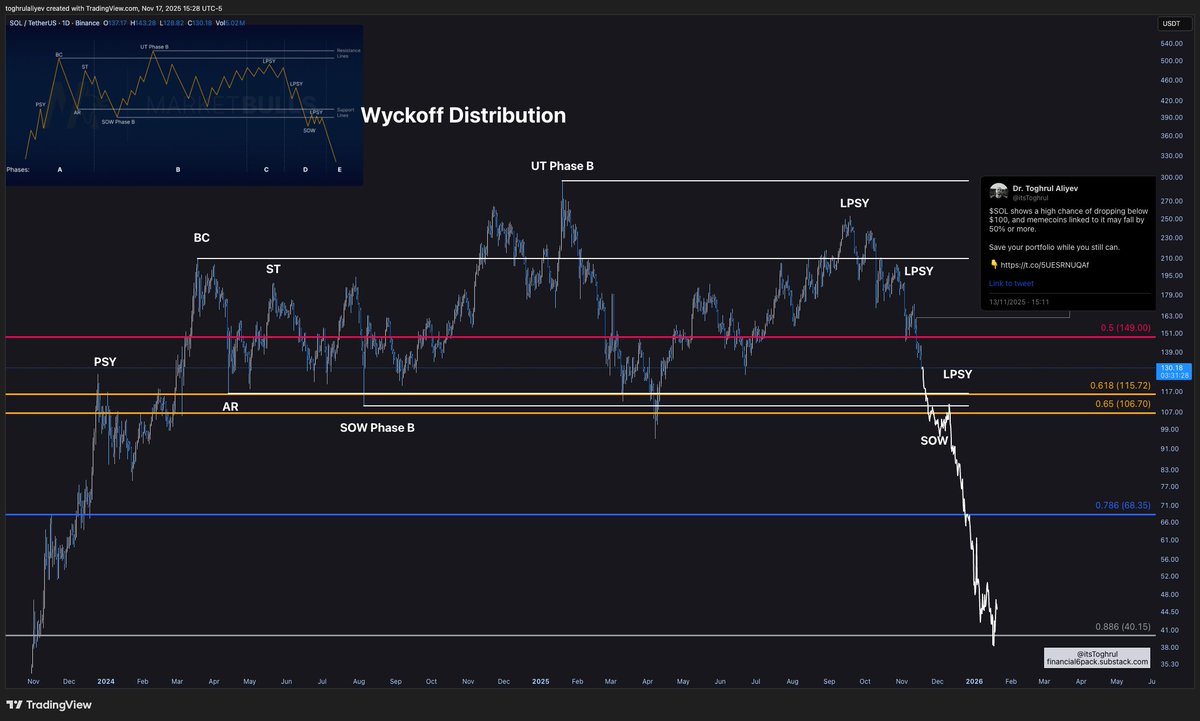

Toghrul Aliyev

@itstoghrul

Doctor, Research Analyst at @CCNDotComNews. I focus on crypto and TradFi, delivering insights and knowledge to guide others toward financial freedom.

ID: 1557398025882025985

https://financial6pack.substack.com 10-08-2022 16:06:57

660 Tweet

360 Takipçi

496 Takip Edilen

Day 4 of asking Ondo Finance Nathan Allman 🌊 Iandebode Josh | Ondo 🌊 to make me the Head of Research at Ondo.

Look how closely the 2025 $ETH / $BTC ratio mirrors that of 2019. Cantonese Cat 🐱🐈 Benjamin Cowen

Day 5 of asking Ondo Finance Nathan Allman 🌊 Iandebode Josh | Ondo 🌊 to make me the Head of Research at Ondo.