vault Lounge is almost here. A private evening for DeFi’s core builders, hosted by MEV Capital & Staking Circle, in one of the most beautiful settings in the world, the coast of Cannes. Selected guests in the right place at the right time.

Silo v2 is live as the first risk-isolated lending protocol on Avalanche🔺, unlocking yield and leverage options for RWAs and yield-bearing assets. 3 vaults by MEV Capital are now live, supporting 10 isolated markets with dual incentives from Avalanche Foundation and Silo Labs. 👇

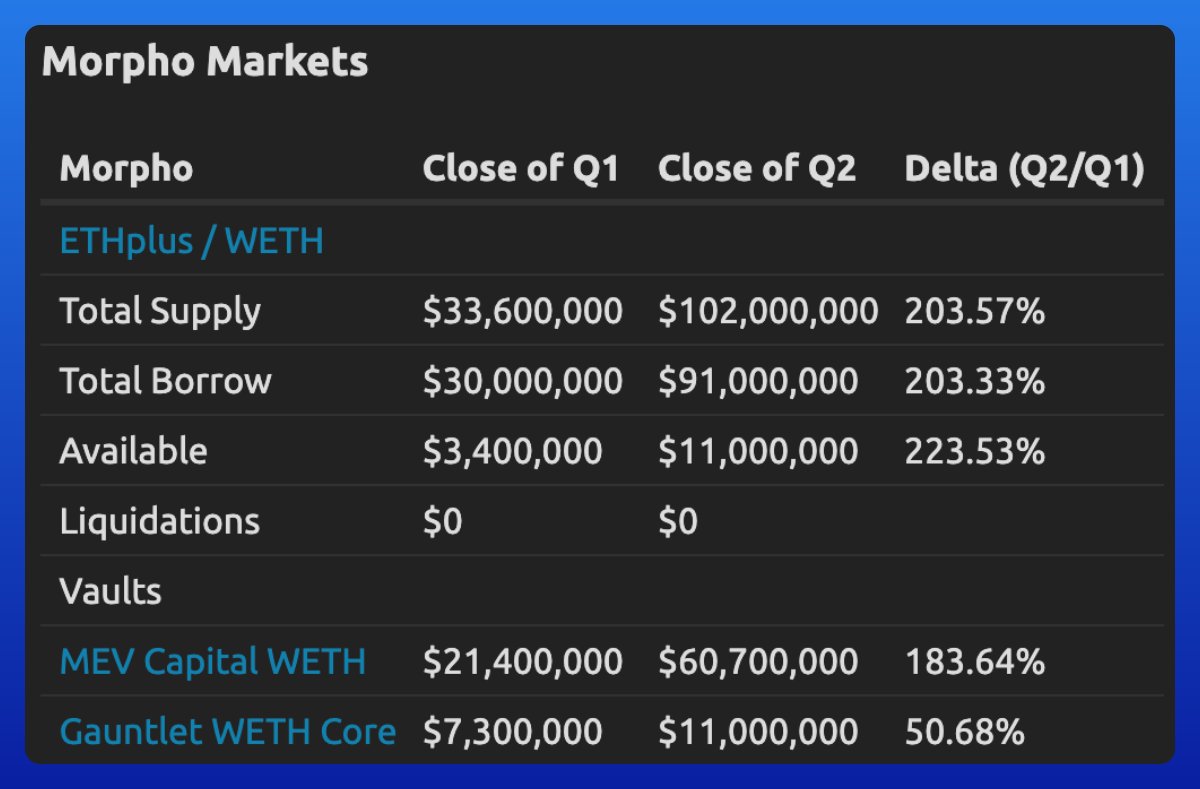

LIVE: Borrow against your upUSDC on Morpho 🦋 The upUSDC/USDC market is now live on Morpho, with $164M+ liquidity supplied from @mevcapital curated USDC vault. To deploy reliable and high-fidelity price-feeds, we work with EO | Breaking Web3's Data Barrier so redemptions and liquidation can

MEV Capital is collaborating with Cicada to co-curate Mystic Finance $pUSD vault Plume - RWAfi Chain Two risk frameworks are coming together to safely bring RWA assets on-chain.

🚀 Our strategy utilizing @ListaDAO is now LIVE! Sigma.Money has deposited $1.4M USDT into the MEV USDT Vault on ListaDAO, in collaboration with @MEVcapital — maximizing capital efficiency for our users. All yield flows into the Sigma Money Reserve → once it exceeds a set

Pendlebeat is live! Excited to announce that beHYPE, hbUSDT and hbHYPE pools are now live on Pendle. - beHYPE pool (expiring October 30, 2025): app.pendle.finance/trade/pools/0x… - hbUSDT pool (expiring December 18, 2025): app.pendle.finance/trade/pools/0x… - hbHYPE pool (expiring December 18,