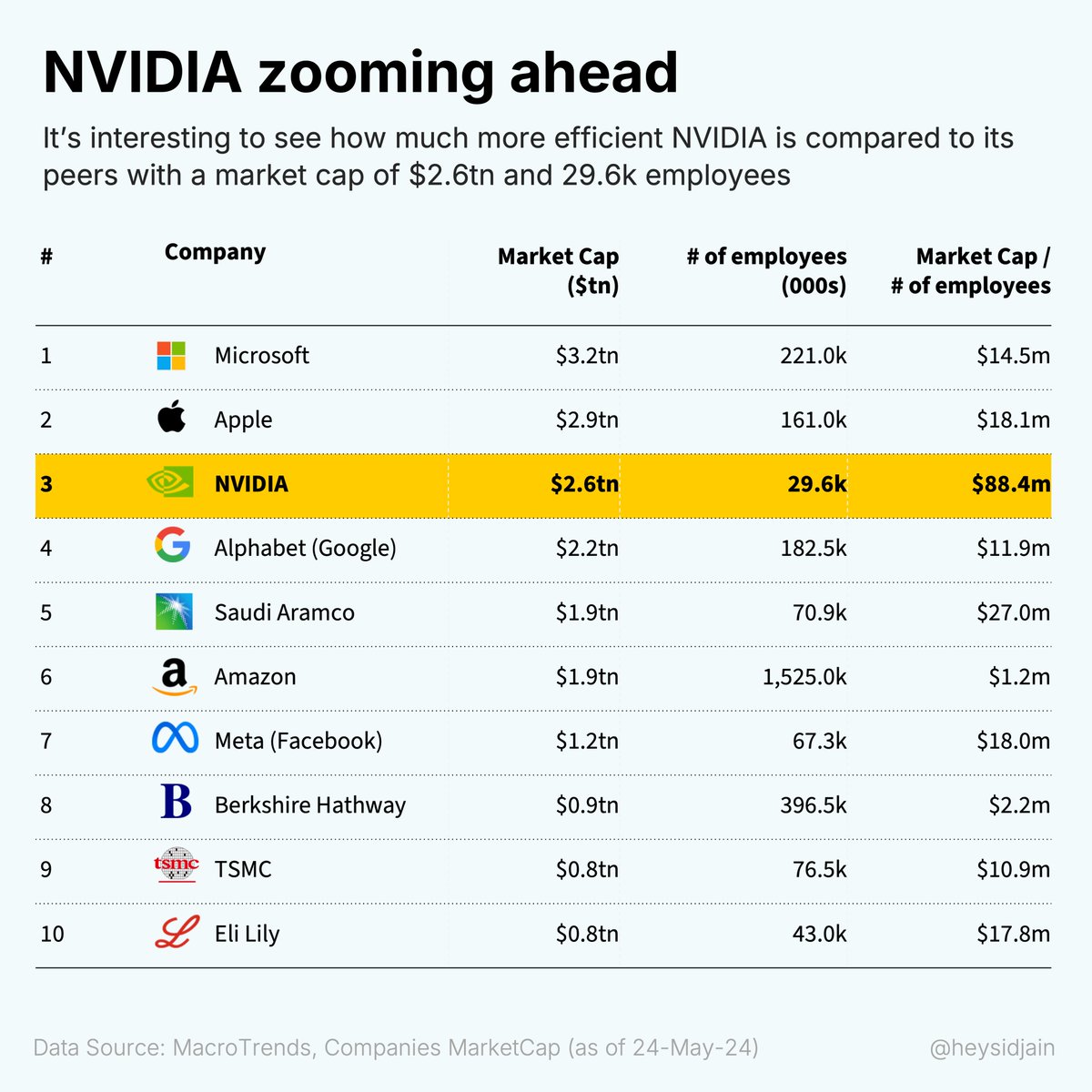

Sid Jain

@heysidjain

Head of Insights at Gain.pro | ex-Senior Analyst @ChartMogul | Previous J.P.Morgan Analyst

ID: 986685426

https://chartmogul.com/reports/saas-growth-report/2023/ 03-12-2012 14:05:36

947 Tweet

359 Takipçi

568 Takip Edilen

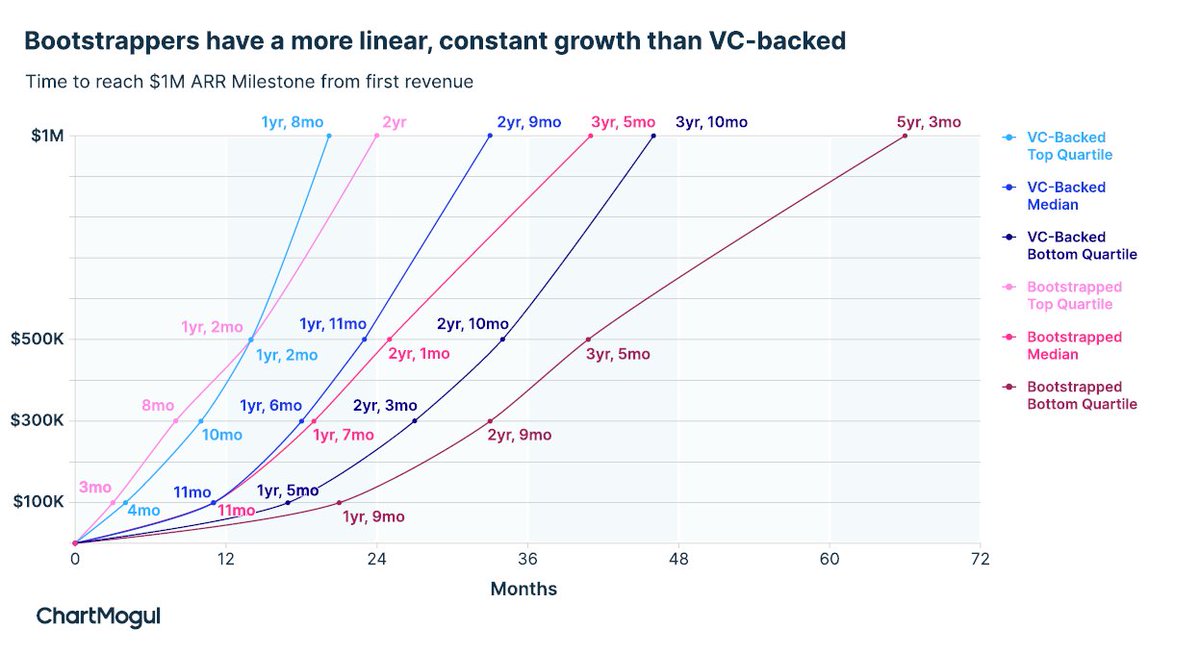

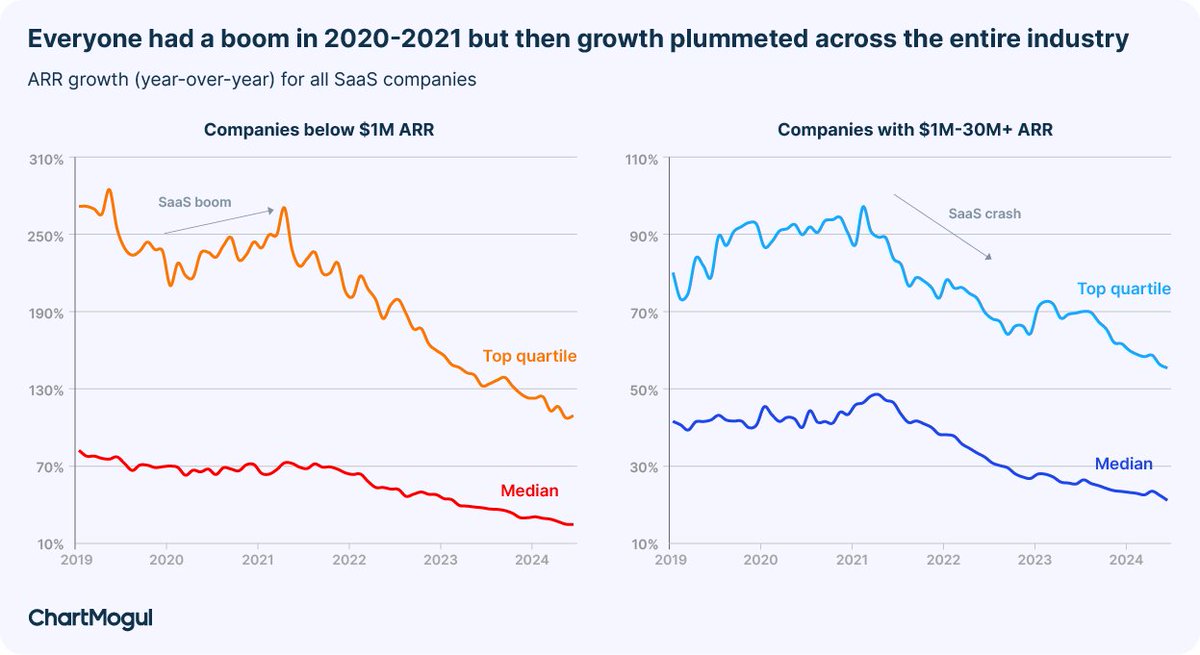

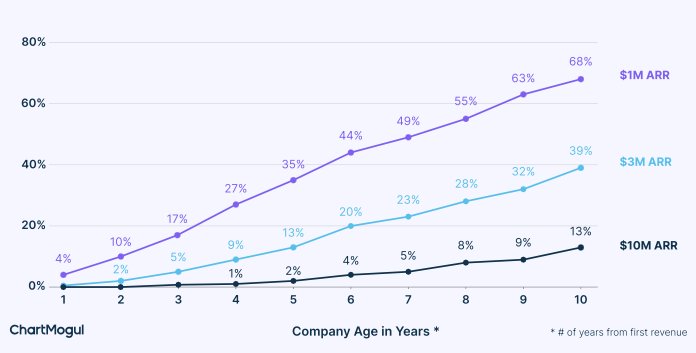

Really good to see this go live, great job ChartMogul team!

Working on the agenda for our 13th annual P9 Founder Summit, and as Harry Stebbings likes to say, "Twitter, do your magic".🪄 Once a year, we spend three days (and nights) with ~ 150 founders to compare notes, learn from each other, and exchange war stories. Some impressions

Wild. I didn't know until today Microsoft is named Microsoft because it originally sold Microcomputer Software (now PC). Thanks for the trivia Acquired Podcast . #microsoft

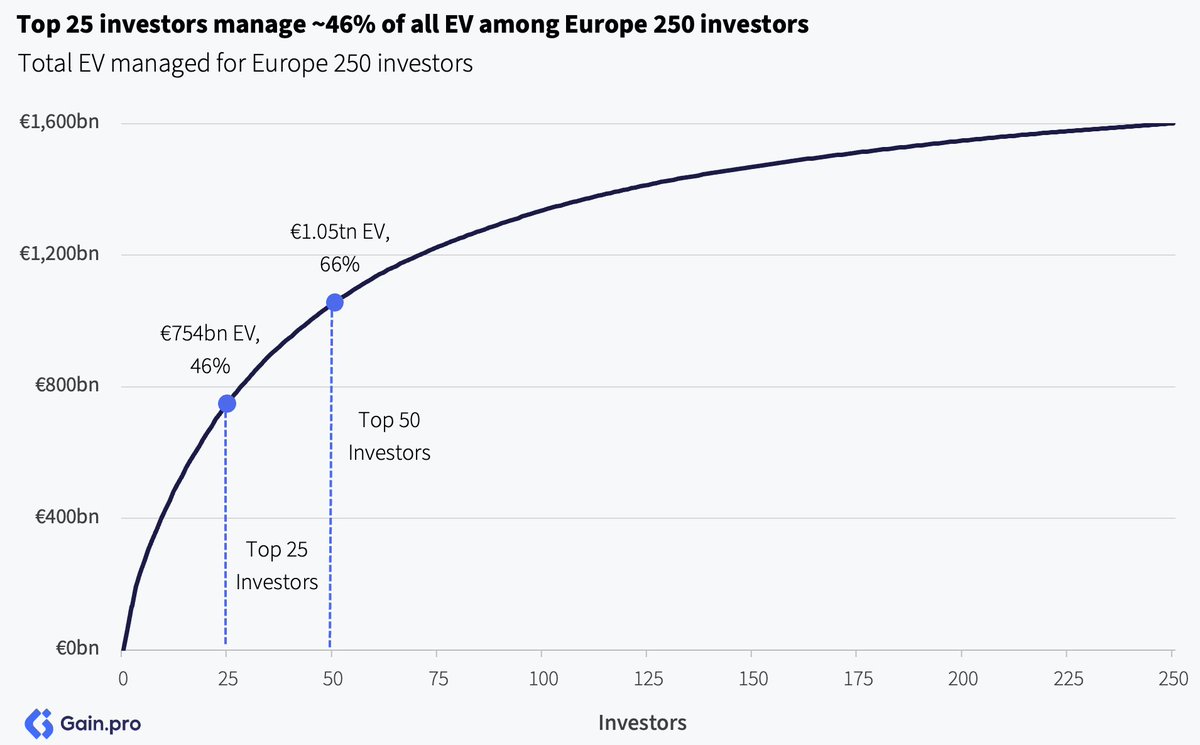

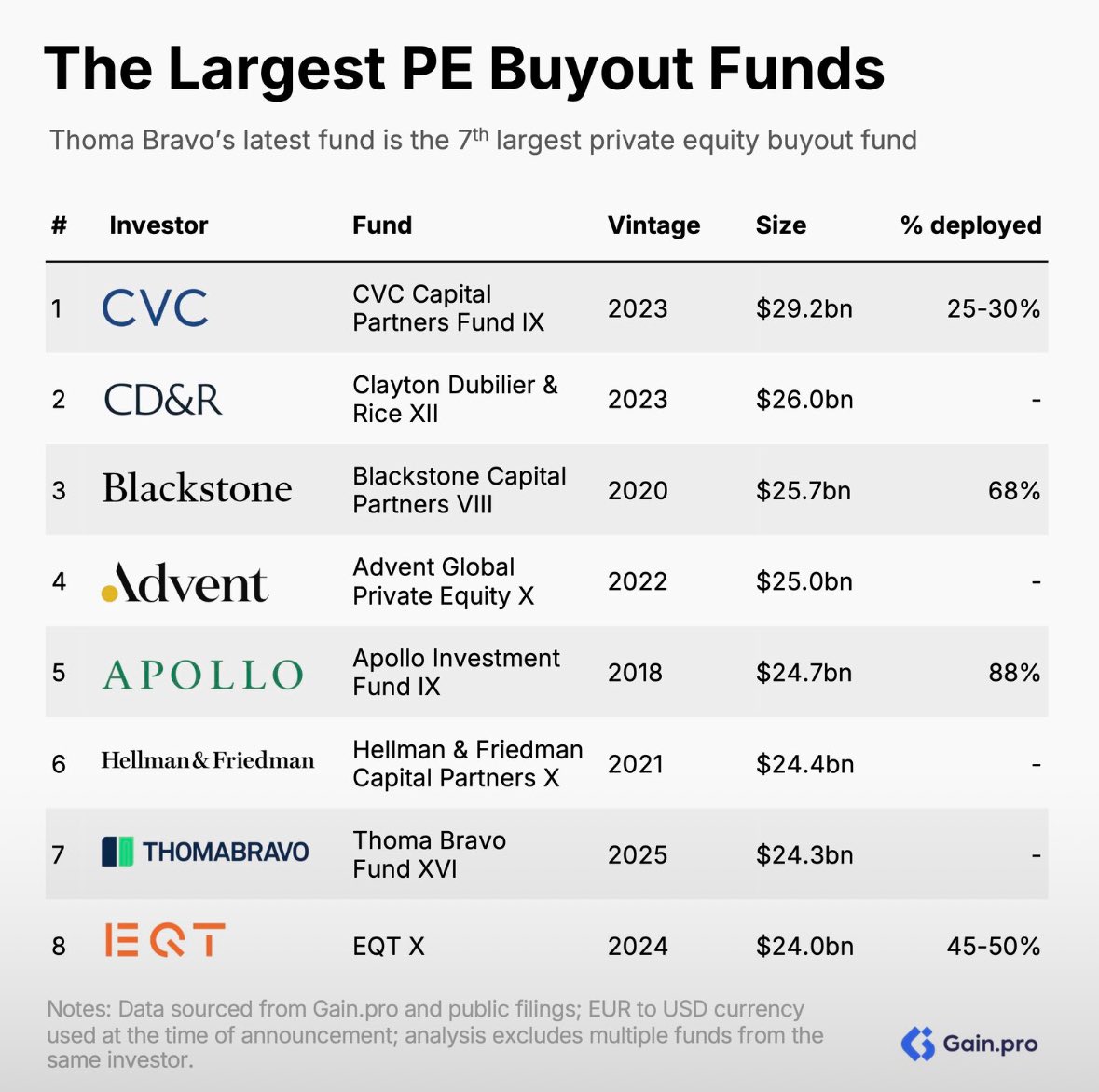

📣 Financial Times covers our latest research, reporting that the holding period for assets is the highest it's been since 2010, with European private equity firms struggling to sell the investments they made back when interest rates were low. This shift stems from the current challenging