Felix Geiger

@flx_geiger

@bundesbank | views are my own | private | monetary policy, financial markets, finance, economics | retweets, likes and following do not imply endorsement

ID: 1418288939950084104

22-07-2021 19:17:00

1,1K Tweet

1,1K Followers

678 Following

New paper with Martin Wolf on Fiscal Stagnation. Key insights: 1) High public debt may push the economy into fiscal stagnation, i.e. a persistent state of low growth and high fiscal distortions. 2) Pro-growth policies are crucial to exit stagnation, but they require credibility.

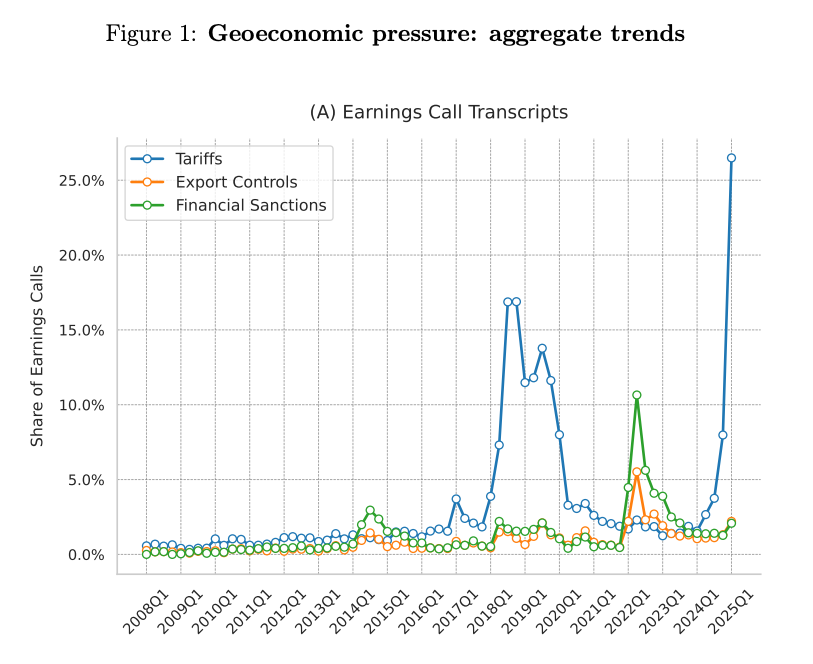

New paper on recent US tariffs with Matt Rognlie and Adrien Auclert Our focus: effects of temporary increases in tariffs (“tariff shocks") Three Qs: 1 Will tariffs lead to a recession? 2 Will they reduce the trade deficit? 3 Why are they not appreciating USD? (as in std theory) 🧵

“The simple test is whether an economist's views tend to diverge from those of his ideological allies when the ideology clashes with the economics. If they do he is a real economist. If they do not, he is only an economist in working hours.” daviddfriedman.substack.com/p/economic-met…

Let me explain why I believe modern economics is such a powerful tool for understanding the world. I’ll do this by discussing a great paper by Simone Cerreia-Vioglio, Lars Peter Hansen, Fabio Maccheroni, and Massimo Marinacci, “Making Decisions Under Model Misspecification,”