Global Markets Investor

@globalmktobserv

Investment, Equity (on Wall Street), Macro Research background. ~10 years experience in markets, supporting investors in succeeding. Join 3900+ FREE subscribers

ID: 1679591758332657665

https://globalmarketsinvestor.beehiiv.com/ 13-07-2023 20:41:03

31,31K Tweet

40,40K Takipçi

74 Takip Edilen

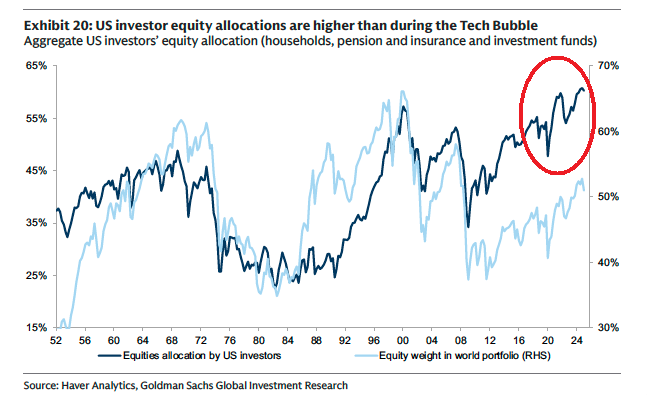

🚨Global equities 'SELL SIGNAL' was triggered for the 4th month STRAIGHT: Institutional investors' cash as a share of assets fell to 3.8% in October, the lowest in over a DECADE. Cash allocations at or below 4% indicate a “SELL SIGNAL” for stocks👇 globalmarketsinvestor.beehiiv.com/p/us-stocks-dr…

⚠️First Brands BANKRUPTCY shakes credit markets: The collapse WIPED OUT $4 billion in leveraged loans held across ~80 CLOs from Blackstone, and others. The sudden failure is a major warning for the broader credit market and leveraged loan sector.👇 globalmarketsinvestor.beehiiv.com/p/us-stocks-dr…