Insight Partners

@insightpartners

With 800+ investments and 30 years of experience, Insight Partners is a trusted partner in software. Scale up, Take off.

ID: 25621510

http://www.insightpartners.com 21-03-2009 02:08:56

8,8K Tweet

17,17K Followers

1,1K Following

🟢#LIVE from #FIIPRIORITY #Miami: With $50 trillion in global assets—half held by individual investors—private wealth’s role in the market is only set to grow. Tune in to insights from Deven Parekh: fii-institute.tv

Scott Barclay shares why Insight Partners invested in Proscia—and how #digitalpathology is enabling precision medicine today.

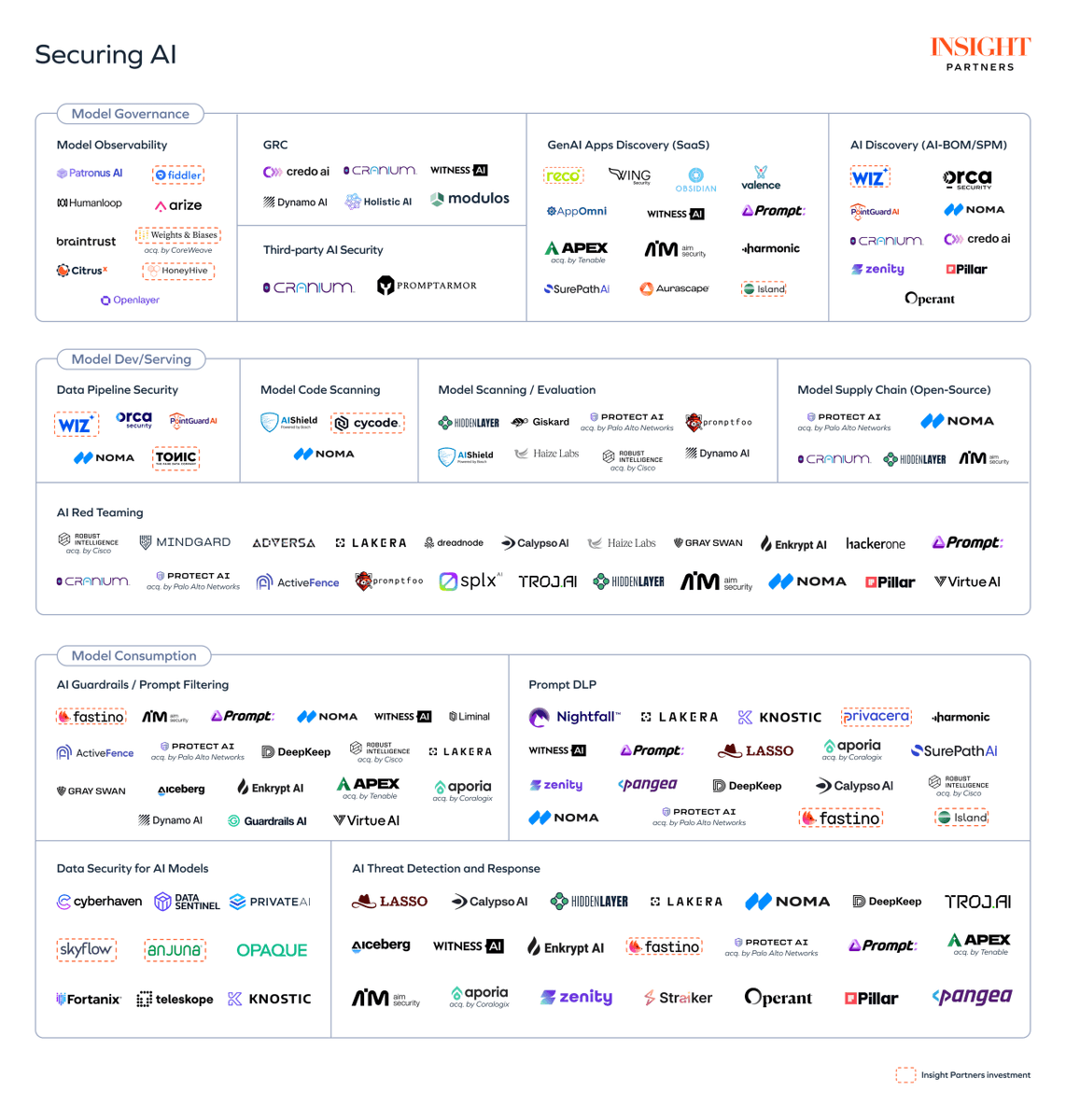

BIG NEWS: Fastino raises $17.5M Seed to launch TLMs – Task-Specific Language Models that beat GPT on accuracy and latency. Led by jon chu at Khosla Ventures + joined by George K. Mathew at Insight Partners, agracias at @valorep, Scott Johnston (ex-Docker CEO), and Lukas Biewald (CEO of

The best exits aren’t engineered at the finish line — they’re earned through years of deliberate scaling. Recorded Future's Christopher Ahlberg, Keyfactor's Jordan Rackie, and Prevalent's Kevin Hickey approached growth with the long game in mind — prioritizing operating discipline,