Dave Escaravage

@2065orbust

ID: 799957854308495360

19-11-2016 12:49:49

88 Tweet

10 Takipçi

120 Takip Edilen

SentimenTrader Hmmm…. Composite has been up 35%, 44%, and 21% over the last three years. The returns in 1977, 1978, and 1979 pale in comparison. The last 12 years since the GFC have been unique and shouldn’t be compared to prior time periods in my opinion.

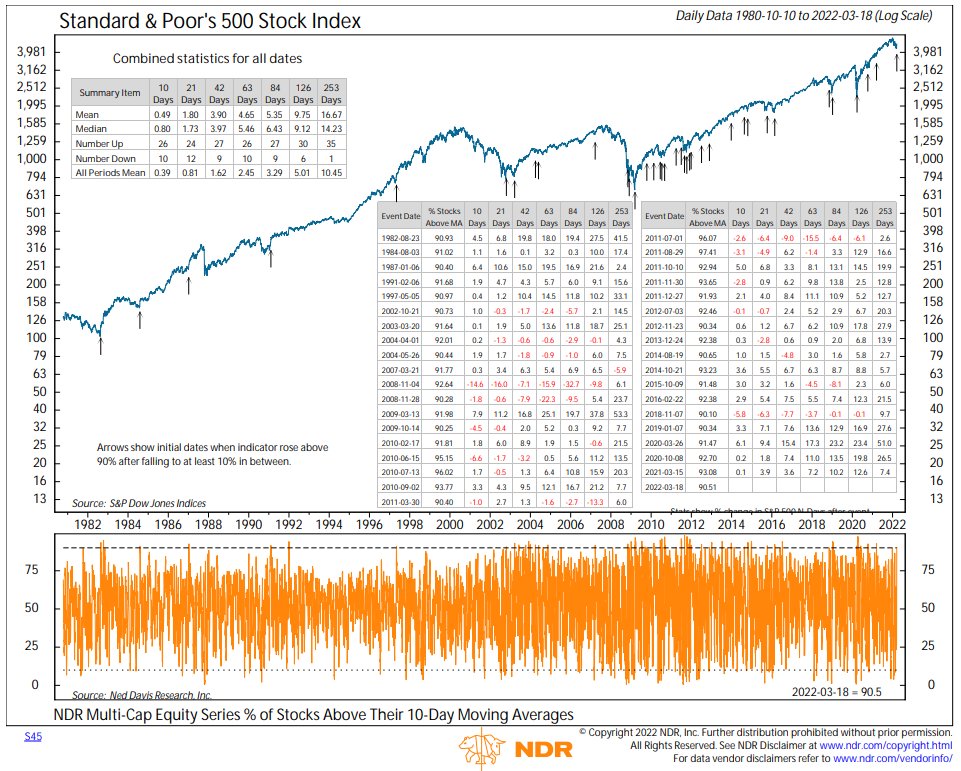

Friday's rally pushed the two breadth thrust indicators that were close over the top. 90.5% of stocks are above their 10-day moving averages. Since 1982, SPX has been higher 35 out of 36 times on year later. Past performance does not guarantee future results. Ned Davis Research 1/2

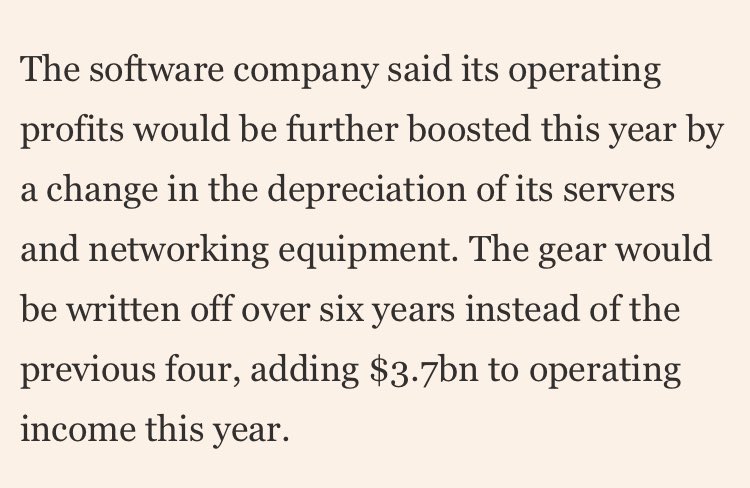

Game of Trades You are comparing august 2020 right when the economy was flushed with 8 trillion dollars to now where every si for yield curve is inverted , gas it’s Almost 100- dollar 110, Fed is QT, inflation is 9.1% - I mean come on !!!! Stop gas lighting your followers