The Homeless Economist

@homelesseconomy

We're all homeless because the rent is too damn high and LVT would solve this🔰| Economic Analyst at The Daily Renter. I might be @EricReingardt

ID: 1733691220126253057

https://thedailyrenter.com/ 10-12-2023 03:33:16

2,2K Tweet

164 Takipçi

149 Takip Edilen

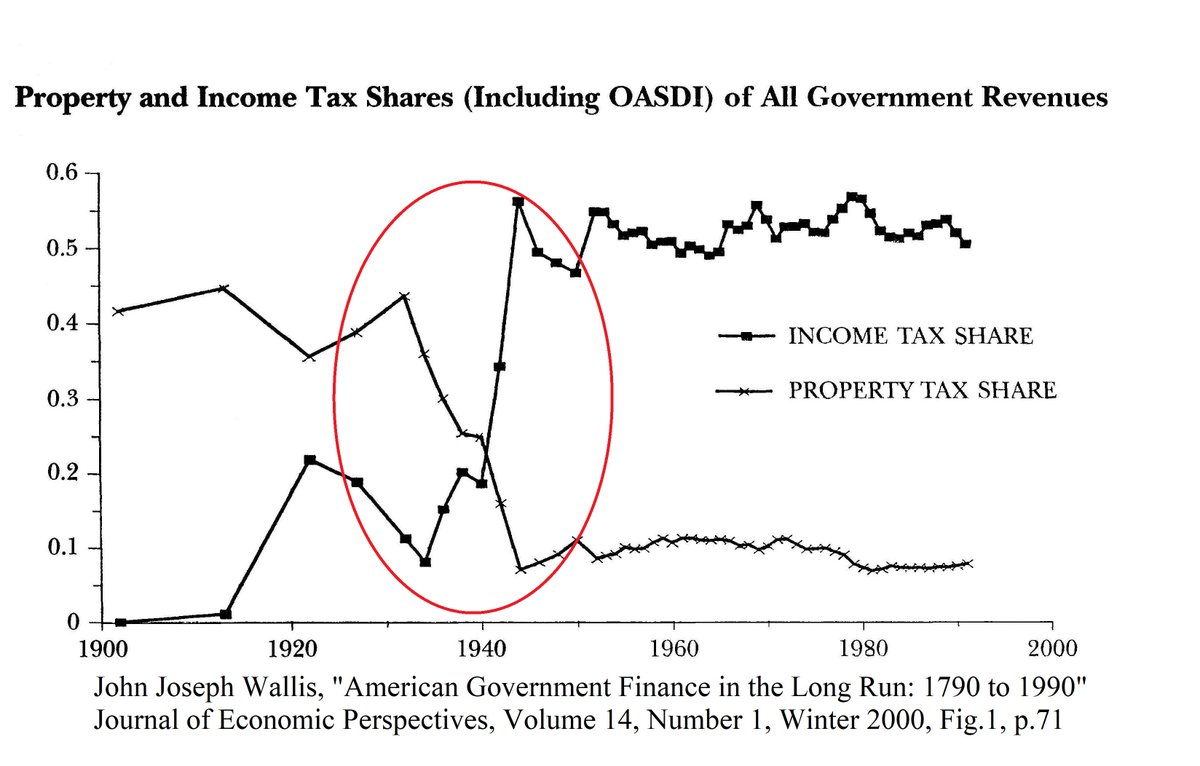

moe tkacik Land value tax would solve this

René #FreePalestine 🟥🚩🇵🇸 It's disheartening that people waste their time trying to come up with messy neoliberal kludges to solve the problem of rising land values (e.g., inclusionary zoning/"value capture") when the obvious solution (treat land like a commons and tax it accordingly) is right there.

Control Fiat Money Creation to benefit all not few None of that is true of a UBI funded from a land value tax. Land ownership is more concentrated than any other general asset. Land value tax drives down rents by forcing prime land onto use, increasing production, driving down prices, and driving up wages. America had the highest

Chris Richardson Where are the economists prepared to argue publicly for the Henry Tax Review's retention of 4 taxes only, incl an all-in land tax & the abolition of more than 100 taxes? Greater capture of land rent via land tax = lower land prices; av land component of a house now being 80%.

Charlie Kirk 🇺🇸 Commentary The virtue signaling on the right has gotten out of hand. This is a retarded idea across the board.

Biko Konstantinos Well, it *used* to work very well during the Progressive Era, until neoclassical economists turned it into the taxing of our *earned* incomes. We were sold a pup at the Great Depression: "There's not enough unearned economic rent!" (i.e. Leave that for our already uber-wealthy.)

Bryan Kavanagh Chris Richardson The Scottish Land Revenue Group is with you on that in principle Bryan, including Emeritus Professor Roger Sandilands (Singapore and Strathclyde).