NGMI

@f_helou

No better entertainment than watching dystopia unfold

ID: 2884298710

19-11-2014 16:33:23

11,11K Tweet

379 Followers

790 Following

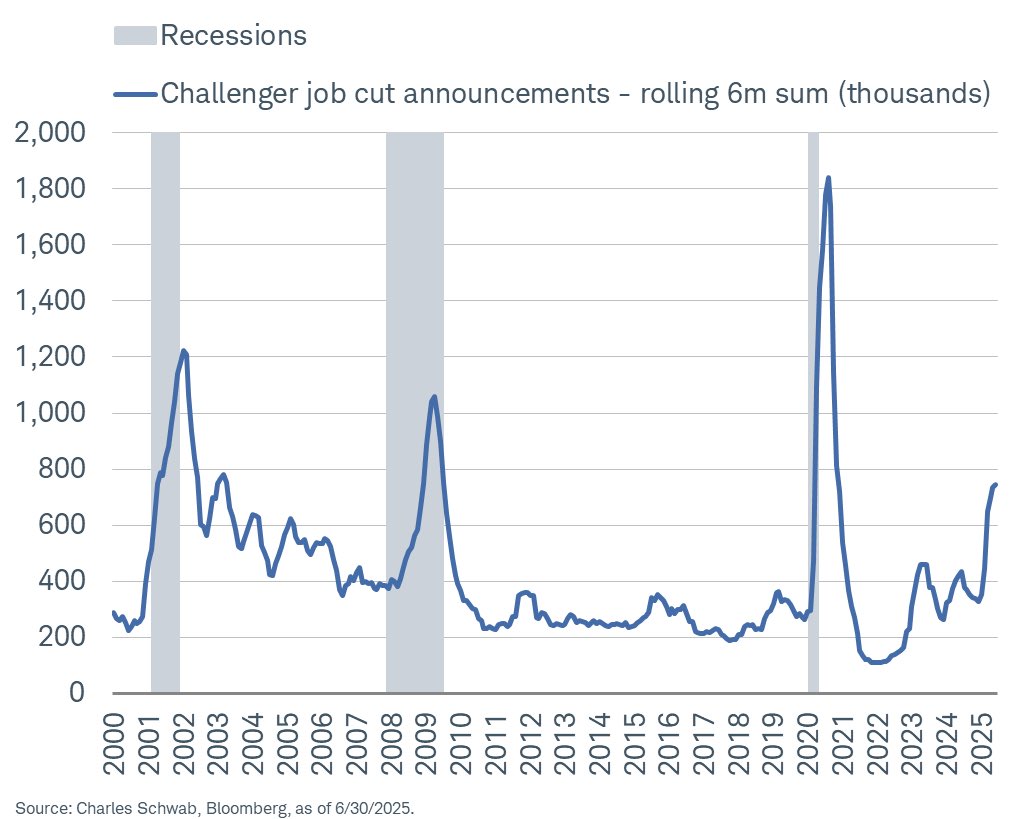

Rolling 6m sum of ChallengerGray job cut announcements has risen to level consistent with prior recessions