Immortal Parsley

@bwalk666

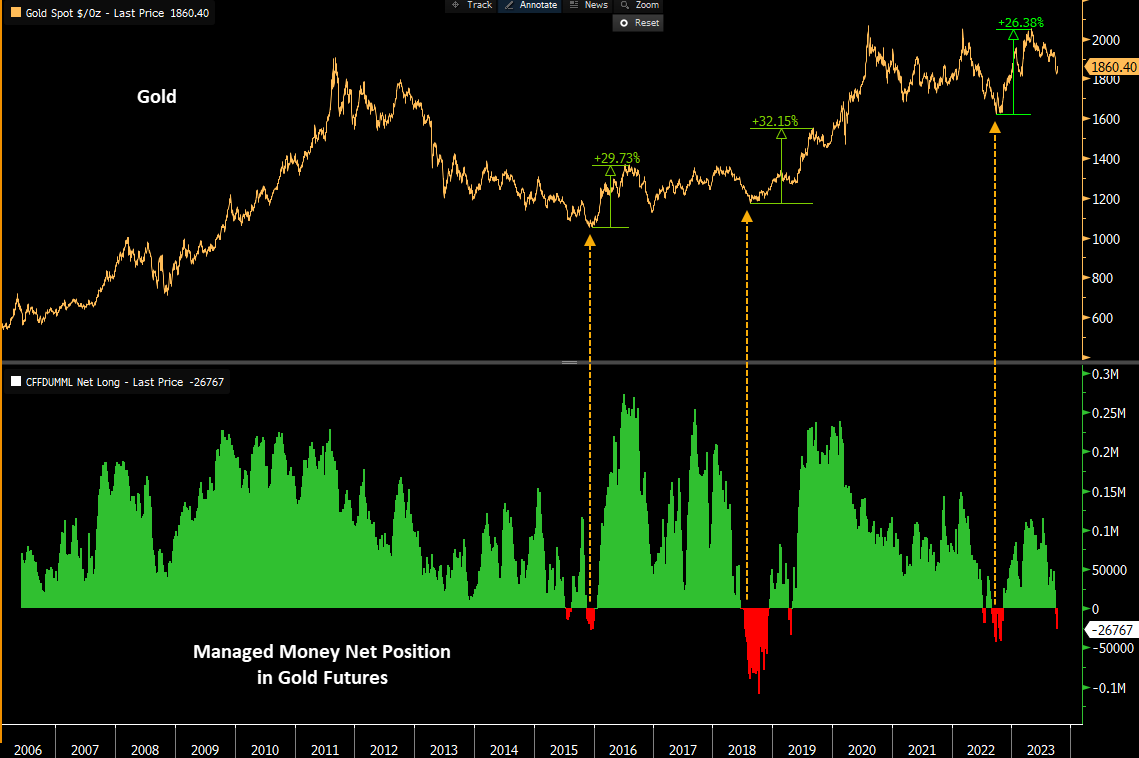

Dividend stock investor, SPY scalper and I’m long precious metals #Silver #Gold. I am not a plant nor am I immortal.

ID: 1441369265039310852

24-09-2021 11:50:37

619 Tweet

200 Takipçi

102 Takip Edilen

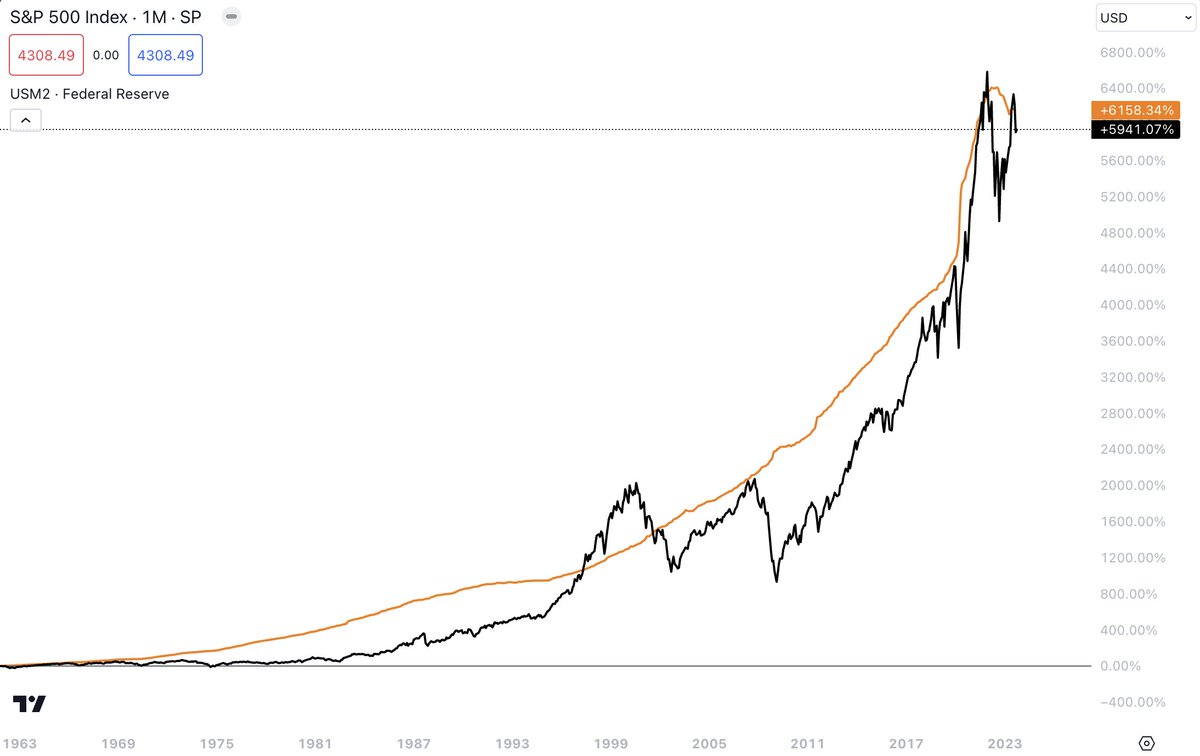

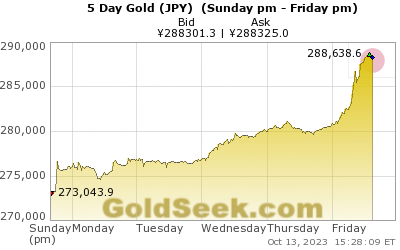

Have house prices risen in the last 44 years? No they haven't. It's the paper you're buying it with that's been devalued by your government/bankers. If you use #Gold, the house will cost you the same as it did back then. Gold is real money. Dollars are a scam Kinesis Money