Enzyme

@enzymefinance

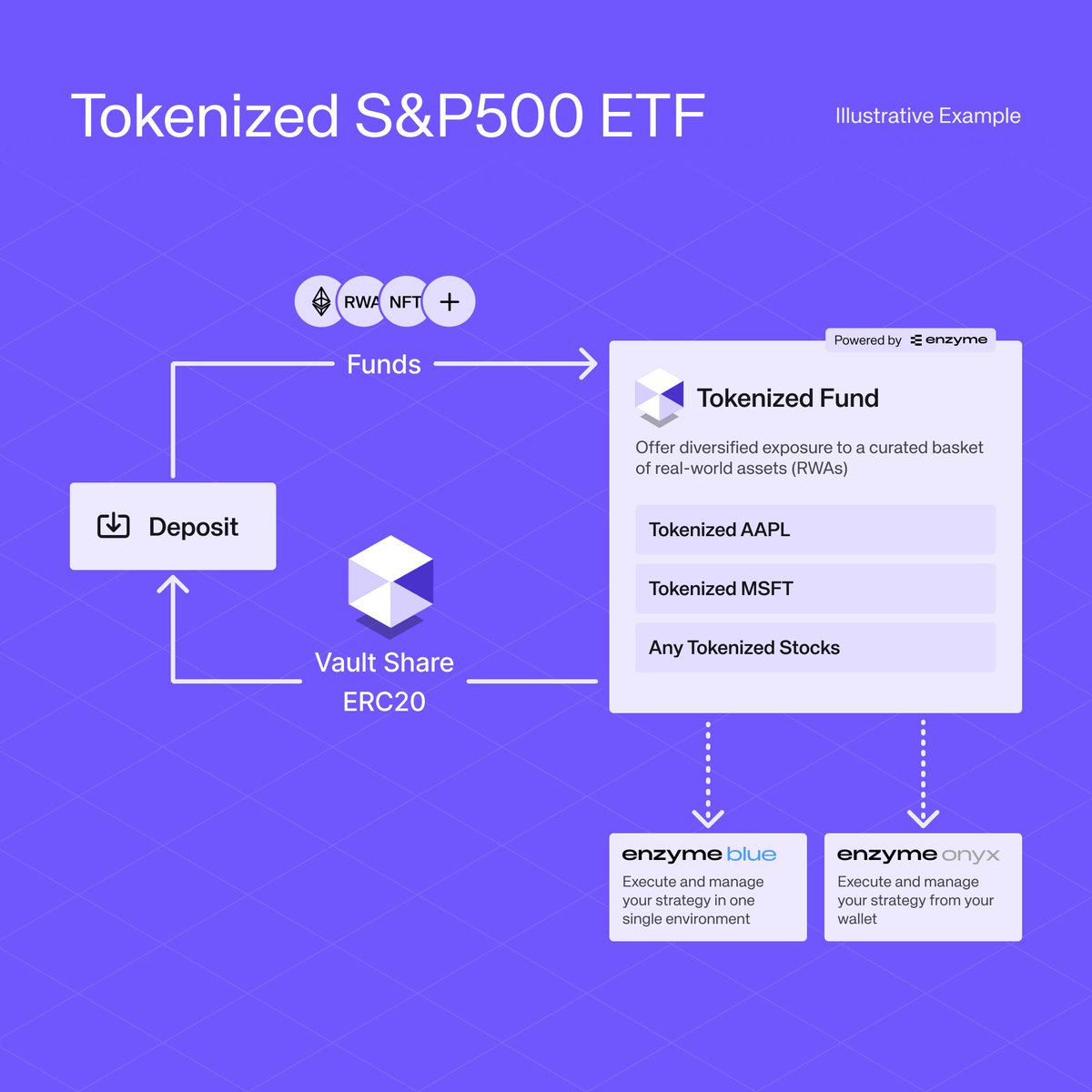

Global infrastructure for tokenized finance. Enabling industry leaders to manage on-chain assets, streamline operations, and build innovative financial strategy

ID: 763039521936203776

https://enzyme.finance 09-08-2016 15:49:33

5,5K Tweet

36,36K Followers

559 Following

Summer in Cannes + DeFi, no better combo than this for sure. We are excited to announce that Enzyme goes to EthCC - Ethereum Community Conference [8] 🇫🇷 The biggest Web3 event in Europe is just around the corner, and we’re very excited to be in Paris with (almost) the whole team to enjoy the good

![Enzyme (@enzymefinance) on Twitter photo Summer in Cannes + DeFi, no better combo than this for sure. We are excited to announce that Enzyme goes to <a href="/EthCC/">EthCC - Ethereum Community Conference</a> [8] 🇫🇷

The biggest Web3 event in Europe is just around the corner, and we’re very excited to be in Paris with (almost) the whole team to enjoy the good Summer in Cannes + DeFi, no better combo than this for sure. We are excited to announce that Enzyme goes to <a href="/EthCC/">EthCC - Ethereum Community Conference</a> [8] 🇫🇷

The biggest Web3 event in Europe is just around the corner, and we’re very excited to be in Paris with (almost) the whole team to enjoy the good](https://pbs.twimg.com/media/Gtz8DyOXYAAwTzT.jpg)

A 2030 vision, written in 2020. Our founder Mona El Isa’s article imagined what onchain asset management could look like. Five years later, much of that world is already here, and built on Enzyme.

Bonjour Cannes 🇫🇷 Kicking off EthCC - Ethereum Community Conference week with French baguettes, Enzyme crew, sea views, & some sharp conversations around the future of on-chain asset management. We’ve got two more side events lined up. Come join us for DeFi, good food, and even better company. À très vite!

Live from EthCC - Ethereum Community Conference 🎥 Sun, sand, sharp minds… the Enzyme crew has been soaking it all in here in Cannes. The vibes? Immaculate. Here’s what’s been happening so far: ・Had side events with our good friends at Nexus Mutual, Sygnum Bank, and ChainSecurity ・Met with other

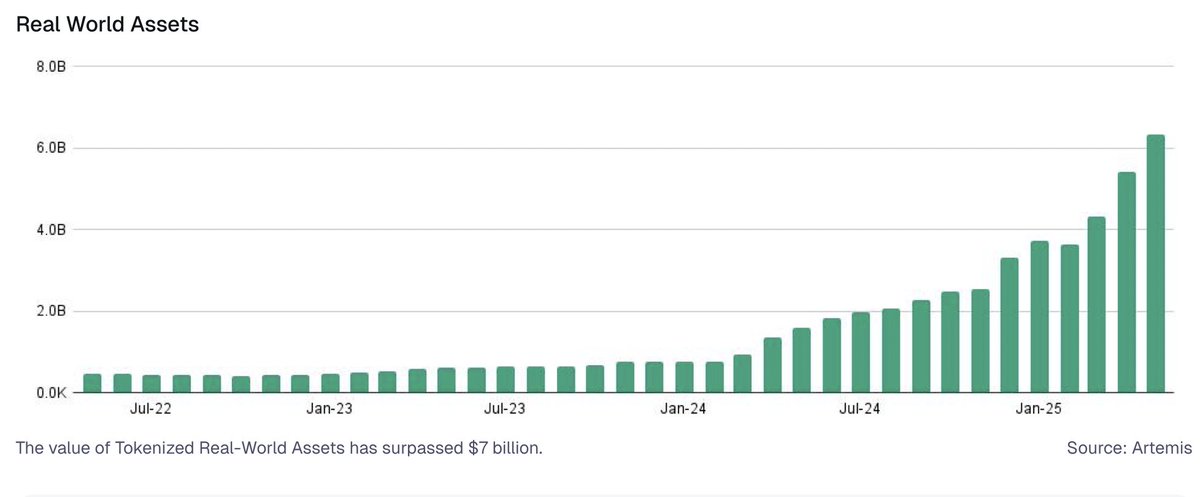

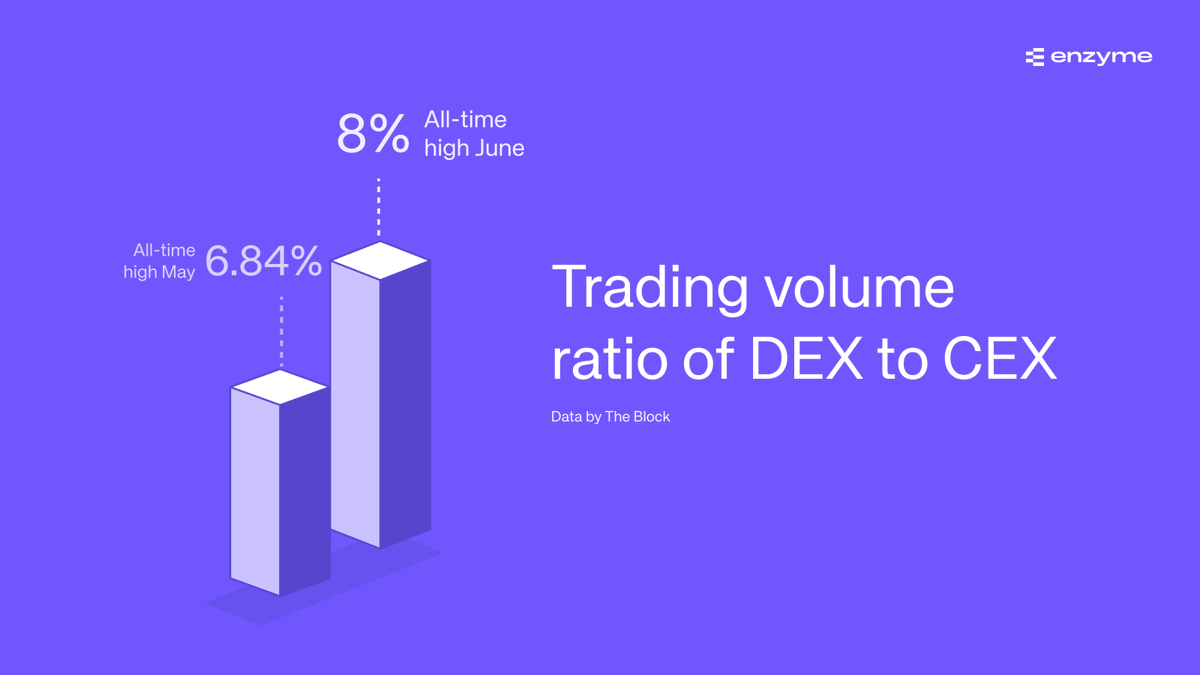

Back from EthCC - Ethereum Community Conference, and still thinking about everything we saw in Cannes 👀 It’s been one of the most vibrant editions yet. Here are some of the key takeaways: ・Institutions are here: For the first time, the institutional presence was unmissable, a strong signal that the onchain

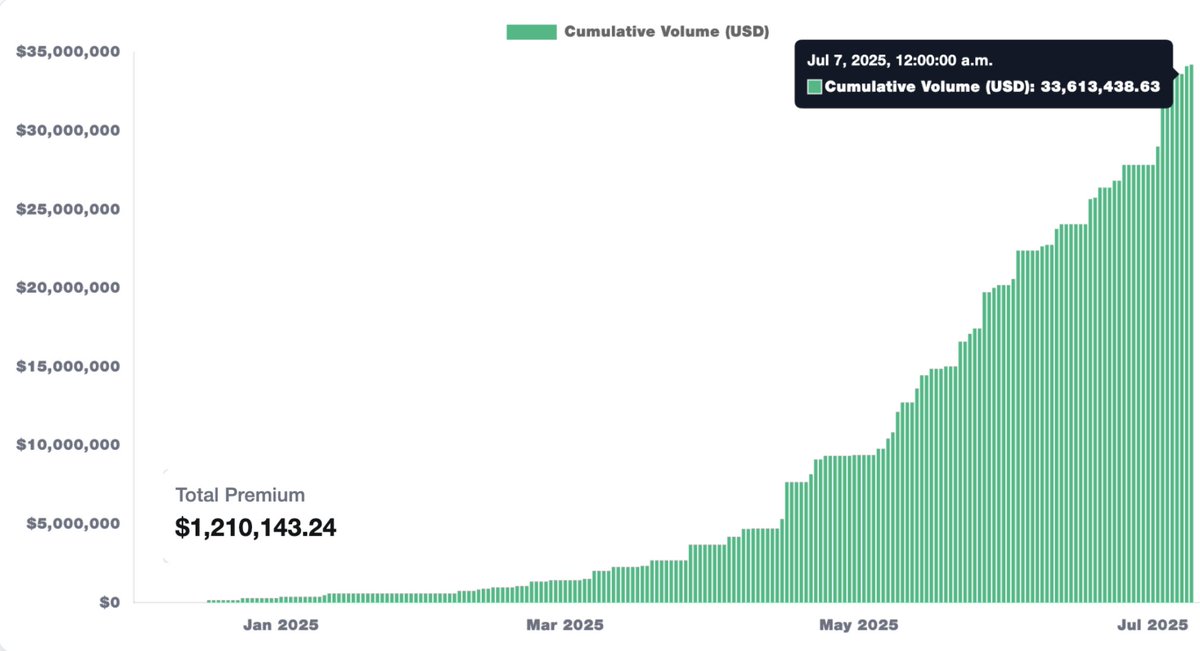

Onchain options are becoming a way to make treasuries work harder. Here’s an example 👇 Compound Labs DAO recently demonstrated a sophisticated approach by integrating covered calls into their treasury strategy using Enzyme.Myso, targeting a ~15% APY. The objective is

Looking back on an amazing week at EthCC - Ethereum Community Conference: Cannes, community, and so many good moments. Watch the highlights from an unforgettable week 👇