Matt Geiger

@geigercounting

ID: 1040218524

http://www.mjgcapital.com 27-12-2012 18:10:09

1,1K Tweet

1,1K Takipçi

615 Takip Edilen

I must say that the demographic trends highlighted in this The Economist feature cut starkly against the Malthusian instincts that got me interested in natural resource investing a couple decades ago.

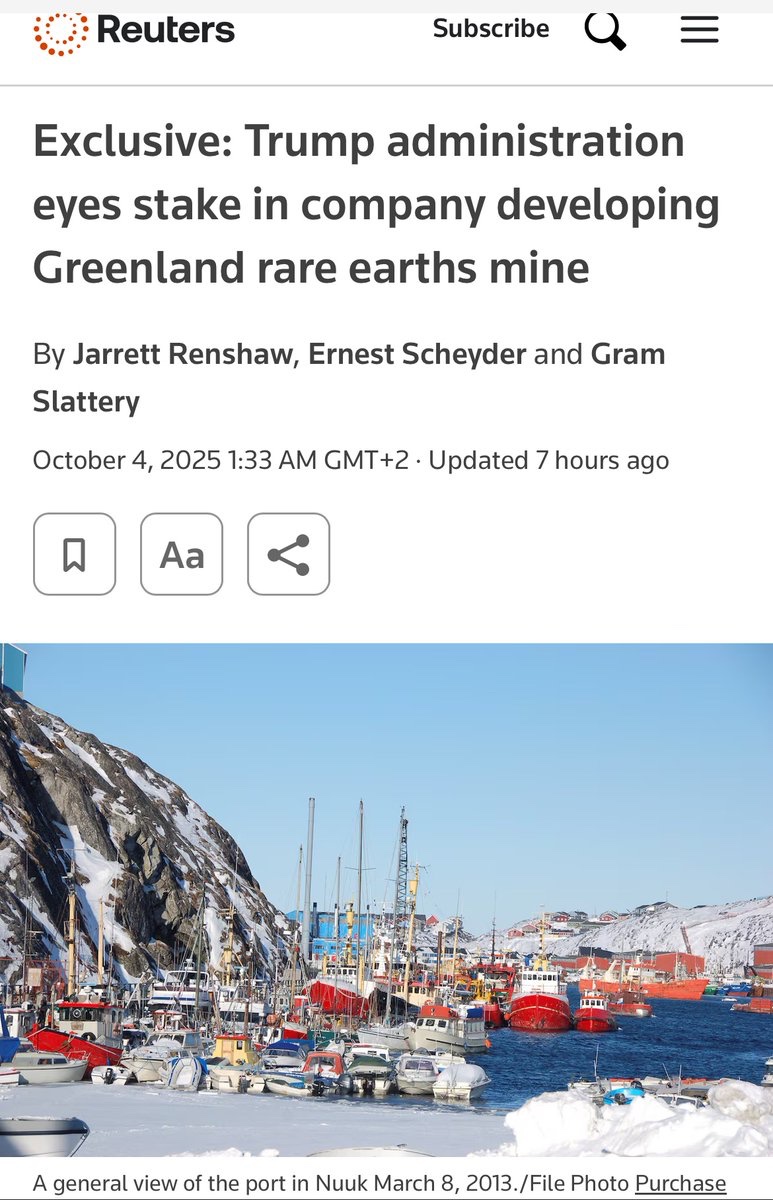

Missed this during the rush of Beaver Creek. James Kwantes 🇨🇦 covers the Altius origin story and the genesis of the Altius and Orogen royalties covering AngloGold’s Arthur Project, among other topics. A worthwhile read for those interested in prospect generation $ALS.TO $OGN.V $AU