Eric Nuttall

@ericnuttall

Father of 3, husband, & energy investor. Proponent of the Canadian energy patch & occasional market commentator. https://t.co/WVA6oG8CCO

ID:49939647

https://www.ninepoint.com/funds/ninepoint-energy-fund/ 23-06-2009 10:18:21

3,0K Tweets

91,5K Followers

397 Following

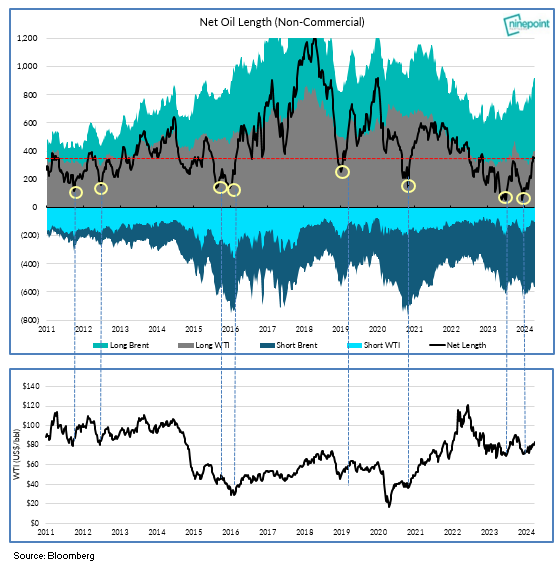

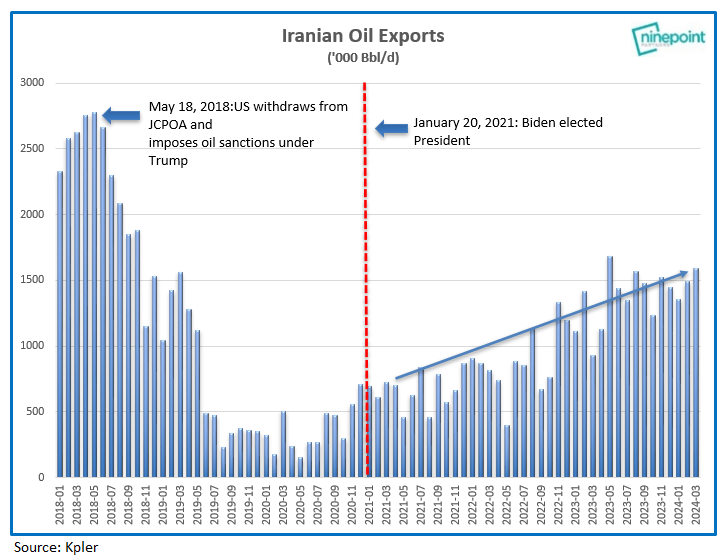

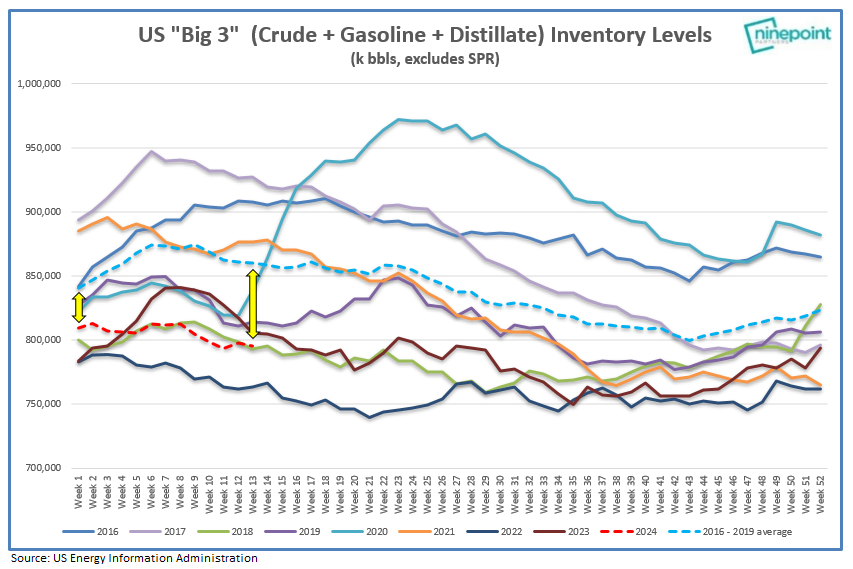

I shared my short and medium term outlook for oil this morning on BNN Bloomberg...we remain bullish™️! bnnbloomberg.ca/video/we-remai…

I shared my short and medium term outlook for oil this morning on BNN Bloomberg...we remain bullish™️! bnnbloomberg.ca/video/we-remai…

This was 4 years ago to the day: April 2020 doing BNN Market Call from my son's bedroom in an undersized rental house under COVID lockdown and schools closed, oil at $25/bbl and energy stocks down massively...telling myself hourly 'this too shall pass.' How far we have all come!

Where do I see oil headed in the coming months? Find out in this interview with Asharq Business اقتصاد الشرق:

now.asharq.com/clip/%D9%86%D8…