Frec

@frecfinance

Creating new opportunities for your wealth 💰

Index investing that gets you more.

ID: 1484305836994281472

http://frec.com 20-01-2022 23:25:08

240 Tweet

676 Takipçi

41 Takip Edilen

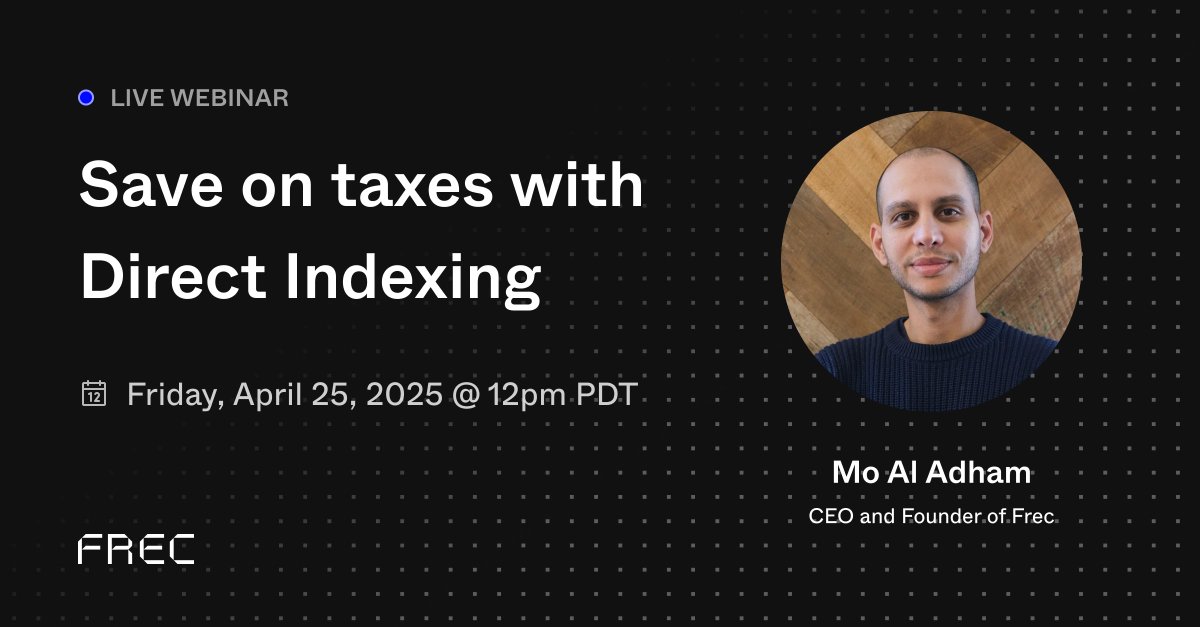

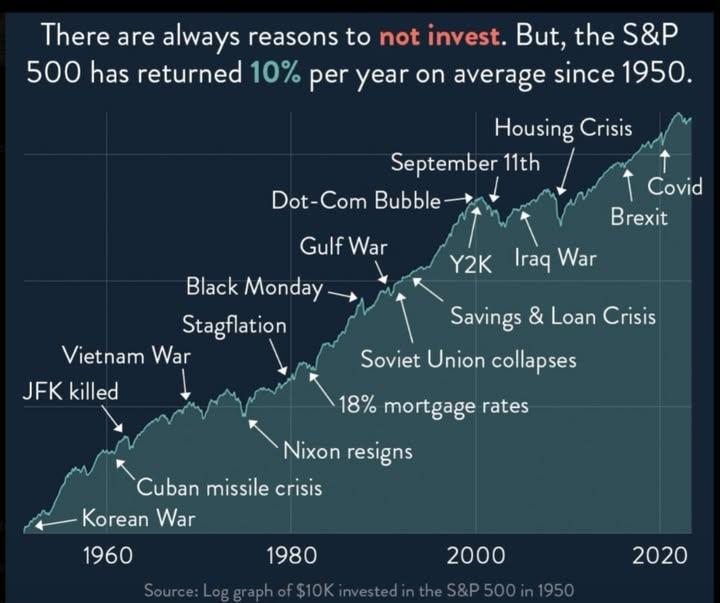

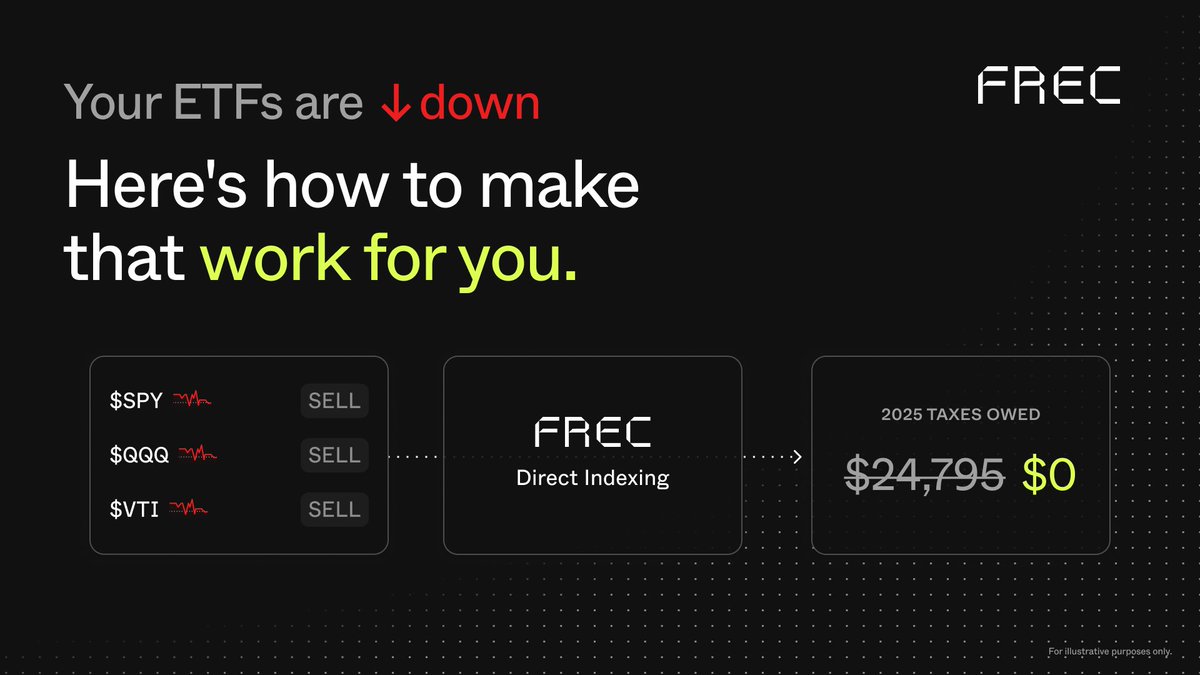

Got questions? We’ve got answers. Join us and Frec CEO Mo Al Adham for a live webinar on why direct indexing is gaining momentum, and how you can use market volatility to your advantage. Whether you’re holding SPY, VOO, or just exploring new approaches, you won’t want to miss