MachineGan

@ggya

#bitcoin

ID: 31628401

16-04-2009 03:32:41

16,16K Tweet

356 Followers

4,4K Following

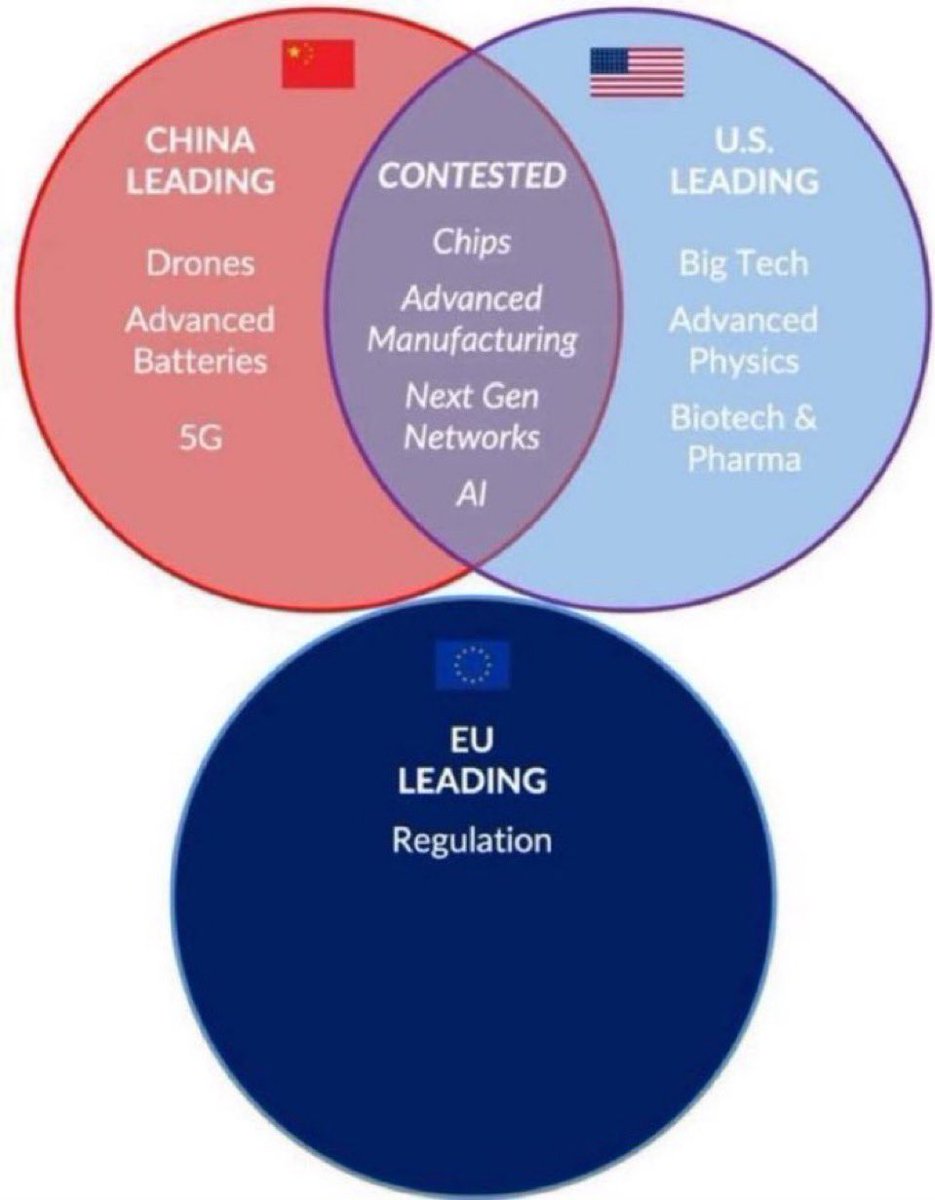

Ian Miles Cheong The 🇪🇺European Union is doing everything in its power to stay meaningless.

How can Liverpool afford all these signings? Ranking of net spend across the 5 completed seasons prior to this summer 2020/21-2024/25 (according to Transfermarkt.co.uk) 1) Chelsea: -£770m 2) United: -£547m 3) Spurs: -£472m 4) Arsenal: -£468m 5) Newcastle: -£365m 6) West Ham: -£274m 7)

Acetyl CoA Ben Jacobs I'm not sure Liverpool will be interested in signing a player who hasn't played a game in 3 years pal