Carden Haystack

@cardenhaystack

Canadian - M&A - Microcap hobbyist

ID: 1722473703873675264

09-11-2023 04:38:53

168 Tweet

81 Takipçi

150 Takip Edilen

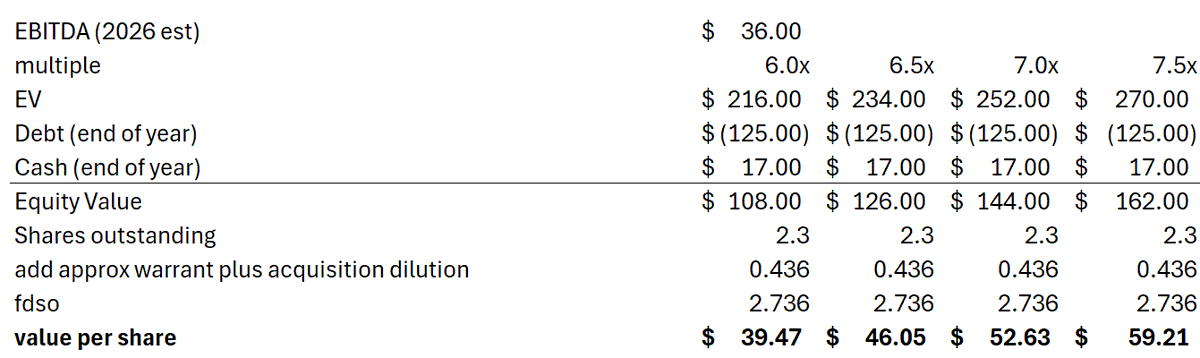

Laputa Jeff Moore Christian Schmidt Gary Wyetzner Cluseau Investments CuriousPerson $RGS worth $40-$60 per share -- their release of the valuation allowance is all you need to know -- the auditors don't let you do this on a whim ... These guys know that sustained profits are no longer