IntraFi

@intrafi

The #1 provider of deposit placement solutions and inventor of reciprocal deposits. Discover our tested and trusted services. Visit: bit.ly/3YI7OaW

ID: 885555281836507136

http://www.intrafi.com 13-07-2017 17:43:26

1,1K Tweet

1,1K Takipçi

274 Takip Edilen

When mission meets market, real change happens. The ACT Deposit Program is “a powerful example of how corporate deposits can be both mission aligned and market smart." – Todd McDonald President of Liberty Bank & Trust in New Orleans and the National Bankers Association chairman. Ponce

This week: Nathan McCauley ⚓, Cofounder and CEO of Anchorage Digital Digital, discusses how his institution obtained the first OCC digital trust charter, how it has changed his business, and why other crypto firms are rushing to apply for the same charter now. ow.ly/2kCf50WUy91

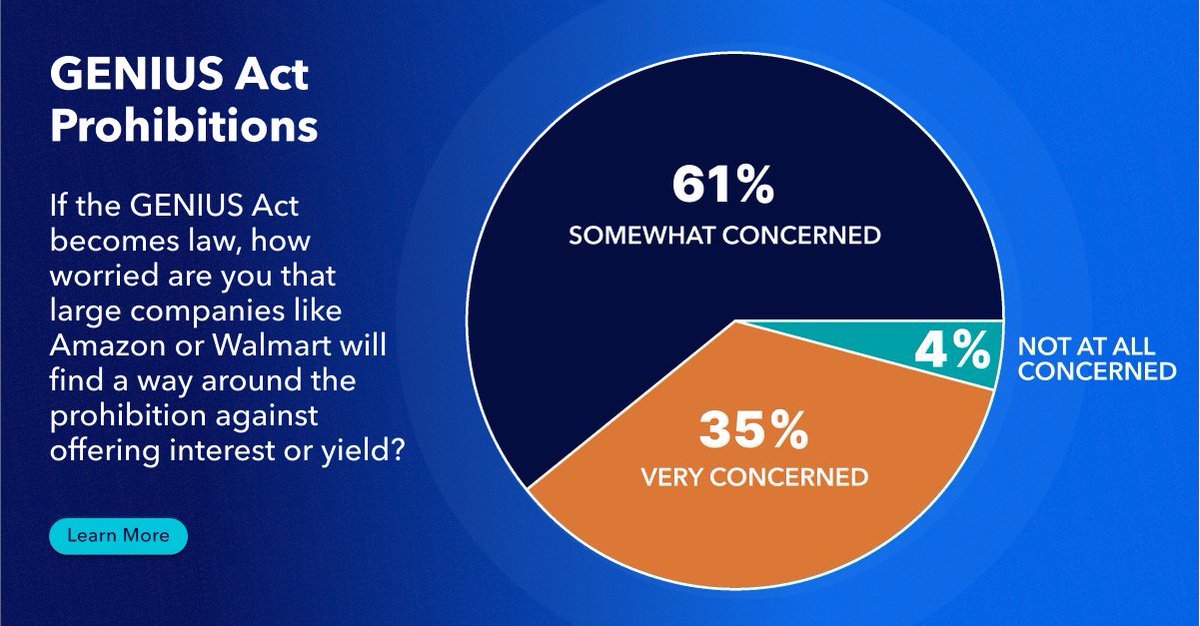

More than two dozen bills dedicated to Making Community Banks Great Again have passed House Financial Services Committee. Panel Chair French Hill handicaps which will have the most impact and what is most likely to be enacted. He also discusses the latest on the crypto market

Aaron Klein, senior fellow at The Brookings Institution, joins to discuss the unprecedented fight over the Federal Reserve's independence and the ongoing Supreme Court case with Fed Governor Lisa Cook. He walks through the legal fault lines and how a ruling could ripple across monetary

You know this one is going to be good, right? Aaron Klein does not disappoint! Listen in: podcasts.apple.com/us/podcast/the…