hedgopia

@hedgopia

Stocks, macro, technicals, derivatives. RTs/Favs not endorsements. Joined in earnest in 2014. @seeitmarket contributor.

ID:27746125

http://www.hedgopia.com 30-03-2009 22:23:45

5,6K Tweets

22,2K Followers

110 Following

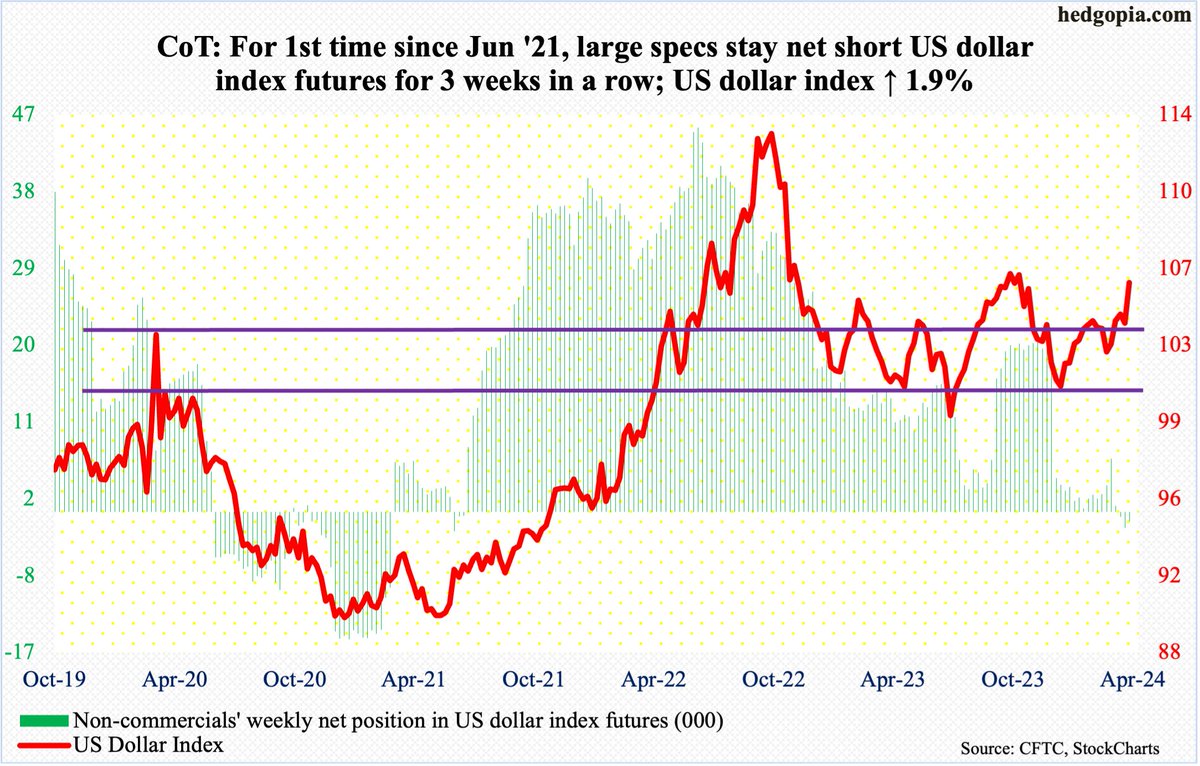

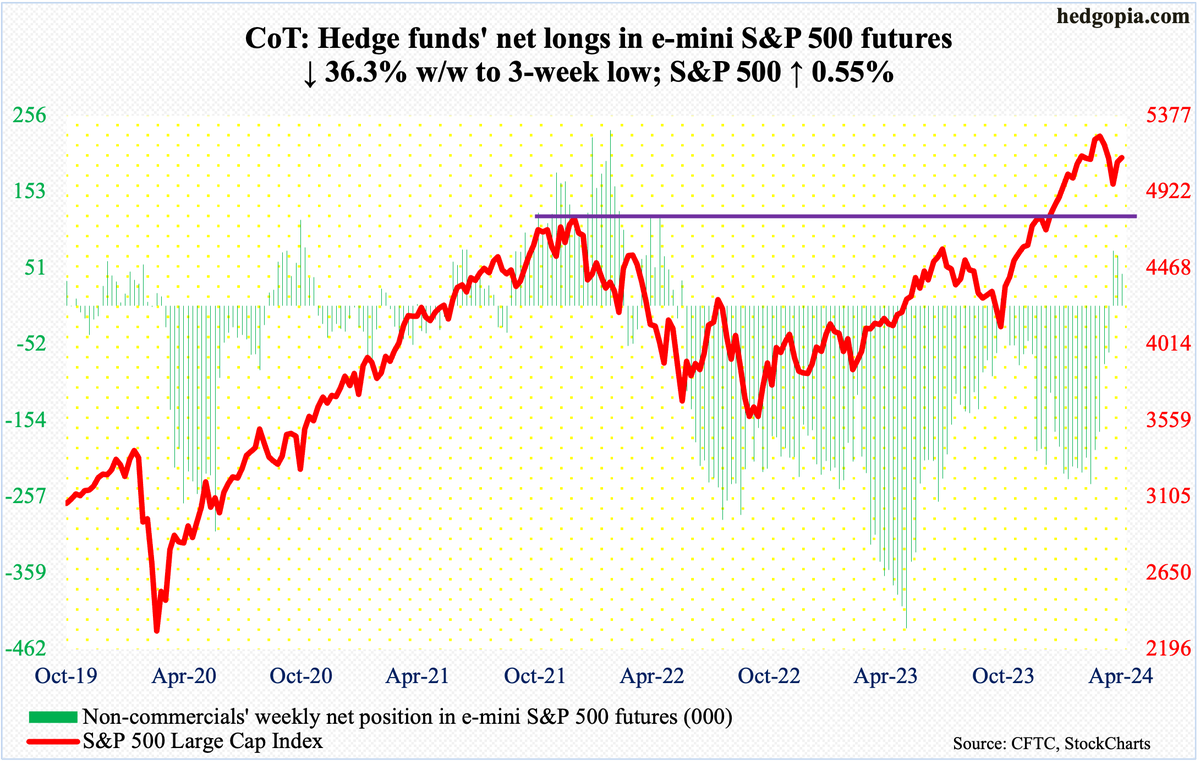

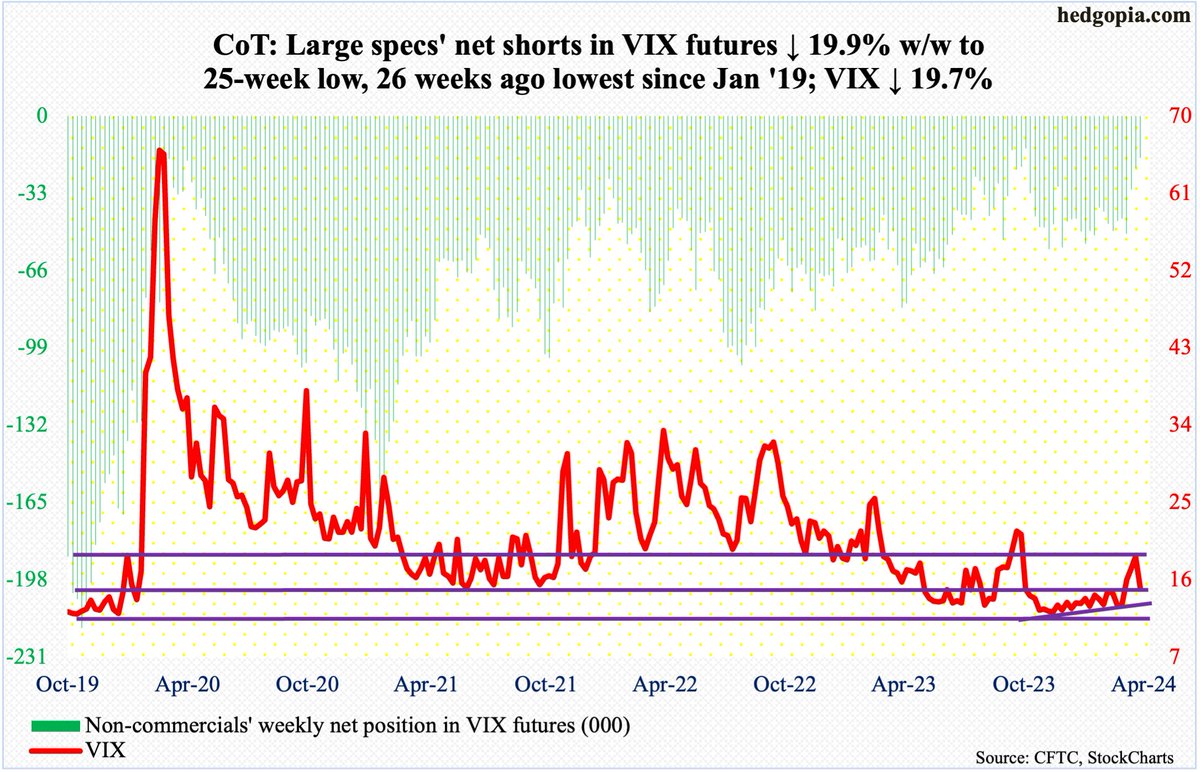

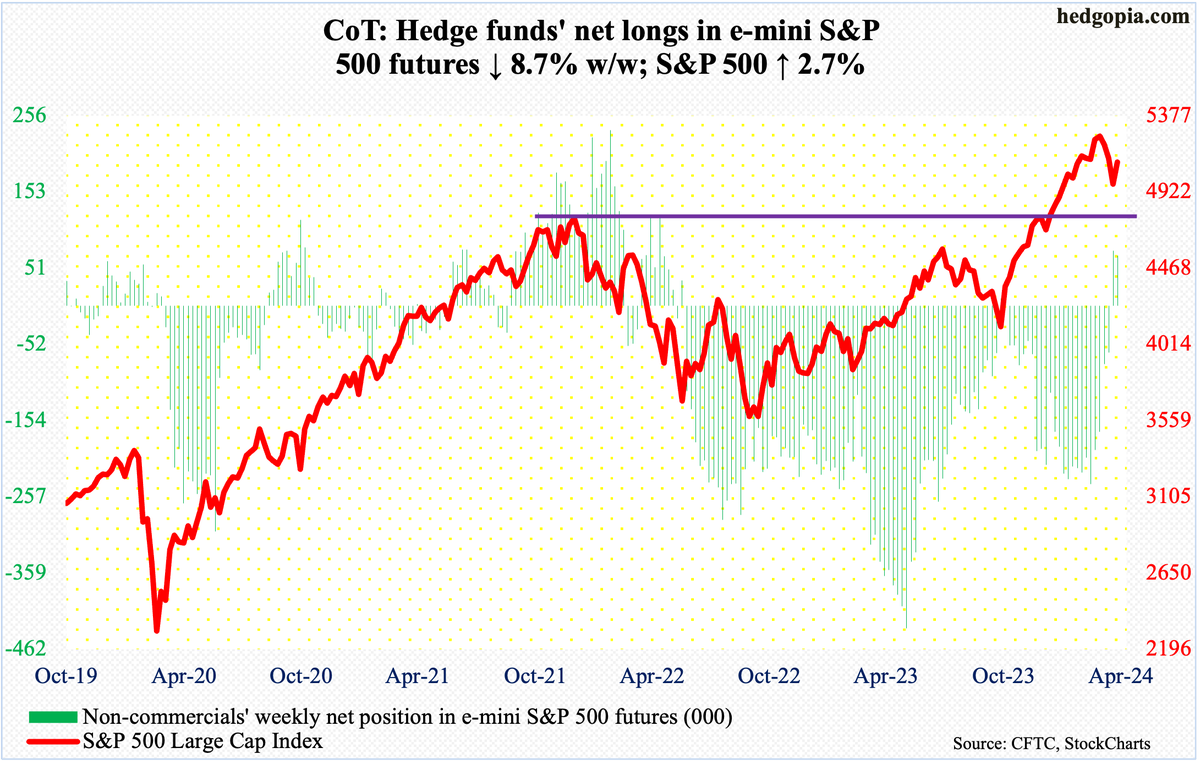

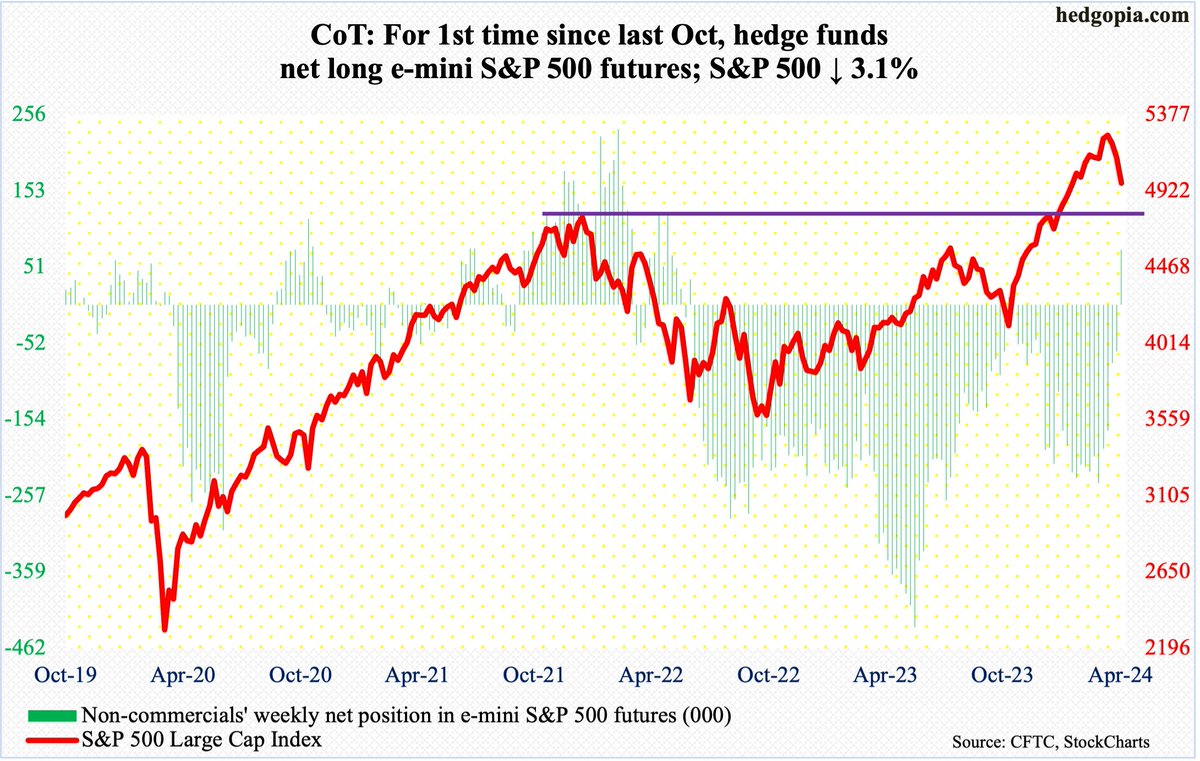

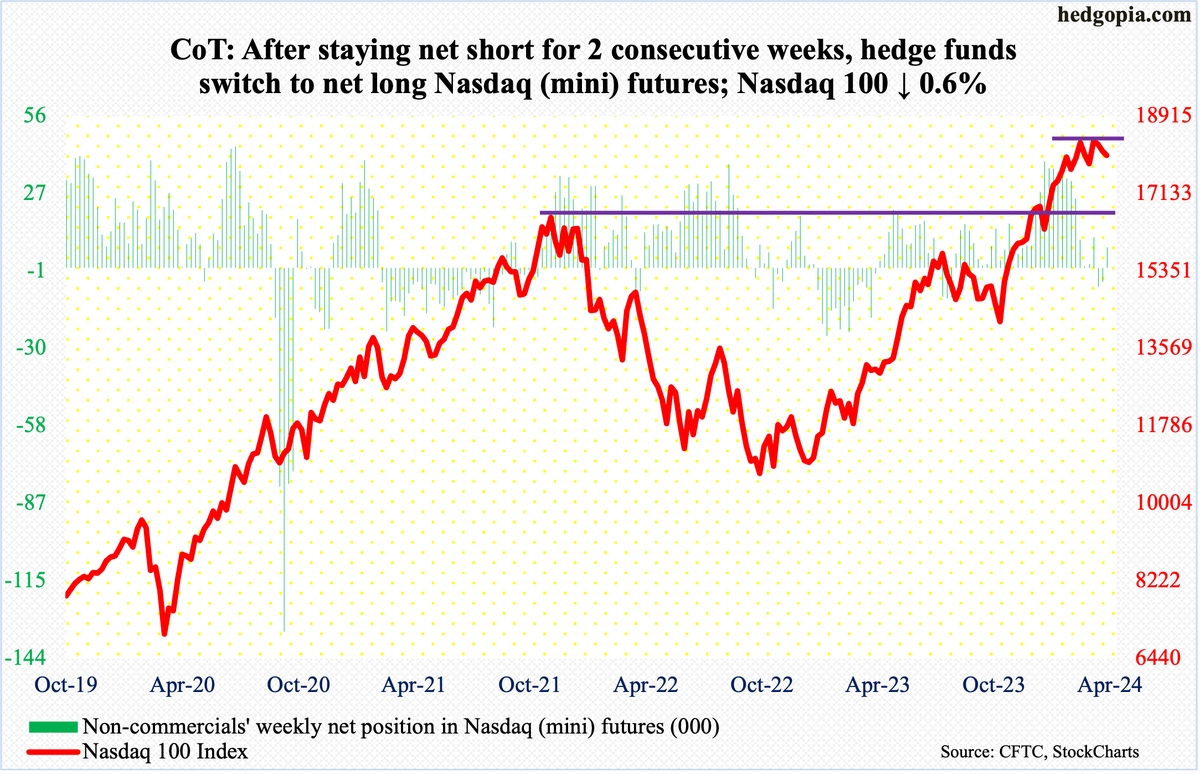

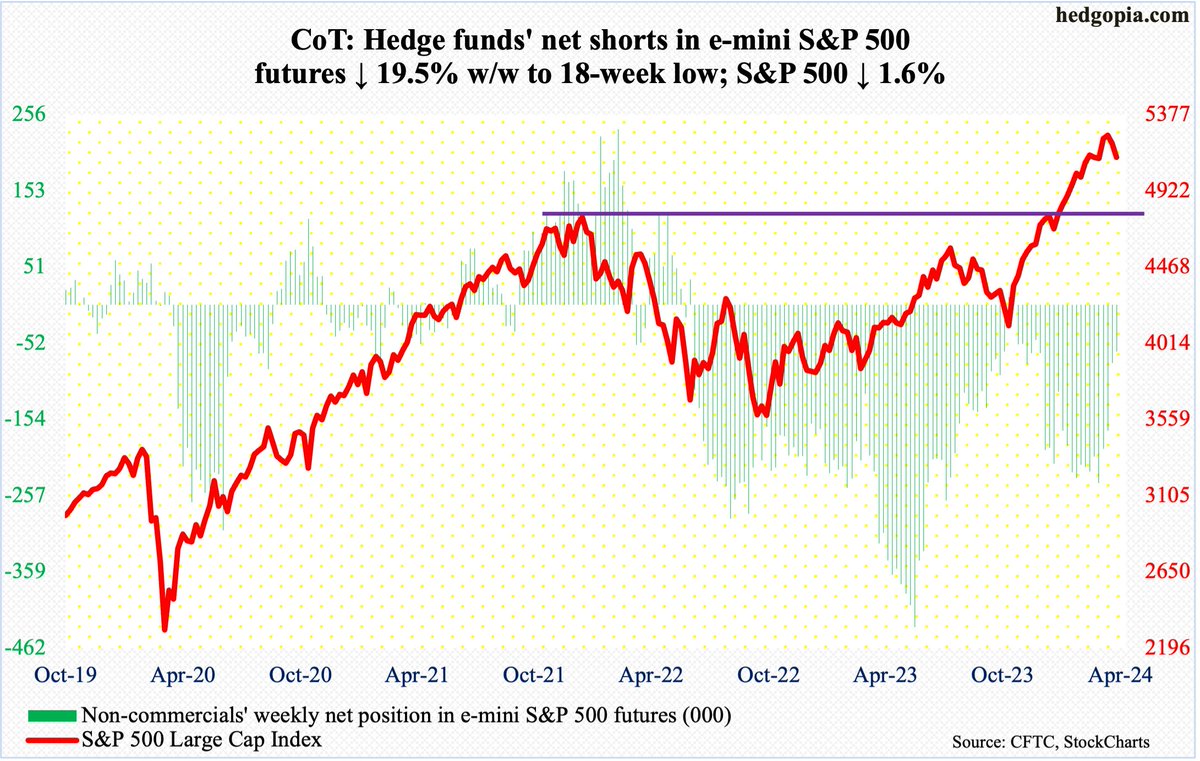

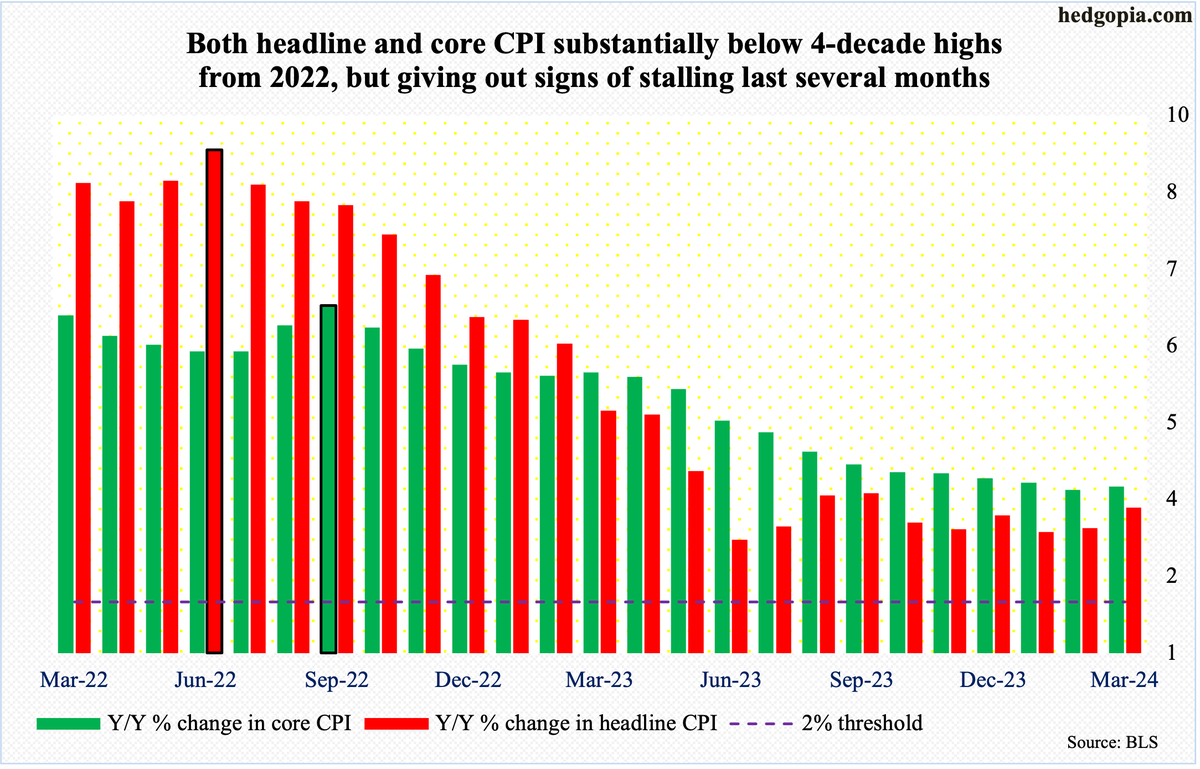

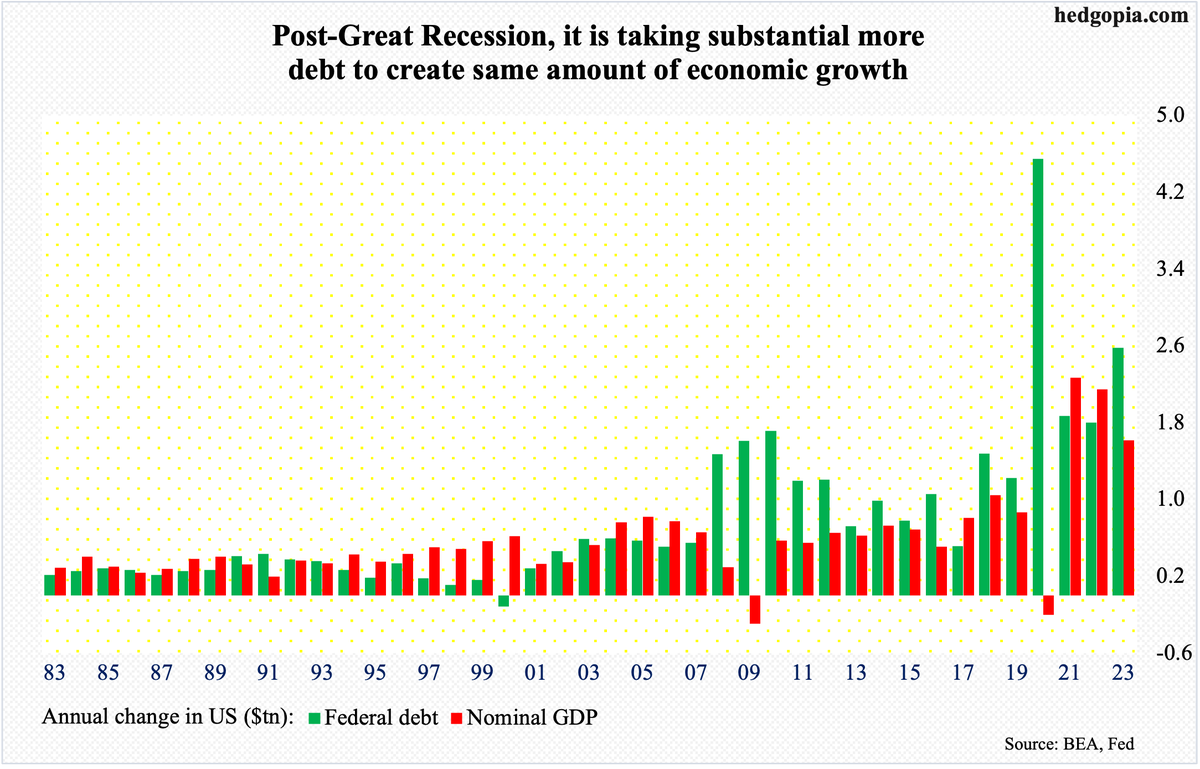

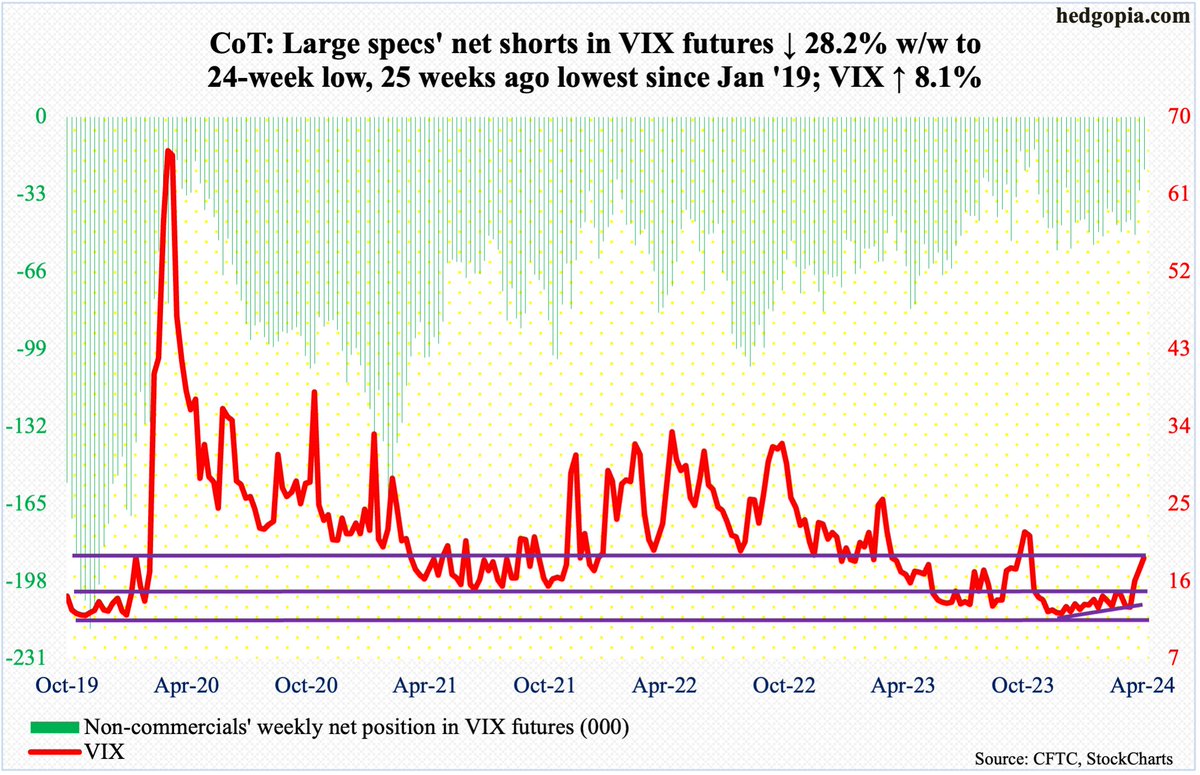

How #hedgefunds are positioned in futures. $TNX $TYX $SPX $RUT $NDX $VIX $GLD $EUR $USD $WTI hedgopia.com/cot-peek-into-…

How #hedgefunds are positioned in futures. $TNX $TYX $SPX $RUT $NDX $VIX $GLD $EUR $USD $WTI hedgopia.com/cot-peek-into-…