Oliver Richardson

@hedgeyecommor

Analyst on the @Hedgeye Communications Team working with @hedgeyecomm. Focused on the Video Game Industry and other internet/media names.

Not Financial Advice

ID: 1928484661522481152

30-05-2025 16:13:13

27 Tweet

210 Followers

95 Following

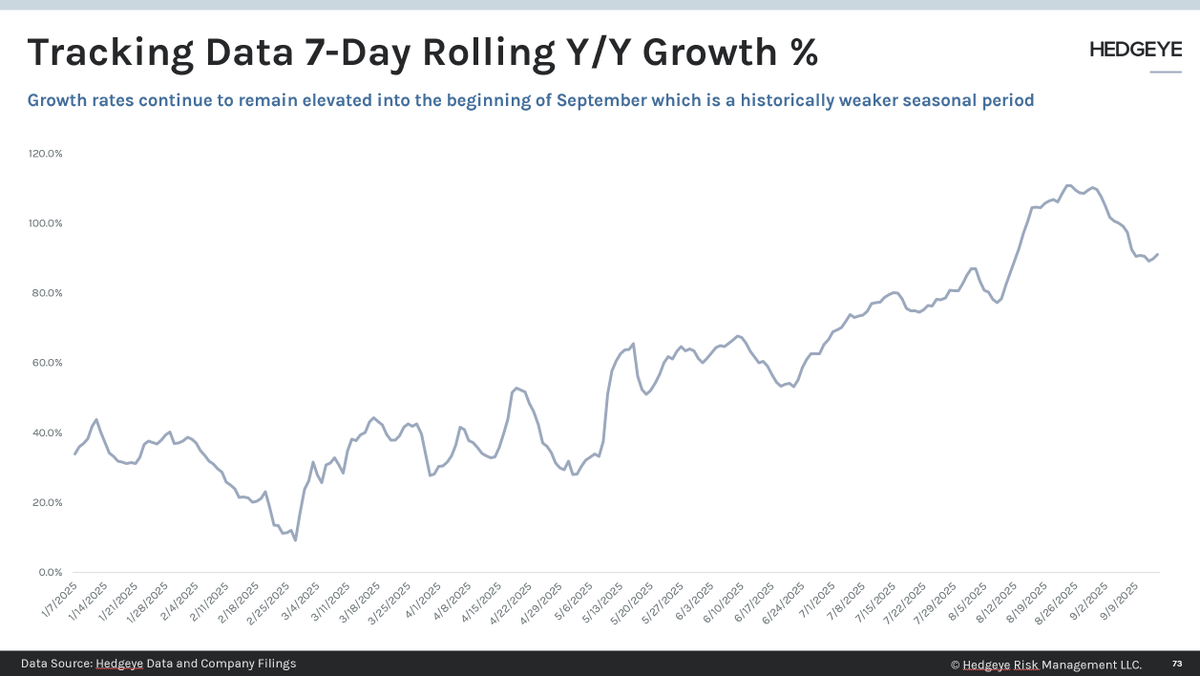

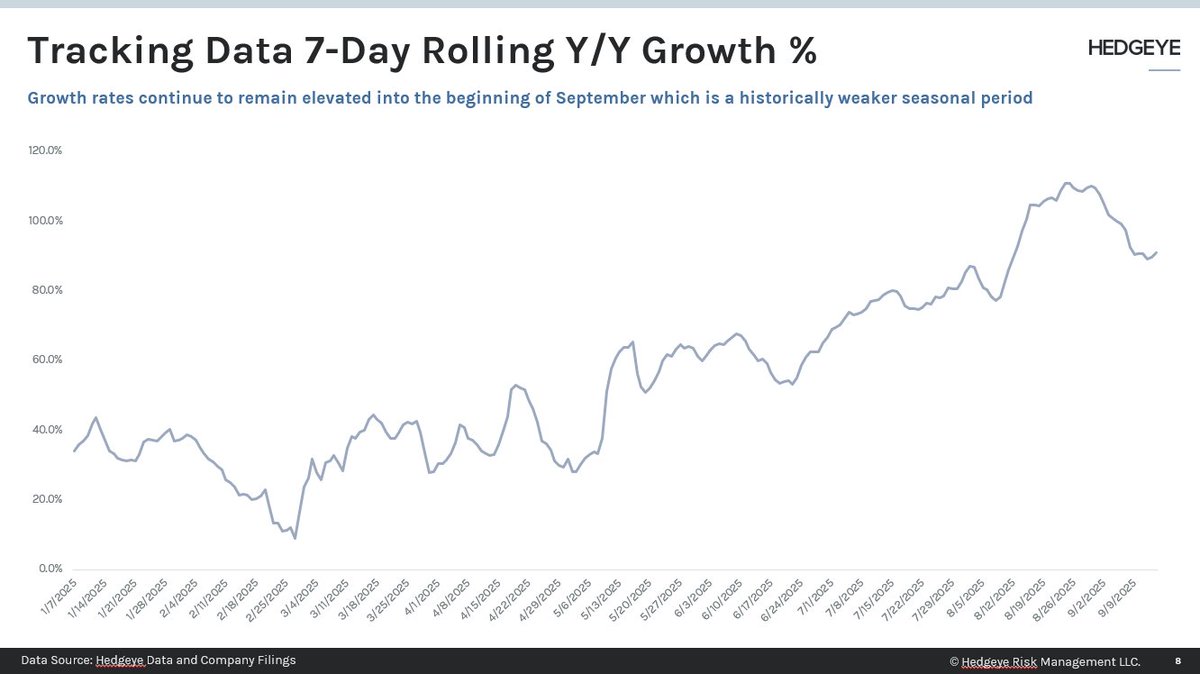

$SPHR ripping—+30% since we made it active long in late Aug. Sphere experience (Wizard of Oz) selling out, data tracking strong, signal sniffed it early. Signal + data + quads = trifecta. #TheCall Andrew Freedman, CFA 🦅

'Winners Win More' → McCullough & Freedman on Sphere $SPHR 🔊 Don’t sell too early. Our process strips emotion from decision-making—and in today’s market structure, winners win more. As Hedgeye CEO Keith McCullough explains in this clip from The Call @ Hedgeye, it can be

Today at 2pm Andrew Freedman, CFA 🦅 and I are presenting our work on $SPHR after making it an active long on 8/24. We will be discussing revitalization in the Sphere Experience segment with the launch of Wizard of Oz as well as other developments in the business.

I am going to be in London 10/28 and 10/29 for client meetings! If you would like to meet please reach out to Pat, myself and/or [email protected].