iob.fi DAO

@iob_fi

Managed #DeFi hedged pool protocol.

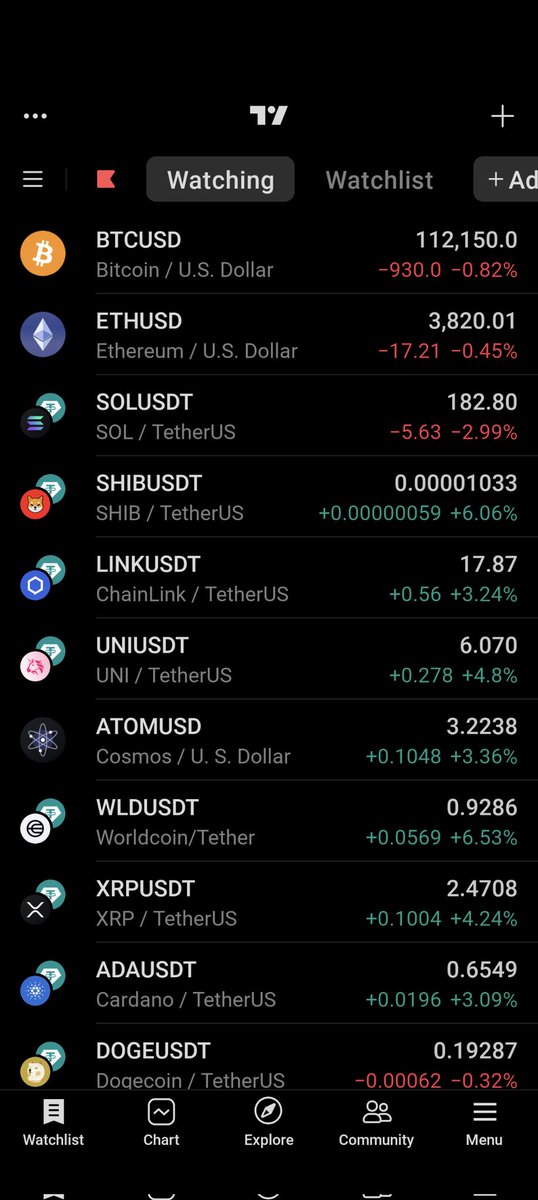

$DEFY Hedged Pool (up 280% annualized+28% staking reward)

Discord: discord.gg/gx78gtf

Telegram: t.me/iob_fi

ID: 1312382302714912775

https://iob.fi 03-10-2020 13:22:16

741 Tweet

1,1K Takipçi

41 Takip Edilen