Brad Preston

@bradnpreston

Founder @beagleworksllc. beagle.works. Father of 3. Fund manager and quant

ID: 330198402

06-07-2011 07:53:38

1,1K Tweet

857 Takipçi

1,1K Takip Edilen

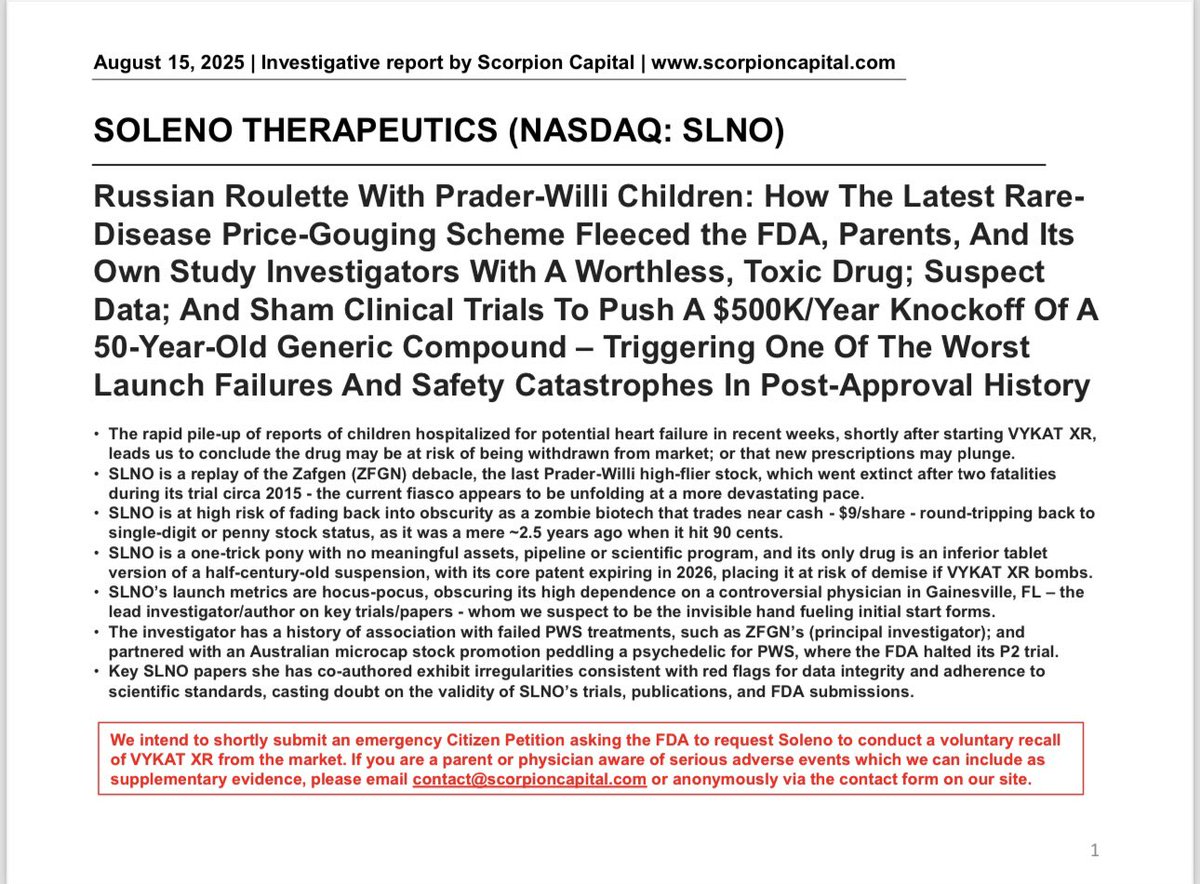

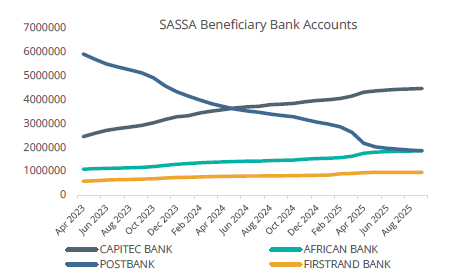

Some added context on Nate Anderson and Hindenburg Research track record: We have recorded 69 companies that Hindenburg has published on since 2017. Of these at least 35 have subsequently had regulatory or legal findings against them or filed for bankruptcy and a number more are

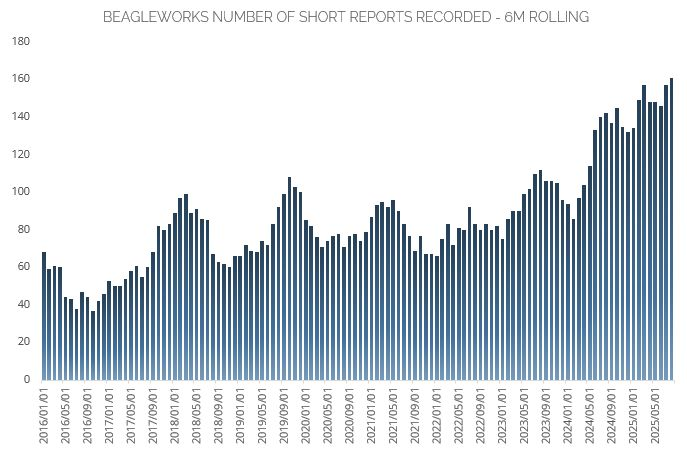

As we build out our data sets and research we will be posting more insights from our process here. Follow BEAGLEWORKS for macro, quant and alternative data insights or drop me a DM for more info on our institutional research offering.