AdvisorChoiceCanada

@advisorchoice

Welcome to your source for relevant news and topics affecting advisors and the financial services industry. IIROC AdvisorReport: bit.ly/1sUafUH

ID: 385424200

http://www.advisorchoice.ca 05-10-2011 13:42:15

3,3K Tweet

357 Takipçi

178 Takip Edilen

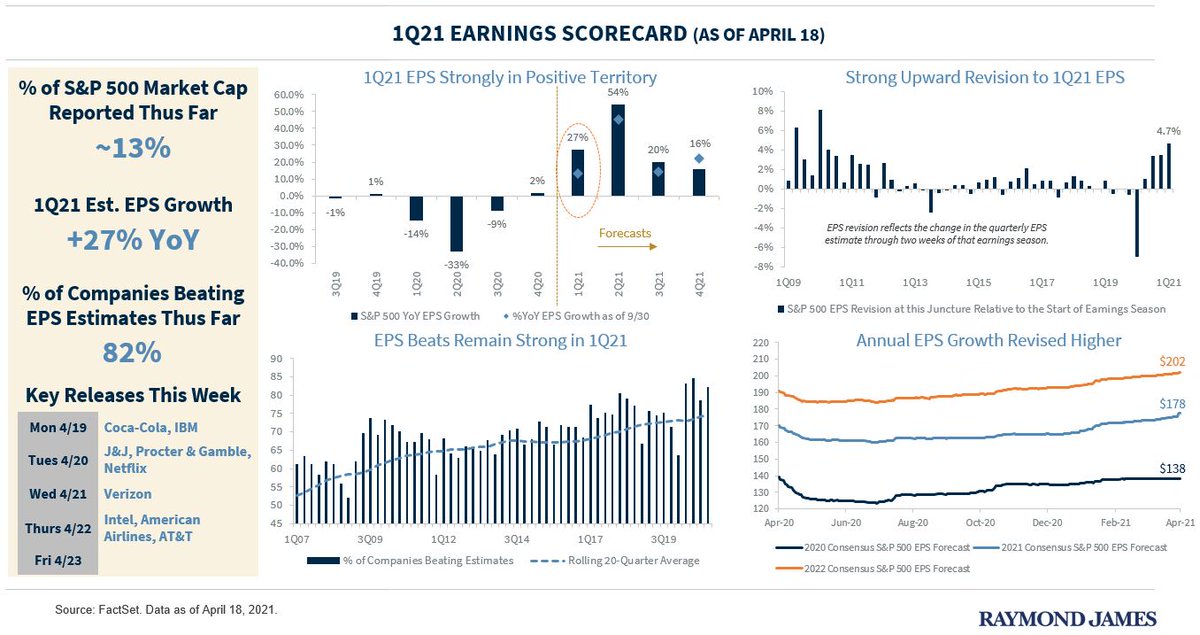

Pres. Biden “set pretty low expectations with a goal of trying to rebuild trust,” Raymond James' Chris Meekins says on reaching the goal of 100 million U.S. vaccinations early. “Let’s celebrate it, but let’s not accept that this was a gargantuan moonshot challenge.”